The value of Bitcoin — and the final market — began the week with one of many largest declines they’ve seen in 2024. Whereas this broad market downturn resulted in widespread concern and panic amongst crypto fanatics, it seems that many traders took the chance to amass extra digital belongings at low costs.

In accordance with the most recent on-chain knowledge, important quantities of Bitcoin have moved out of cryptocurrency exchanges. The query right here is — what does this imply and the way does it have an effect on the BTC worth?

Are Buyers Backing The Bull Run To Proceed?

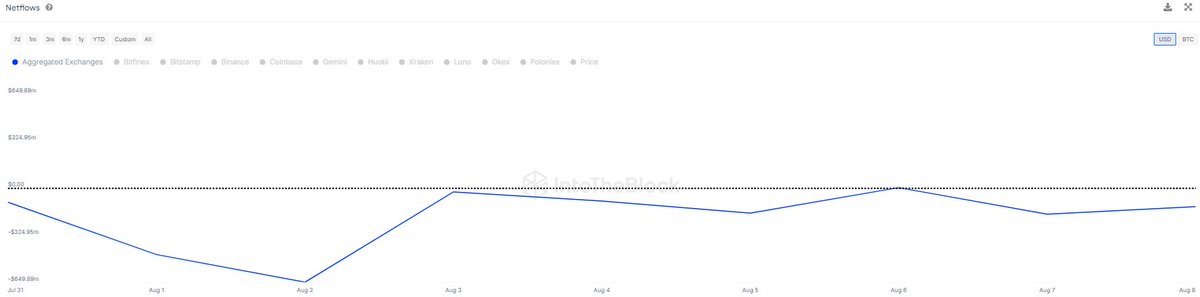

In accordance with current knowledge from IntoTheBlock, greater than 28,000 BTC (value over $1.7 Billion) have been transferred out of crypto exchanges previously week. This on-chain revelation relies on modifications within the Netflows metric, which screens the quantity of a selected cryptocurrency despatched out and in of centralized exchanges.

A rise within the Netflows’ worth (or when it’s optimistic) indicators that extra funds are coming into than leaving crypto exchanges. However, when the metric’s worth falls under, it implies that extra crypto belongings are flowing out of than into buying and selling platforms.

Supply: IntoTheBlock

As proven within the chart above, the Netflows metric for Bitcoin has been on a decline over the previous few days, implying that giant traders have been transferring their belongings from centralized exchanges. In accordance with IntoTheBlock, the $1.7 billion in BTC withdrawn within the final seven-day interval is the most important outflow seen inside this timeframe up to now in 2024.

Though it’s troublesome to inform the rationale behind this huge exodus, crypto actions of this magnitude away from centralized exchanges sometimes point out a shift in investor sentiment. It suggests a change in holding technique and even recent accumulation by giant traders, displaying their religion within the long-term promise of Bitcoin.

Furthermore, the decline within the availability of the premier cryptocurrency on buying and selling platforms may end in a provide crunch. In the end, this fall in BTC’s change reserve could set off a surge within the Bitcoin worth.

Bitcoin Worth At A Look

Following a steep decline from above $64,000 to $48,000 on Monday, August 5, the worth of Bitcoin has proven nice resilience previously week, combating its approach again above the $62,000 degree.

As of this writing, the premier cryptocurrency stands at round $60,400, reflecting a 1% worth decline within the final 24 hours. In the meantime, knowledge from CoinGecko reveals that BTC continues to be down by over 3% this week.

The value of Bitcoin hovering across the $60,000 mark on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView