Amid cryptocurrencies like Bitcoin (BTC) turning into extra current and related within the mainstream, BlackRock (NYSE: BLK), a $10 trillion asset supervisor and creator of the most important Bitcoin exchange-traded fund (ETF) on the planet, has shared its views concerning the maiden crypto asset’s future.

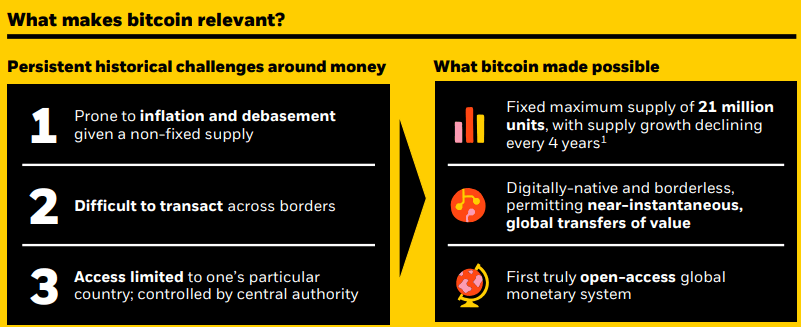

Certainly, BlackRock outlined the dynamics of Bitcoin “because it pertains to danger, return, and portfolio interactions, (…) in recognition of the early stage Bitcoin is at in its journey, and the rapidity with which its adoption and understanding by the worldwide investor neighborhood is evolving,” in a report referred to as Bitcoin: A Distinctive Diversifier.

How Bitcoin surpassed $1 trillion

Particularly, within the part referring to BTC’s $1 trillion in market capitalization, the report highlighted its “outstanding rise and important international adoption so far” but additionally that its “evolving market worth displays (…) uncertainty” concerning the potential to be a “widespread retailer of worth and/or international fee asset.”

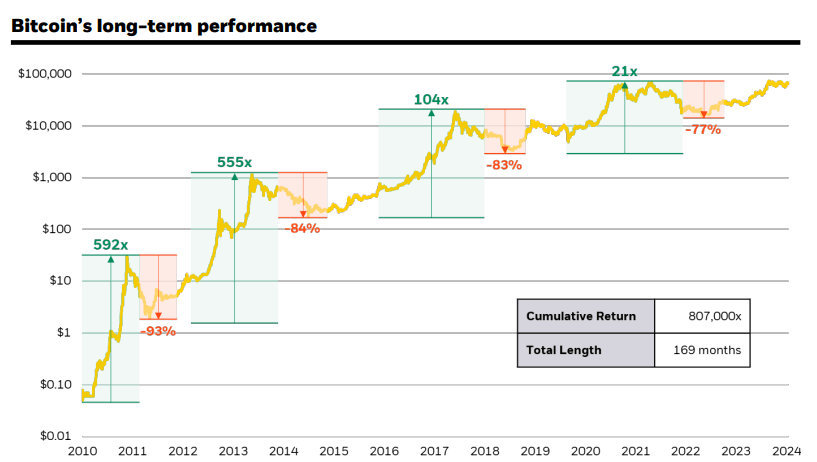

However, the asset supervisor noticed that Bitcoin had outperformed all main asset lessons in 7 out of the final 10 years, main it to a unprecedented return in extra of 100% annualized over the past decade,” and careworn its capacity to get better from bearish durations:

“This efficiency was achieved regardless of Bitcoin additionally being the worst-performing asset within the different three of these 10 years, with 4 drawdowns in extra of fifty%. By means of these historic cycles, it has proven a capability to get better from such drawdowns and attain new highs, regardless of these prolonged bear market durations.”

As BlackRock’s crew deduced, such actions within the worth of the flagship decentralized finance (DeFi) asset illustrate, to a sure diploma, its “evolving prospects by time of turning into adopted on a widespread foundation as a world financial various.”

On the identical time, the report referred to Bitcoin’s danger, arguing that, whereas its volatility does make it “a ‘dangerous’ asset on a standalone foundation, (…) a lot of the danger and potential return drivers Bitcoin faces are basically totally different from conventional ‘dangerous’ belongings, making it unfitting for many conventional finance frameworks – together with the ‘danger on’ vs. ‘danger off’ framework employed by some macro commentators.”

