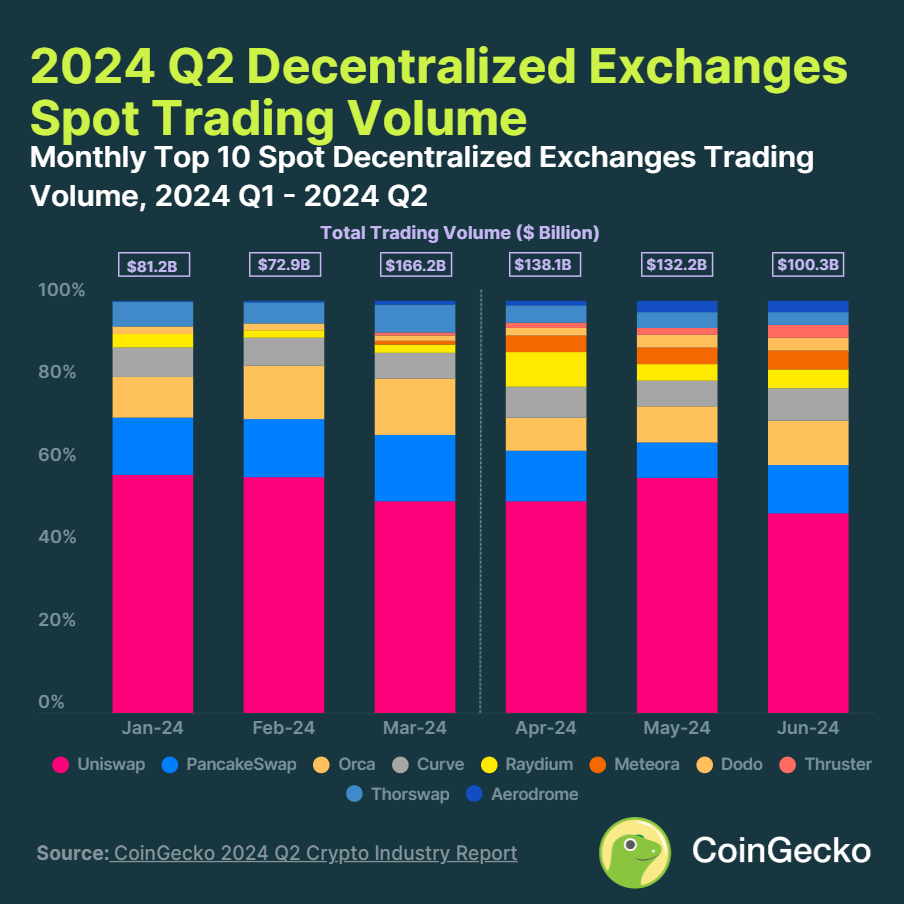

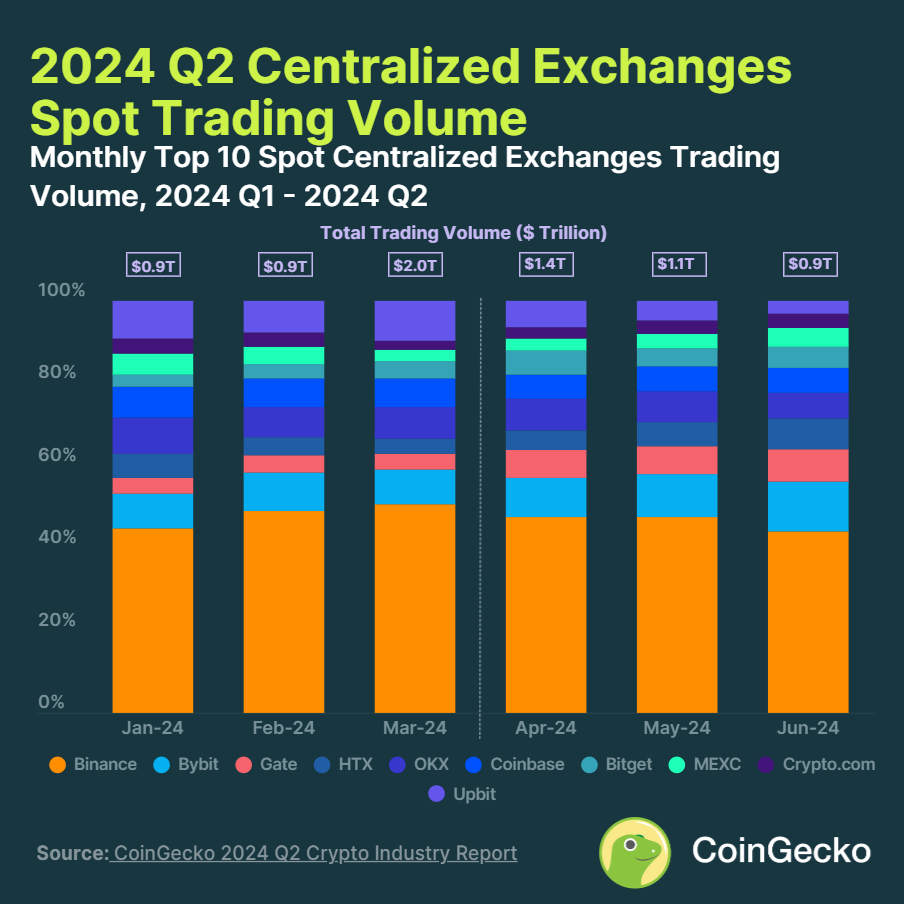

Decentralized exchanges (DEXs) noticed a 15.7% quarter-on-quarter improve in spot buying and selling quantity, reaching $370.7 billion in Q2 2024. This development contrasts with centralized exchanges (CEXs), which skilled a 12.2% decline, recording $3.4 trillion in quantity.

Uniswap maintained its dominance with a 48% market share amongst DEXs. Newcomers Thruster and Aerodrome made important positive aspects, with Thruster’s quantity rising 464.4% to $6 billion and Aerodrome rising 297.4% to $5.9 billion.

“This shift will be attributed to the inherent benefits of DEXs, together with privateness, full transparency, and self-custody. In distinction, CEXs face challenges comparable to KYC necessities, excessive charges, and collapse dangers,” Tristan Frizza, founding father of decentralized trade Zeta Markets, shared with Crypto Briefing.

Frizza added that regardless of practically 80% of trades nonetheless occurring on centralized exchanges, the limitations which have traditionally held decentralized finance (DeFi) again, comparable to difficult onboarding and efficiency points, are being lowered.

Subsequently, because the DeFi ecosystem matures, DEXs are bettering by way of liquidity and consumer expertise, making decentralized buying and selling extra interesting to a broader viewers.

“Solana, as an example, helps over 33% of the full day by day DEX quantity throughout all blockchains as a consequence of its unmatched velocity and cost-effectiveness. This makes it a really perfect setting for each retail and institutional customers.”

Tristan additionally highlights the developments associated to DEX for perpetual contracts buying and selling, mentioning the launch of a layer-2 blockchain on Solana devoted to Zeta Markets, referred to as Zeta X.

“We intention to mix the comfort and velocity of a CEX with the core advantages of DeFi—transparency, self-custody, governance participation, and on-chain rewards. This may assist lead the shift from CeFi to DeFi.”

Within the CEX area, Binance retained its prime place with a forty five% market share regardless of quantity declines. Bybit surged to second place, rising its market share to 12.6% in June.

Solely 4 of the highest 10 CEXs noticed quantity will increase, with Gate main at 51.1% development ($85.2 billion), adopted by Bitget at 15.4% ($24.7 billion), and HTX at 13.7% ($25.5 billion).

The DEX development was attributed to meme coin surges and quite a few airdrops, whereas CEX efficiency aligned with total crypto market developments.