The Ethereum Basis has as soon as once more offered a major quantity of ETH, this time 100 ETH at $2,645, in response to PANews knowledge. This brings the full Ethereum (ETH) offered by the Basis to 1,050 ETH in September alone, valued at roughly $2.53 million.

These gross sales happened at costs between $2,301 and $2,645, suggesting a strategic promoting method throughout Ethereum’s worth swings. These transactions elevate questions on their potential affect available on the market, particularly as ETH exhibits indicators of restoration.

以太坊基金会再次出售100枚ETH,九月已累计出售1050枚ETH $ETH

据链上分析师@ai_9684xtpa监测,以太坊基金会以2,645美元的价格再次卖出100枚ETH,价值26万美元。九月以来基金会已累计出售1050枚ETH,总价值253万美元,最低卖出价格2301美元,最高2645美元。#EF https://t.co/MGicM3riVu

— PANews (@PANewsCN) September 23, 2024

Ethereum Worth Pattern and Market Exercise

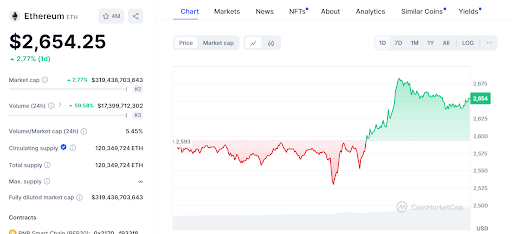

As at presstime, Ethereum’s present worth stands at $2,651.16, reflecting a 2.23% enhance over the previous 24 hours. Importantly, this upward motion comes after a interval of volatility the place ETH briefly examined a help stage close to $2,593 earlier than bouncing again.

Every day buying and selling quantity has jumped by 59.85%, reaching $17.35 billion. This vital rise in buying and selling exercise signifies elevated market curiosity and the potential for extra volatility as buyers react to the Basis’s promoting.

Learn additionally: Ethereum’s Circulating Provide Will increase, Worth Stays Risky

Supply: Coinmarketcap

Bullish Momentum Builds, However Challenges Stay

The current bounce from the $2,593 help stage has created bullish momentum, pushing ETH in the direction of an area excessive of $2,675. Nonetheless, the worth barely retreated and settled round $2,651. Even with this small pullback, the $2,593 help stage has held agency and should proceed to be a vital worth zone within the close to time period.

A number of help and resistance ranges are rising as essential markers in Ethereum’s worth pattern. The help at $2,593 proved its significance when the worth bounced from this stage. As well as, one other key help stage to observe is $2,550, which may present help if $2,593 doesn’t maintain.

Learn additionally: Ethereum’s ‘Parasitic’ Relationship with L2s: Professional’s Take

Wanting forward, ETH faces quick resistance at $2,675, the place the worth was briefly rejected. If it breaks via this stage, the following goal could be the psychological resistance at $2,700. Overcoming this level may result in additional good points, doubtlessly driving ETH greater within the coming days.

Technical Indicators Level to Bullish Pattern

Ethereum’s 1-day Relative Energy Index (RSI) is at the moment at 60.49, inserting it in impartial territory. This studying means that the market is neither overbought nor oversold, leaving room for additional worth motion.

ETH/USD 1-day worth chart, Supply: Coinmarketcap

Moreover, the Transferring Common Convergence Divergence (MACD) is buying and selling above the sign line, indicating rising bullish momentum.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t answerable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.