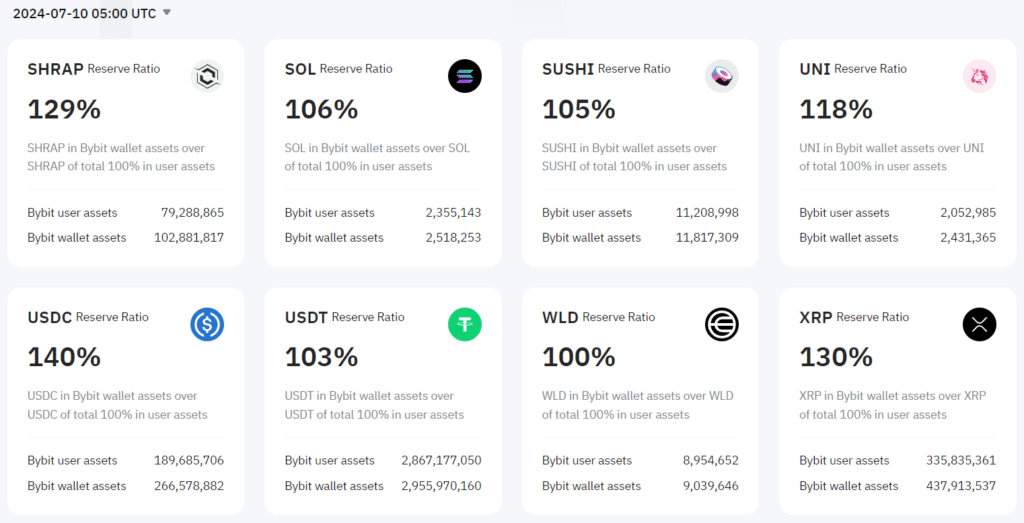

Cryptocurrency alternate Bybit has launched the twelfth proof of reserve, that includes a 17.8% enhance in USDT holdings.

Crypto traders are displaying an elevated urge for food for stablecoins because the Bybit crypto alternate revealed in its newest proof of reserve almost an 18% enhance of consumers’ holdings in Tether (USDT). In line with the alternate’s report, customers’ USDT balances grew by 433 million USDT as of Jul. 10, marking a 17.8% rise from Jun. 6.

The report additionally famous a dramatic enhance in Circle’s USD Coin (USDC), with deposits surging by over 150 million USDC, an almost 400% soar from June. In distinction, the algorithmic stablecoin DAI, issued by MakerDAO, skilled a decline, with holdings reducing by 33% over the identical interval.

Bybit person reserves in stablecoins as of Jul. 10 | Supply: Bybit

You may also like: Arthur Hayes foresees market backside, predicts gradual uptrend

In the meantime, holdings of conventional cryptocurrencies Bitcoin (BTC) and Ethereum (ETH) noticed modest beneficial properties of 5.62% and 0.46%, respectively, suggesting that merchants may be reallocating their liquidity from stablecoins into extra risky crypto belongings.

The uptick in stablecoin holdings coincides with rising market capitalization within the sector, as Bitcoin seems to have reached a neighborhood value backside. CryptoQuant CEO Ki Younger Ju famous in a Jul. 17 publish on X that the stablecoin market cap hit an all-time excessive earlier in July, with USDT comprising 70% of the full market.

Whereas Ju acknowledged that present liquidity ranges may not considerably influence value actions, he deemed the upward pattern as “noteworthy” given the prevailing market circumstances.

Learn extra: Bitcoin’s hashrate reached post-halving backside, analysts say