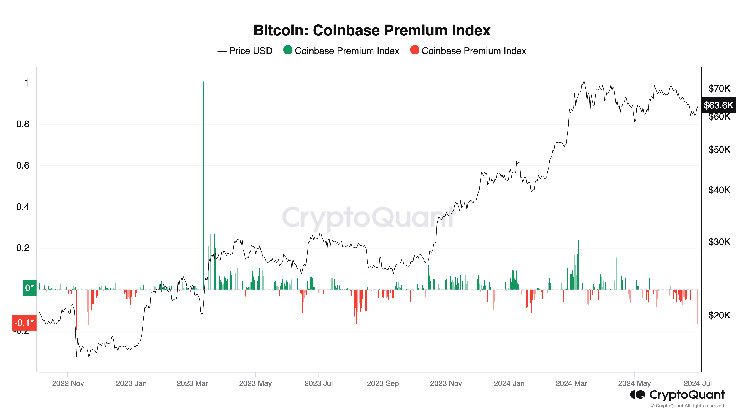

Bitcoin’s worth premium on Coinbase has plummeted to destructive ranges not often seen, CryptoQuant information confirmed.

Comparable readings in November 2022 and August 2023 foreshadowed imminent native worth bottoms and subsequent rallies.

Bitcoin (BTC) is buying and selling at a deep low cost on crypto alternate Coinbase, which may very well be an indication that the biggest crypto asset’s worth is bottoming foreshadowing the subsequent leg larger.

“All the time darkest earlier than the daybreak,” requested David Lawant, head of analysis at institutional crypto buying and selling platform FalconX, in an X publish. “The final time the Coinbase premium was this destructive was a few months earlier than the large rally from Oct ’23 to March ’24,” he added.

The so-called “Coinbase Premium Index” measures the worth distinction for bitcoin on Coinbase, broadly utilized by U.S. customers and plenty of institutional market contributors, in comparison with the off-shore Binance, the main alternate by buying and selling quantity and in style amongst retail customers.

The metric has been destructive for an prolonged interval throughout June and most of Could, echoing final yr’s market lull in August and September, in accordance with information from analytics agency CryptoQuant. On Friday, it slid to almost -0.19, its lowest studying on the every day timeframe because the November 2022 collapse of crypto alternate FTX.

Such destructive readings recommend weak demand and promoting stress from U.S. buyers, as bitcoin has been consolidating range-bound since March’s all-time highs. Buyers have additionally grown involved about outflows from the U.S.-listed spot BTC exchange-traded funds – a lot of which use Coinbase for settlements – and the U.S. authorities promoting seized belongings by means of Coinbase, which could have contributed to the worth low cost on Coinbase.

Learn extra: Bitcoin and Crypto Closing Out Lame Quarter and One Analyst Believes Extra Ache Might Be in Retailer

Nonetheless, such a deeply destructive Coinbase Premium beforehand appeared close to to native bottoms in worth, adopted by important rallies within the coming months.

The early November 2022 studying coincided with the bear market low for BTC at under $16,000, with costs later surging to almost $25,000 by February. That was a greater than 50% rally.

The August 2023 low within the premium occurred a pair weeks earlier than bitcoin hit an area backside round $25,000. Then, BTC traded range-bound till October to nearly double in worth by January pushed by anticipation for the upcoming U.S. bitcoin ETFs, and later to new all-time highs.

Most just lately, the metric spiked to equally low ranges (-0.17) in the course of the Could 1 capitulation to $56,000, from the place BTC rallied about 27% to close $72,000 in June earlier than faltering.

“Not less than just lately, the Coinbase premium has turn out to be a dependable, confirming, and generally even main indicator of general market traits,” Lawant advised CoinDesk in a direct message. “This underscores the numerous affect of the U.S. market in figuring out market worth formation.”

On condition that a number of upcoming catalysts are U.S.-centric – comparable to ETF flows, U.S. financial coverage and the presidential election, he mentioned he expects this development to proceed.

“One thing tells me the subsequent 6-12 months will likely be splendid—and doubtless unstable,” Lawant predicted.