Lastly, BlackRock concluded that Bitcoin’s adoption trajectory will seemingly develop beneath the affect of considerations over international financial stability, geopolitical points, the fiscal stability of the USA, in addition to the nation’s political stability, describing this because the “inverse of the connection (…) usually attributed to conventional ‘danger belongings’ with respect to such forces.”

Bitcoin worth evaluation

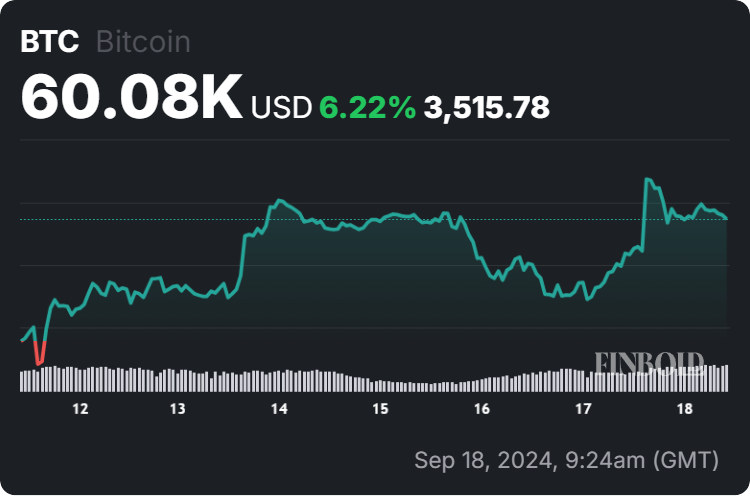

In the meantime, Bitcoin was at press time altering palms on the worth of $60,080, reflecting a 1.91% enhance within the final 24 hours, gaining 6.22% throughout the earlier seven days, and accumulating an advance of three.73% prior to now month, in line with the newest knowledge retrieved on September 18.

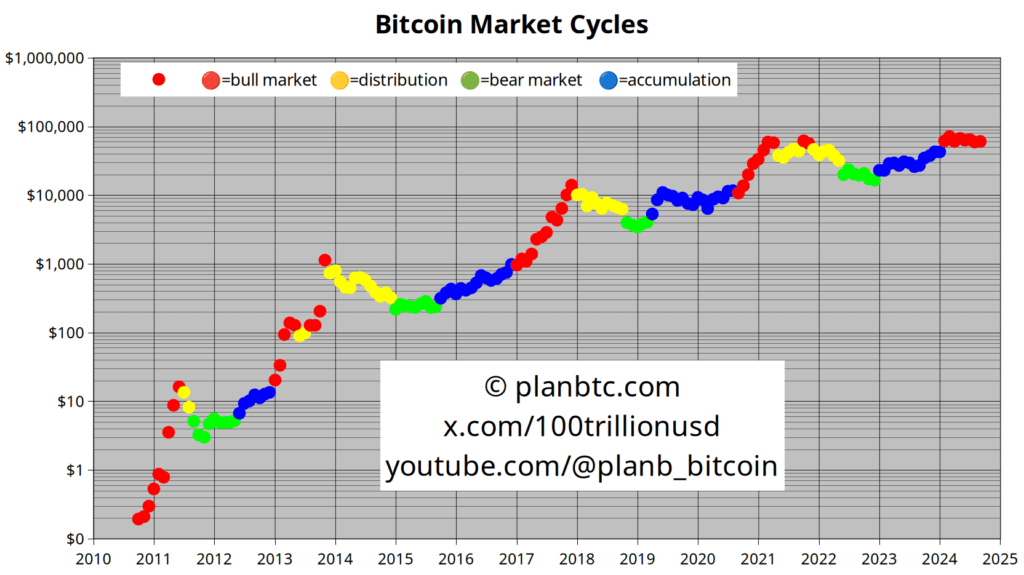

It is usually price noting that famend crypto professional PlanB just lately noticed that Bitcoin appears to be within the early phases of a bull market however remains to be ready for a “set off to blow up upwards,” opining that the victory of the previous U.S. President Donald Trump within the upcoming presidential election may present this set off.

All issues thought of, Bitcoin would possibly, certainly, proceed to observe alongside the identical bullish path as described by the corporate with $10 trillion in belongings beneath its administration. Nevertheless, it is very important keep in mind that traits within the crypto market can change with out warning, so doing one’s personal due diligence is crucial when investing.

Disclaimer: The content material on this website shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.