- Bitcoin’s September rally, the place the crypto rose 21%, was pushed largely by Chinese language stimulus packages.

- Market gamers are underwhelmed because the Chinese language authorities’s stimulus plans didn’t dwell as much as their expectations.

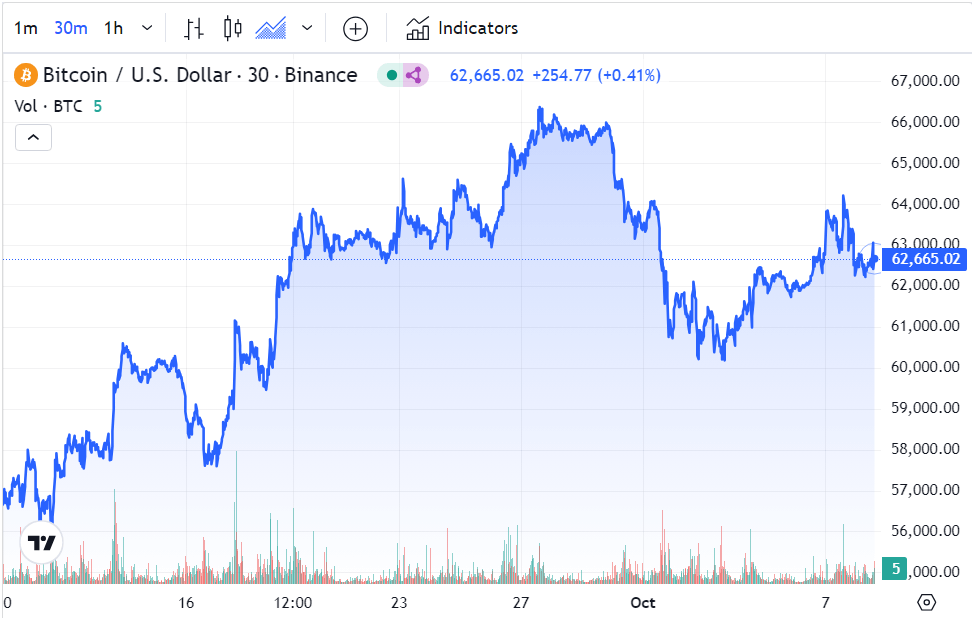

- Bitcoin failed to remain above $64,000 because the market seeks a catalyst regardless of ‘Uptober’ expectations.

The latest Bitcoin rally, which began in early September and is believed to have been pushed largely by Chinese language stimulus packages, has begun to fizzle out. The most important crypto by market capitalization briefly crossed the $66,000 mark on September twenty seventh however couldn’t maintain the rally. As of October 2nd, it fell to $60,000 and trades at $62,700.

Chinese language stimulus

Whereas September is traditionally a bearish month for cryptos, Bitcoin carried out favourably final month pushed largely by a stimulus program from the Individuals’s Financial institution of China (PBOC) in response to slowing financial progress and Fed price cuts.

The PBOC slashed charges on medium-term lending and the 7-day repo to spice up financial exercise, a measure identified to enhance sentiments round dangerous belongings. Mortgage charges and minimal downpayment necessities for all sorts of houses had been additionally slashed to assist China’s housing market.

Expectations remained that the federal government can be keen to maintain its stimulus efforts by way of a multi-trillion-yuan spending plan; nonetheless, the federal government introduced that it’s going to frontload 100 billion Yuan from its 2025 finances along with one other 100 billion to assist the development trade, a far cry from expectations.

Uptrend catalysts for the crypto market

The concentrate on Chinese language stimulus comes at a degree when the crypto market awaits a catalyst to spur a rally. The Fed’s 50bps rate of interest slash in September is anticipated to herald a rally, however October has been underwhelming as Bitcoin struggles to interrupt the $64,000 stage and institutional inflows into US Bitcoin (and Ethereum) spot ETFs dwindle.

Bitcoin fell roughly 1% after the announcement of the federal government’s stimulus plans however recovered considerably within the London buying and selling session.