Whereas Bitcoin has been experiencing consecutive declines not too long ago, these declines are thought-about to be efficient attributable to BTC gross sales from the German and US governments and miners.

Whereas BTC is at the moment above $61,000, knowledge on Private Consumption Expenditures (PCE), which is intently adopted by the FED when making rate of interest selections and is taken into account a number one inflation indicator, was introduced.

Accordingly, all knowledge introduced concerning private consumption expenditures in Might had been as follows:

Core Private Consumption Expenditures Worth Index (Annual) Introduced 2.6% – Anticipated 2.6% – Earlier 2.8%

Core Private Consumption Expenditures Worth Record (Month-to-month) Introduced 0.1% – Anticipated 0.1% – Earlier 0.2%

Private Consumption Expenditures Worth Index (Annual) Introduced 2.6% – Anticipated 2.6% – Earlier 2.7%

Private Consumption expenditures Worth Index (Month-to-month) Introduced 0.0% – Anticipated 0.0% – Earlier 0.3%

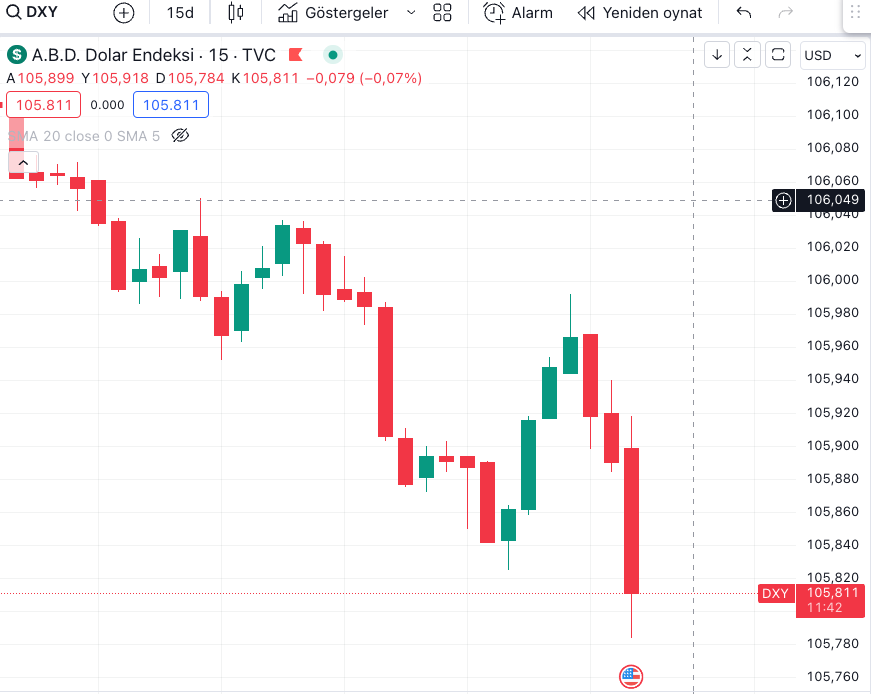

What Was the First Response of Bitcoin and the Greenback?

What’s Core Private Consumption Expenditures Worth Index? What’s the Impact on Worth?

Core Private Consumption expenditures (PCE) decide the speed of inflation skilled by customers when buying items and providers aside from Meals and Power.

Foreign money merchants observe the Core PCE Worth Record because the Reserve Financial institution’s most popular shopper inflation indicator.

PCE differs barely from CPI in that it solely identifies providers and items which might be consumed and focused individually. The Nutrient and Power calculation is roughly 25% of the PCE, however these can range enormously from month to month and may distort the entire image. Just like the CPI, it displays worth adjustments in shopper items and providers. By excluding the variable parts, PCE can be a greater indicator beneath the inflationary slope. (investing.com)

*This isn’t funding recommendation.