Litecoin ETF’s rising market potential excites buyers as SEC awaits key approval choice.

Key Takeaways

- Canary Capital’s Litecoin spot ETF is listed on the DTCC underneath ticker LTCC.

- The ETF is anticipated to be the primary to obtain SEC’s choice amongst related functions.

Canary Capital’s spot Litecoin ETF has appeared on the Depository Belief and Clearing Company (DTCC) system underneath the ticker LTCC, marking a key preparatory step for the fund’s potential launch.

The DTCC itemizing establishes the mandatory buying and selling infrastructure for the ETF, although SEC approval stays pending. DTCC serves as the first clearing and custody service supplier for US securities transactions.

Canary Capital filed its spot Litecoin ETF utility in October 2024, adopted by related filings from asset managers together with Grayscale and CoinShares. The Canary utility is predicted to be the primary to obtain an SEC choice.

Bloomberg ETF analysts Eric Balchunas and James Seyffart view the outlook for Litecoin-based funds as extra favorable in comparison with different crypto asset funds. The analysts word that the ETF meets approval necessities, with Litecoin already categorized as a commodity by the CFTC.

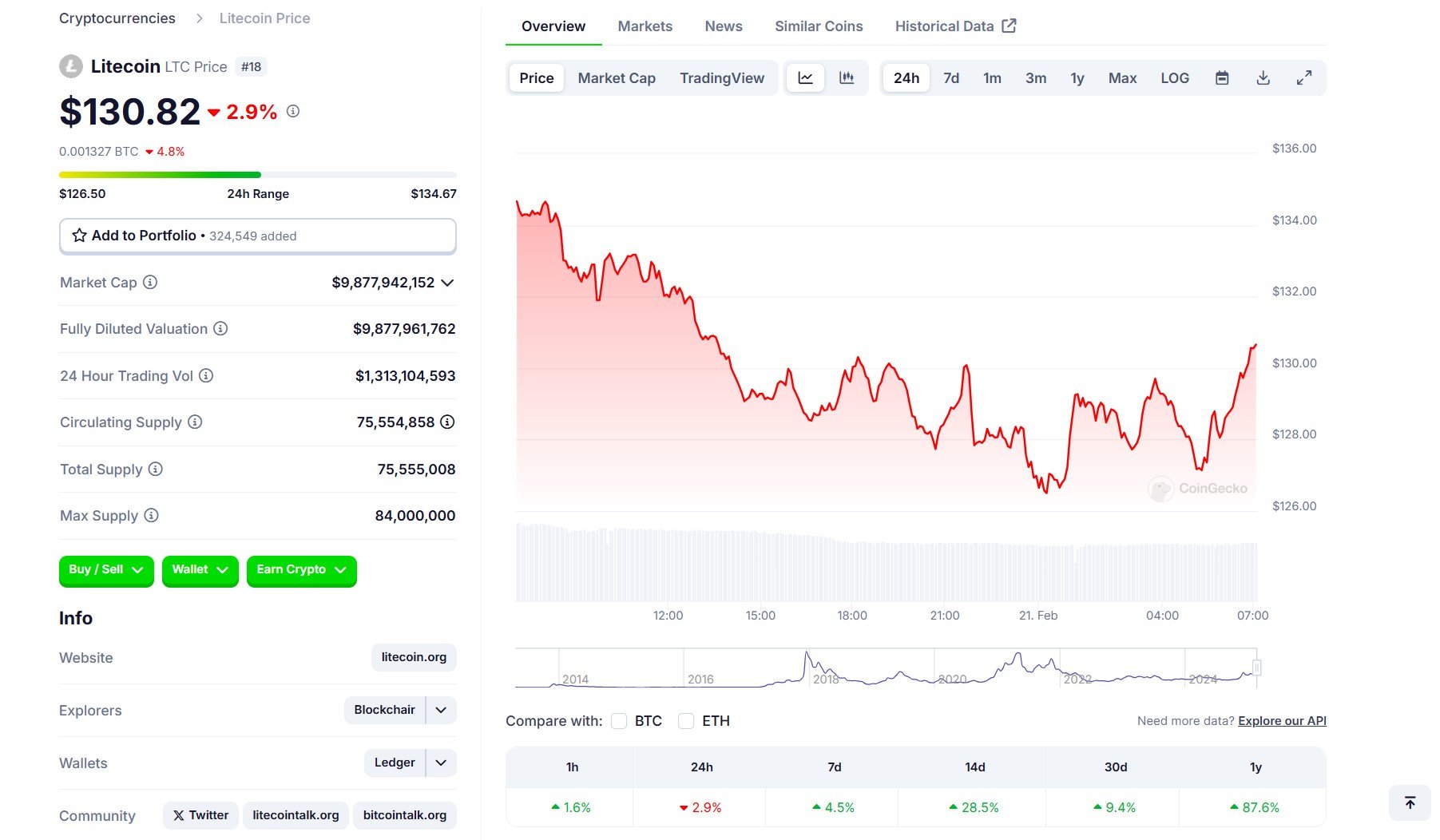

Litecoin’s worth has risen over 100% because the first Litecoin ETF submitting was submitted to the SEC, in keeping with CoinGecko knowledge. The digital asset is at the moment buying and selling at round $130, displaying a 2% improve previously hour.