On-chain knowledge reveals a big lower within the Bitcoin whale and alternate actions because the asset’s worth stays near the $67,000 mark.

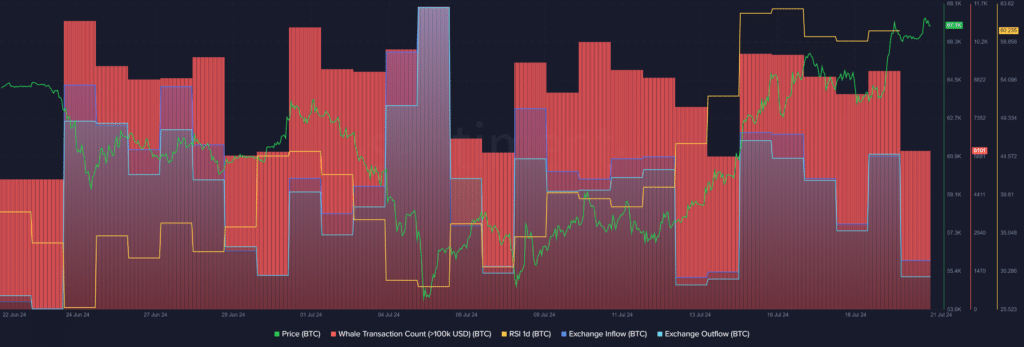

Based on knowledge offered by Santiment, the variety of whale transactions consisting of no less than $100,000 value of Bitcoin (BTC) dropped by 33% over the previous 24 hours — falling from 9,176 to six,101 distinctive transactions per day.

BTC worth, whale exercise, alternate exercise and RSI – July 21 | Supply: Santiment

Fairly equally, the Bitcoin alternate exercise additionally recorded a notable lower. Per knowledge from Santiment, the variety of BTC getting into centralized and decentralized exchanges plunged from 48,289 to 26,073 cash prior to now 24 hours.

You may also like: VC roundup: Allium raises $16.5m as crypto funding exercise cools

Furthermore, knowledge from the market intelligence platform reveals that the variety of Bitcoins leaving exchanges — to self-custodial wallets — took a deep dive from 52,616 to 23,355 tokens over the previous day.

The decline within the asset’s on-chain exercise reveals that Bitcoin holders, each giant and small, may very well be ready for potential market actions.

Based on Santiment, the Bitcoin Relative Power Index (RSI) is hovering across the 60 mark. The indicator reveals that the flagship cryptocurrency is barely overbought at this worth level as a result of unsure market circumstances.

For BTC to stay within the bullish zone, its RSI would wish to chill down beneath the 50 mark. Notably, the Bitcoin RSI was sitting at 28 on July 5, displaying the asset was oversold at $54,000.

Bitcoin is up by 0.55% prior to now 24 hours and was buying and selling at $67,000 ultimately verify Sunday. The token’s market cap is hovering across the $1.32 trillion mark, with a day by day buying and selling quantity of $18 billion.

One of many bullish occasions for Bitcoin’s bullish momentum may very well be the constant spot BTC ETF inflows within the U.S. — serving to the funding merchandise surpass a market cap of $17 billion.

Learn extra: Ethereum enjoys worth improve as ETF anticipation intensifies