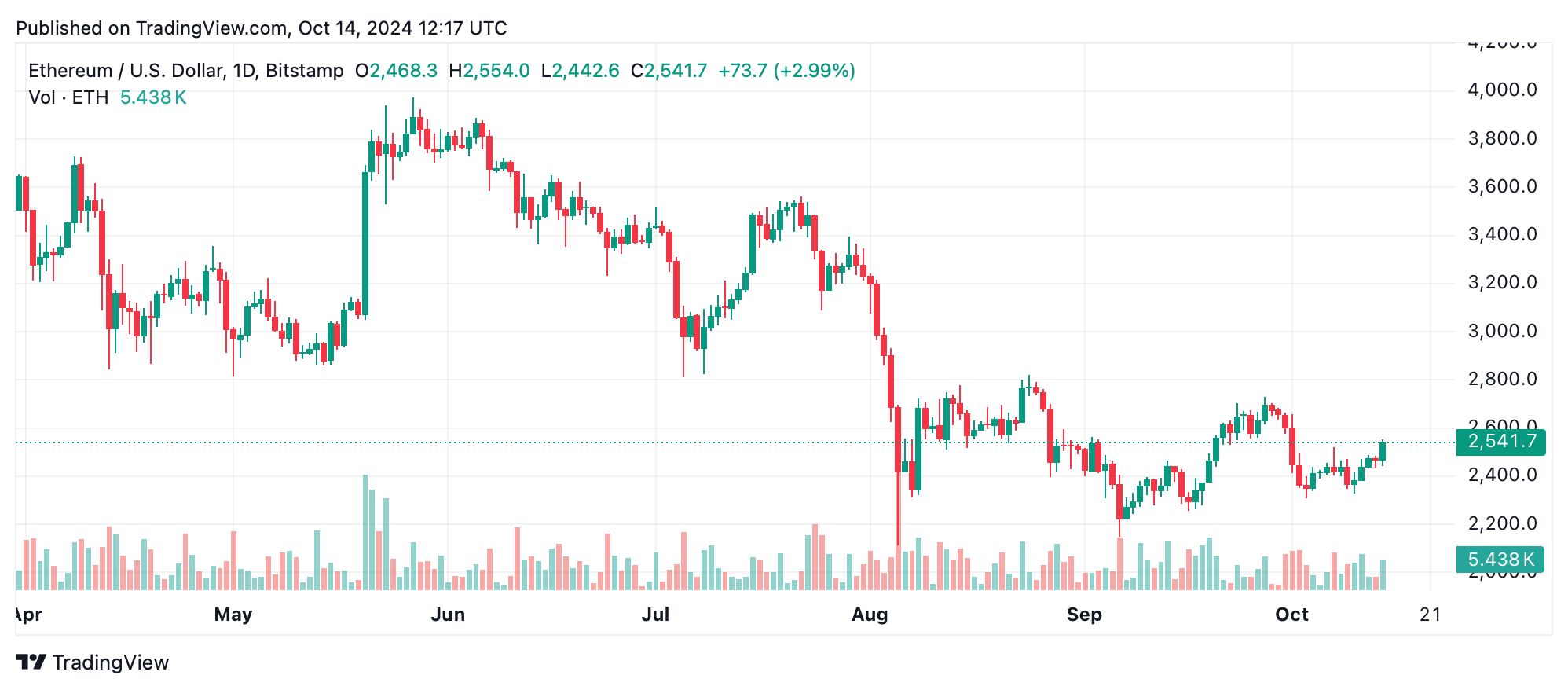

As of Oct. 14, 2024, ethereum’s worth is $2,541, with a complete market cap reaching $305 billion. Within the final 24 hours, ETH has swung between $2,436 and $2,555, supported by a buying and selling quantity of $14.31 billion. Regardless of this exercise, technical indicators trace at continued bearish momentum, with key assist ranges underneath stress.

Ethereum

On the 1-hour chart, ethereum continues to indicate weak spot, buying and selling under each its 50- and 200-hour transferring averages, signaling a short-term bearish pattern. Oscillators just like the relative energy index (RSI) sit round 45, indicating impartial to barely bearish momentum. The transferring common convergence divergence (MACD) stays under the sign line, additional reinforcing the bearish outlook. Until ethereum breaks above $2,560, extra declines appear possible.

The 4-hour chart provides a wider perspective on ethereum’s ongoing struggles. ETH has been unable to recapture its 50-period transferring common, now appearing as resistance round $2,560. A descending sample is forming, with decrease highs, whereas oscillators just like the stochastic RSI present overbought situations, hinting at a possible downward correction. Assist at $2,450 is crucial on this timeframe.

Zooming out to the every day chart, ethereum stays under its 100-day transferring common, a key indicator of long-term tendencies. The MACD histogram has stayed damaging for a number of days, and the RSI stays close to 40, emphasizing persistent promoting stress. Though ethereum skilled temporary upward strikes inside its 24-hour vary, it hasn’t managed to interrupt away from its bearish path.

Transferring averages (MAs) throughout all charts paint an image of bearish dominance. ETH stays under each its 50-day and 200-day transferring averages, indicating that bears nonetheless have the higher hand. Merchants ought to preserve an in depth eye on the $2,500 degree—if it breaks, the downtrend might prolong to the following assist at $2,430.

Bull Verdict:

For the bulls, ethereum must make a decisive transfer above $2,543 and reclaim its 50-period transferring averages throughout key timeframes. If this occurs, it might spark shopping for momentum, pushing ETH towards its subsequent resistance at $2,600. With growing quantity and bullish oscillators, ethereum would possibly see a shift in sentiment and probably reverse the present bearish pattern.

Bear Verdict:

For the bears, the outlook stays favorable so long as ethereum struggles under $2,543 and stays underneath key transferring averages. A break under $2,500 would affirm the continuation of the downtrend, with the following main assist at $2,430. Ongoing weak spot in oscillators and damaging transferring common crossovers recommend that ethereum might face additional draw back stress within the brief time period.