Bitcoin’s value on Might 29, 2024, displays a interval of consolidation following latest volatility. The present value stands at $67,739 with an intraday vary of $67,201 to $68,880. Technical indicators and shifting averages present a blended outlook, indicating each potential stability and the opportunity of future actions.

Bitcoin

Bitcoin’s 1-hour chart reveals a excessive of $69,513 and a low of $67,193. The sharp decline adopted by sideways motion signifies an absence of sturdy momentum in both course. Quantity spikes are seen in the course of the sharp actions, but latest decrease volumes counsel dealer indecision. Key ranges to watch are the help at $67,200 and resistance at $69,500, as breaking these might decide short-term course.

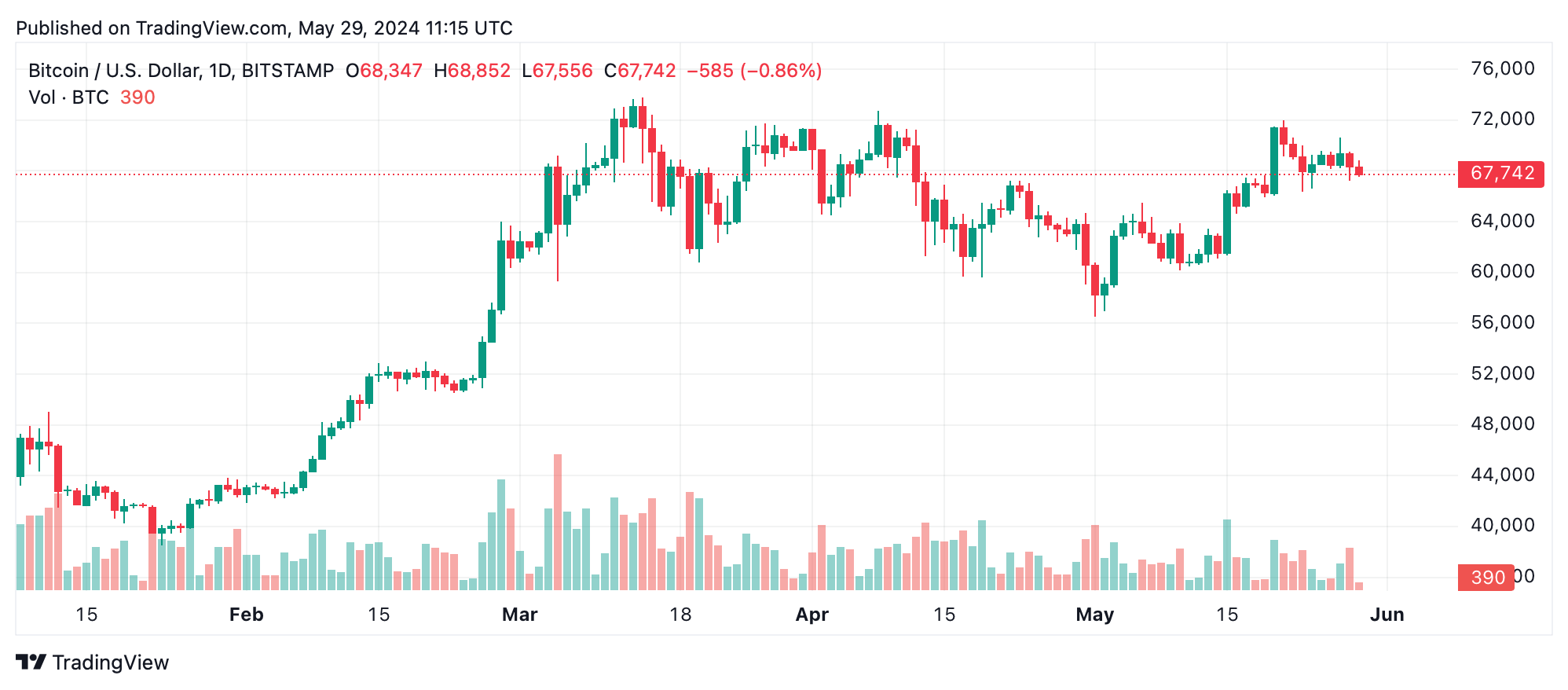

BTC/USD day by day chart.

On the 4-hour chart, BTC reached a excessive of $70,601 and a low of $66,343. The worth motion signifies a major bullish transfer adopted by a consolidation part with decrease highs and better lows, doubtlessly forming a symmetrical triangle. The amount spikes throughout sharp value adjustments, adopted by decrease volumes throughout consolidation, emphasize the cautious sentiment prevailing available in the market.

BTC/USD 4-hour chart.

The day by day chart supplies a broader perspective, displaying an total uptrend from a low of $56,500 to a excessive of $71,958. Just lately, the value has been consolidating within the $68,000 to $70,000 vary. The amount evaluation on the day by day chart helps this consolidation part, with decrease buying and selling exercise indicating a brief pause within the bullish momentum.

Analyzing the oscillators, the relative energy index (RSI) stands at 54, indicating a impartial stance. Different oscillators just like the Stochastic, commodity channel index (CCI), and common directional index (ADX) additionally present impartial values. Nevertheless, the momentum and MACD degree counsel a purchase sign, highlighting potential bullish sentiments within the close to time period.

The shifting averages (MAs) current a blended outlook. Quick-term averages such because the ten-day exponential shifting common (EMA) and ten-day easy shifting common (SMA) point out a promote sign, whereas the medium to long-term averages just like the EMA (20, 30, 50, 100, 200) and SMA (20, 30, 50, 100, 200) sign bullish sentiment. This divergence underscores the present market’s indecision, with short-term warning contrasting with longer-term optimism.

Bull Verdict:

If bitcoin can maintain above the important thing help degree of $67,200 and break by the $69,500 resistance with growing quantity, it could sign a continuation of the bullish development, doubtlessly concentrating on new highs.

Bear Verdict:

Ought to bitcoin fail to keep up the $67,200 help and face continued promoting strain, it’d point out a bearish reversal, resulting in additional declines and testing decrease help ranges.