Bitcoin’s worth at the moment stands at $71,347, exhibiting a formidable rise throughout the 24-hour intraday vary of $70,065 to $71,595. With a buying and selling quantity of $25.17 billion and a market capitalization of $1.4 trillion, bitcoin has gained 4.9% this week, 5.6% over the previous two weeks, and 14.4% within the final 30 days.

Bitcoin

Bitcoin’s 1-hour chart reveals a current restoration following a pointy decline, with a key resistance stage at $71,629 and help round $70,116. The upper quantity throughout current drops signifies sturdy promoting strain, whereas the following enhance in quantity suggests sturdy shopping for curiosity.

BTC/USD day by day chart by way of Bitstamp.

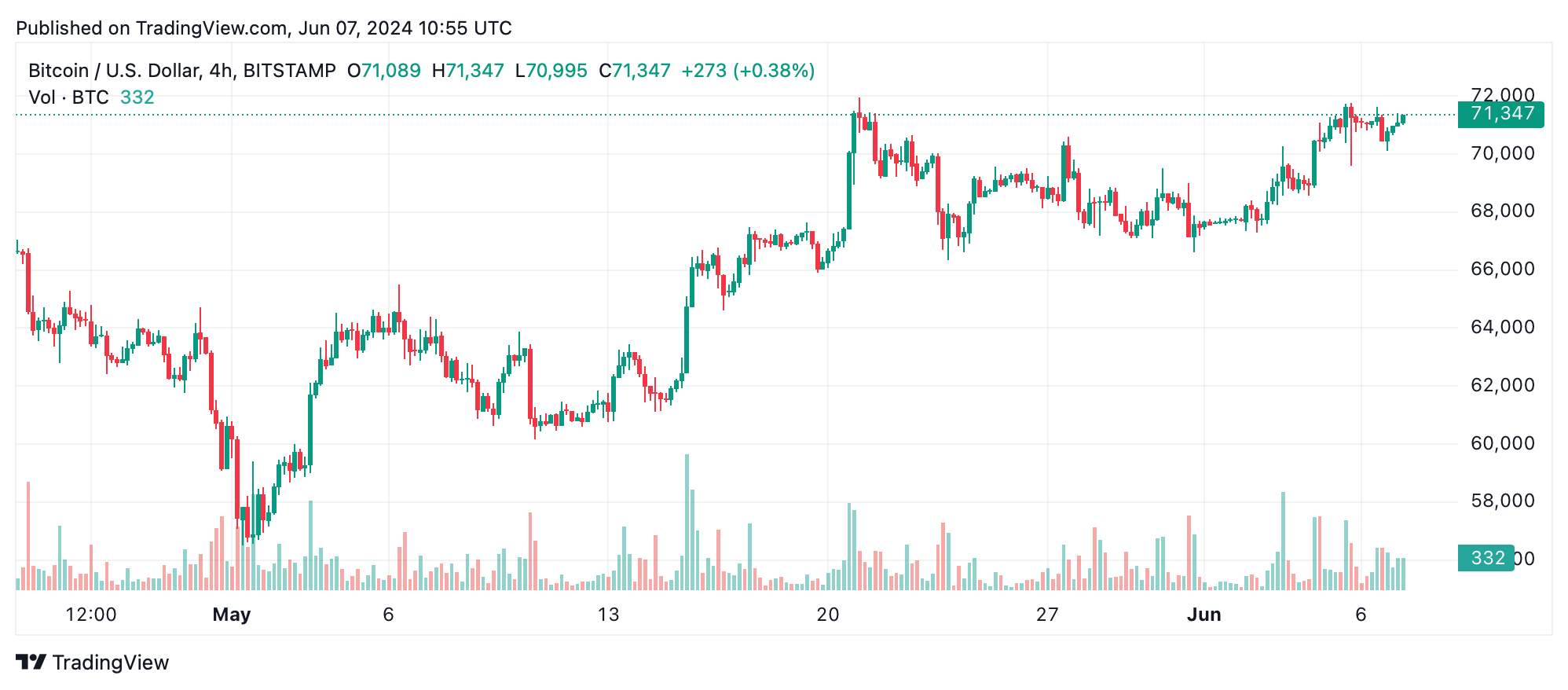

The 4-hour chart maintains an upward pattern from roughly $67,281 to a current peak of $71,759. In line with the 1-hour chart, the first resistance is at $71,759, with help at $70,116. Quantity evaluation right here reveals elevated exercise throughout upward actions, confirming sturdy shopping for curiosity.

BTC/USD 4-hour chart by way of Bitstamp.

On the day by day chart, bitcoin reveals a sustained uptrend from $60,176 to a current excessive of $71,958. Resistance is about at $71,958, whereas help is stronger at $67,000. Quantity spikes throughout worth surges point out continued shopping for curiosity, whereas decreased quantity throughout consolidations suggests momentary pauses.

BTC/USD oscillator values current a combined however usually constructive outlook. The relative energy index (RSI) at 63 is impartial, and the Stochastic at 86 signifies overbought situations. The commodity channel index (CCI) suggests bearish sentiment, whereas the shifting common convergence divergence (MACD) and Momentum indicators sign shopping for alternatives.

Transferring averages (MAs) throughout completely different durations constantly point out a powerful bullish sign, with each exponential shifting averages (EMAs) and easy shifting averages (SMAs) above key worth ranges, reinforcing the bullish sentiment. Longer-term MAs, such because the 50-day EMA at $66,713 and the 50-day SMA at $65,634, point out constructive sentiment.

The 100-day EMA and SMA, at $63,566 and $66,477 respectively, together with the 200-day EMA at $56,491 and the 200-day SMA at $55,282, constantly present purchase alerts, underscoring the long-term constructive outlook for bitcoin. Amidst these technical indicators and market behaviors, bitcoin’s present trajectory suggests a strong resilience to short-term volatilities, underscored by a steadfast bullish momentum over various time frames.

Bull Verdict:

Given the constant upward tendencies noticed throughout the 1-hour, 4-hour, and day by day charts, together with sturdy shopping for curiosity indicated by quantity spikes and constructive shifting averages, bitcoin seems poised for additional good points. Merchants ought to stay optimistic, awaiting key breakouts above resistance ranges to capitalize on the continuing momentum.

Bear Verdict:

Regardless of the present upward tendencies, warning is warranted as key oscillators present combined alerts and potential overbought situations. If bitcoin fails to interrupt above important resistance ranges or reveals vital promoting strain close to help ranges, merchants ought to put together for doable downward corrections and contemplate protecting measures.