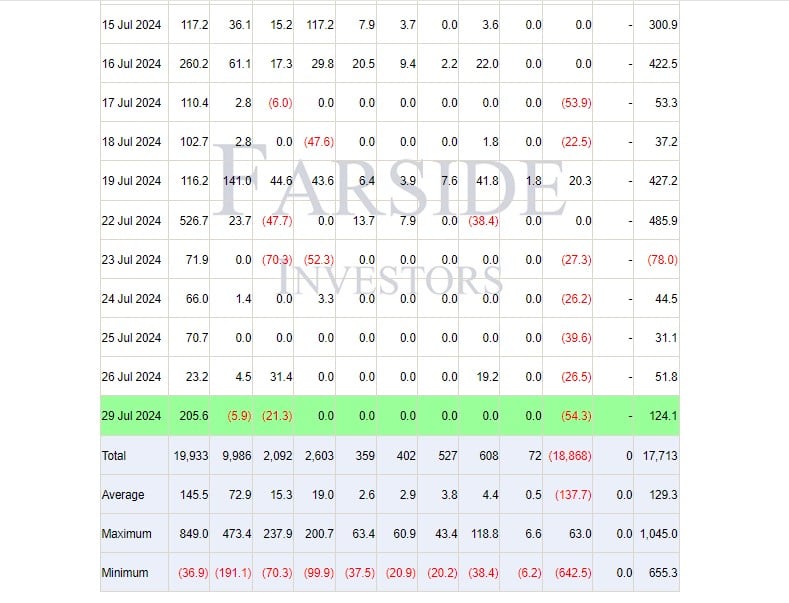

BlackRock’s iShares Bitcoin Belief (IBIT) outperformed its ETF friends on Monday, attracting round $205 million in web inflows whereas the remainder of the market reported both losses or zero web flows, knowledge from Farside Buyers exhibits.

US spot Bitcoin ETFs collectively attracted roughly $124 million in web inflows on Monday, with BlackRock’s IBIT accounting for the whole achieve.

In distinction, Grayscale’s GBTC, Bitwise’s BITB, and Constancy’s FBTC skilled web outflows of $54 million, $21 million, and $6 million, respectively. Different competing funds reported zero inflows.

The Bitcoin ETF market will quickly welcome Grayscale’s Bitcoin Mini Belief (BTC), a newly accepted mini model of the Grayscale Bitcoin Belief. The spin-off provides a aggressive edge with a administration charge of 0.15%, considerably decrease than the 1.5% charged by GBTC.

Beginning July 31, Grayscale will switch 10% of GBTC’s holdings to the Mini Belief, with GBTC shareholders receiving proportional shares within the new fund. With the brand new BTC fund, Grayscale goals to offer traders with a lower-cost possibility to realize publicity to Bitcoin via Grayscale’s funding merchandise.

BTC’s decrease charges will place it as a robust competitor within the Bitcoin ETF market. Grayscale’s GBTC, as soon as a dominant participant, has misplaced its edge since being transformed to an ETF. As of July 29, GBTC’s property below administration (AUM) had been $18.1 billion, outpaced by BlackRock’s IBIT with virtually $23 billion in AUM.

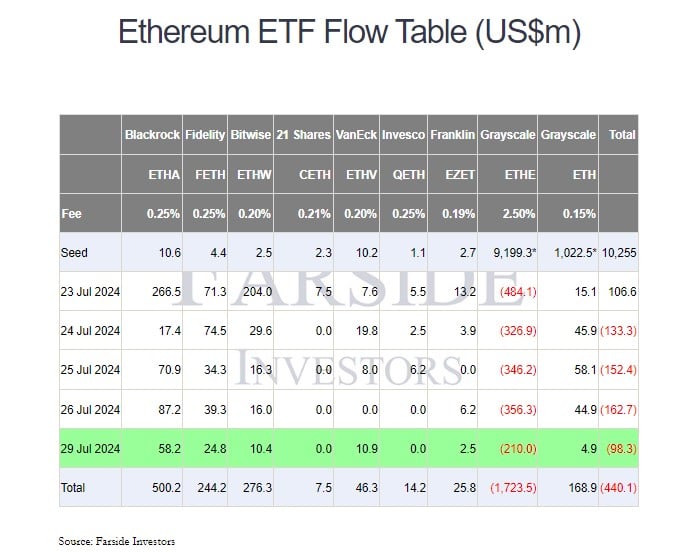

BlackRock’s spot Ethereum ETF inflows hit $500 million

Elsewhere, BlackRock’s iShares Ethereum Belief (ETHA) posted $58 million in web inflows on Monday, bringing the complete inflows to $500 million, in keeping with Farside Buyers.

After a tough begin, US spot Ethereum merchandise have entered their second week of buying and selling as traders put together for aggressive outflows from Grayscale’s Ethereum ETF (ETHE). With $210 million pulled out of the fund on Monday, ETHE has seen round $1.7 billion drained because it was transformed into an ETF.

Other than BlackRock’s ETHA, the opposite 5 Ethereum ETFs that made positive factors had been Constancy’s FETH, VanEck’s ETHV, Bitwise’s ETHW, Franklin Templeton’s EZET, and Grayscale’s ETH.

General, the new Ethereum funds ended Monday with round $98 million in web outflows.