BlackRock’s iShares Bitcoin Belief (IBIT) has considerably impacted the crypto market by buying near $780 million in Bitcoin (BTC) over simply three days.

This surge in funding positions IBIT as a significant affect in shaping investor sentiment and market tendencies.

BlackRock’s IBIT Attracts Huge Inflows

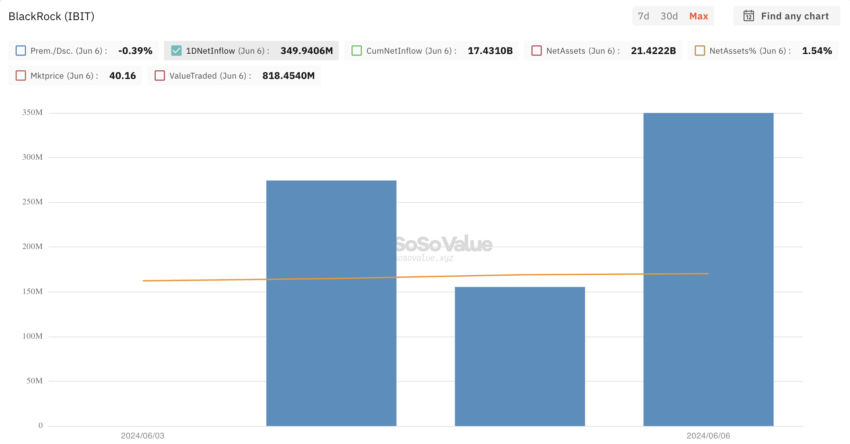

On Monday, IBIT recorded 0 influx. Nevertheless, the fund attracted a considerable $274.43 million on Tuesday, adopted by $155.43 million on Wednesday.

In accordance with information from SoSoValue, it had drawn a further $350 million on Thursday. Consequently, this week’s whole influx for IBIT approached $780 million.

Just lately, BlackRock’s iShares Bitcoin Belief reached a brand new peak by turning into the world’s largest Bitcoin ETF. It now boasts $21.4 billion in belongings, surpassing Grayscale’s $20.1 billion. The $12.3 billion Constancy Sensible Origin Bitcoin Fund ranks third.

Learn extra: How To Commerce a Bitcoin ETF: A Step-by-Step Strategy

BlackRock IBIT Inflows. Supply: SoSoValue

On Thursday, different funds noticed comparatively smaller inflows in comparison with IBIT. Constancy’s and VanEck’s Bitcoin ETFs acquired web inflows of $3.1 million and $2 million, respectively.

Conversely, Ark Make investments’s ARKB skilled one of many largest fund withdrawals, with web outflows of $96.6 million. Grayscale’s transformed GBTC and Bitwise’s BITB additionally confronted outflows, shedding $37.6 million and $3.1 million, respectively.

Spot Bitcoin ETFs have continued to draw traders, reaching the longest streak of web inflows since their inception. These funds have amassed a complete of $15.55 billion since January. Though inflows slowed throughout April and Might, they’ve since rebounded, although nonetheless beneath March’s peak ranges.

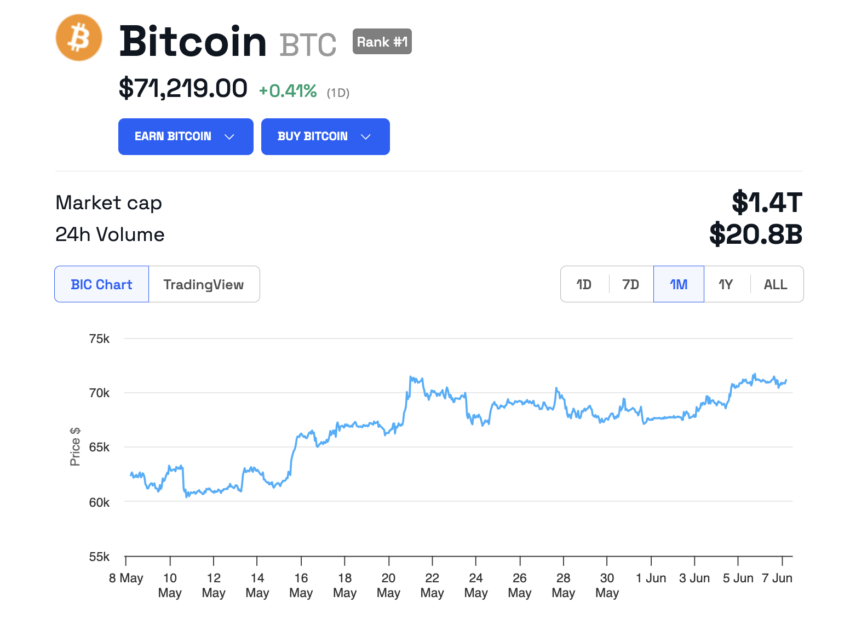

Within the midst of those inflows, Bitcoin’s worth has risen barely. It’s at the moment buying and selling round $71,219, marking a 0.41% enhance over the previous 24 hours.

Market analysts are optimistic, predicting that Bitcoin may exceed its March peak of $73,798. This expectation is pushed by robust ETF demand and anticipated Federal Reserve rate of interest cuts.

“There have been large inflows into spot-Bitcoin ETFs. Macro continues to development in crypto’s favor, with financial development slower at a non-recessionary tempo and indicators of disinflation persevering with,” Sean Farrell, head of digital-asset technique at Fundstrat International Advisors, stated.

Learn extra: Methods to Defend Your self From Inflation Utilizing Cryptocurrency

Bitcoin Value Efficiency. Supply: BeInCrypto

Different central banks have already began fee cuts. The European Central Financial institution (ECB) lower its key fee to three.75%, and the Financial institution of Canada (BoC) diminished theirs to 4.75%.

These cuts are meant to stimulate financial exercise by making borrowing cheaper, which may result in elevated investments in crypto. Decrease rates of interest usually lower the enchantment of conventional financial savings, pushing traders in the direction of riskier belongings like crypto.