The worst appears to be over for Ethereum (ETH), as sure metrics recommend that the underside is already in for the second-largest crypto by market cap. Based mostly on this, ETH appears to be headed for a new all-time excessive (ATH), surging previous its present ATH of $4,800.

Ethereum MVRV Exhibits Backside Is In

Knowledge from the onchain analytics platform Glassnode exhibits that Ethereum’s market worth to realized worth (MVRV) lowest pricing degree is at $1,687, which means that the underside is already in for the crypto token. These MVRV pricing ranges spotlight how low or excessive a token will probably attain in a market cycle based mostly on unrealized loss or unrealized income.

As such, Ethereum is unlikely to see a drop beneath the $1,687 worth degree and as an alternative appears headed for its market high. It’s value mentioning that Ethereum dropped to as little as $2,200 following the market crash on August 5. That worth degree is near the $2,109 MVRV pricing band, which Glassnode highlighted, additional proving that the crypto has bottomed.

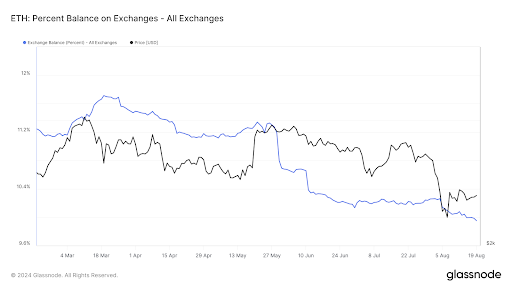

In the meantime, the shift to accumulation amongst Ethereum buyers signifies that they’re now not seeking to promote their property however are holding in anticipation of upper costs. Knowledge from Glassnode exhibits that the share of ETH’s provide held on exchanges has drastically declined to beneath 10%. That is important because it probably reduces the promoting stress on Ethereum and primes it for an enormous rally so long as buyers proceed to carry.

Knowledge from Glassnode exhibits that Ethereum may rise above $5,000 and attain as excessive as $6,759, which is the best MVRV pricing degree for the crypto in the intervening time. That worth degree may mark a market high for Ethereum on this bull run, though crypto analysts like Tyler Durden have predicted that the crypto may nonetheless attain $10,000.

Different Metrics That Assist An Imminent Value Rally For ETH

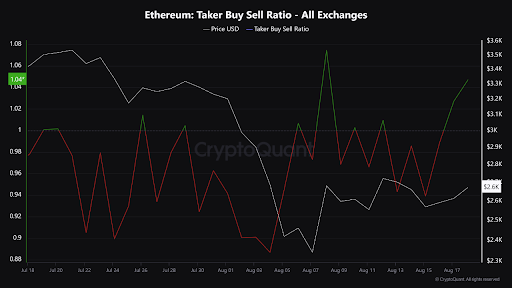

A latest weblog publish on the onchain analytics platform Cryptoquant highlighted two metrics that present that Ethereum is gearing up for its subsequent leg up. One is the Taker Purchase-Promote Ration, which calculates the ratio of Ethereum consumers to sellers. This metric is alleged to be optimistic once more as Ethereum bulls are regaining energy and suppressing any promoting stress from the bears.

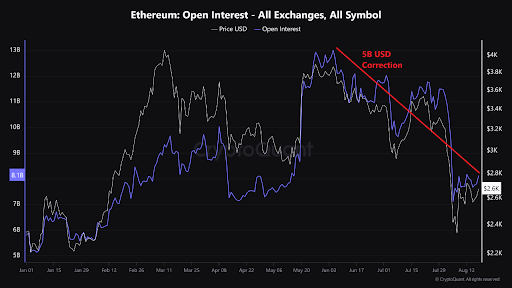

Ethereum’s open curiosity (OI) is once more rising after dropping to $7 billion following the August 5 market crash. Knowledge from Coinglass exhibits that the OI is presently at 10.81 billion, indicating that leveraged gamers are returning to the scene. That is important as buying and selling quantity within the derivatives market additionally significantly impacts ETH’s worth.

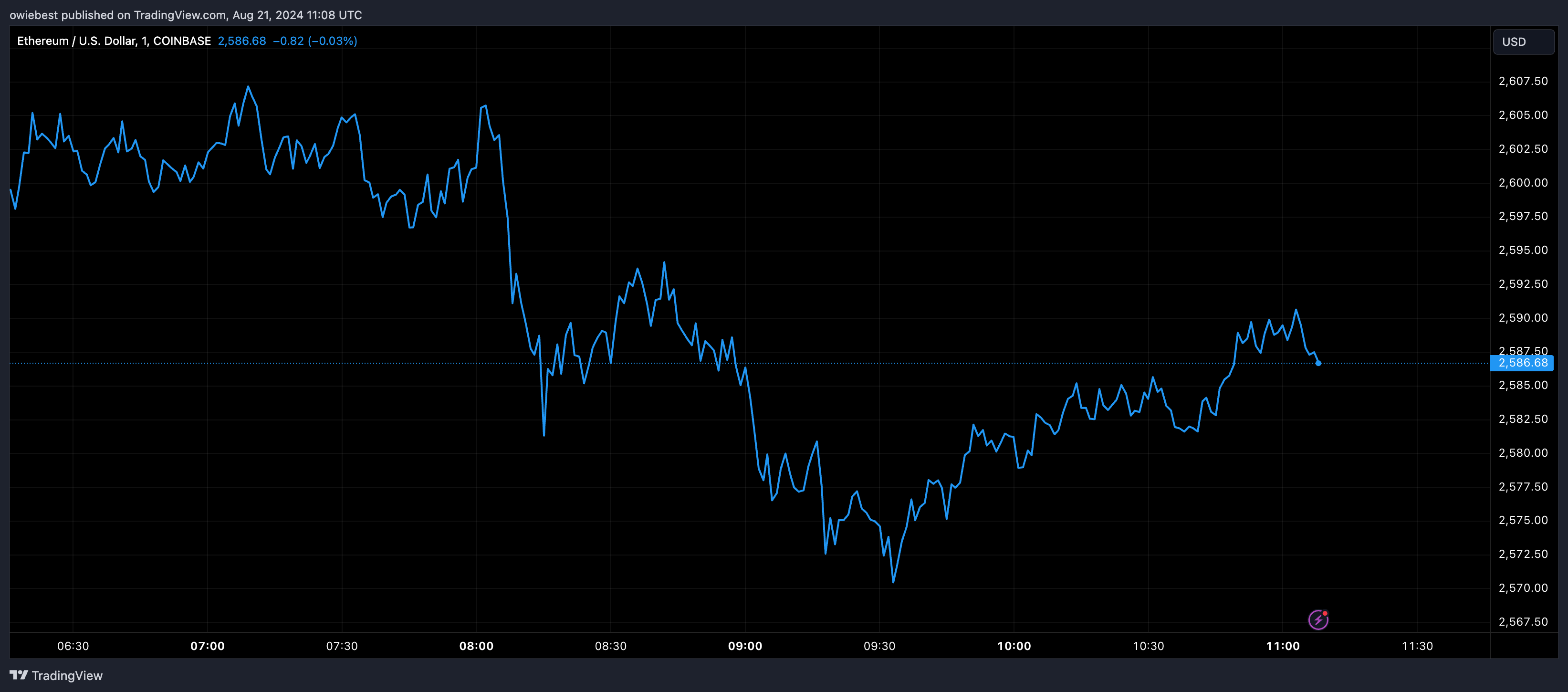

On the time of writing, Ethereum is buying and selling at round $2,590, down over 3% within the final 24 hours, based on information from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com