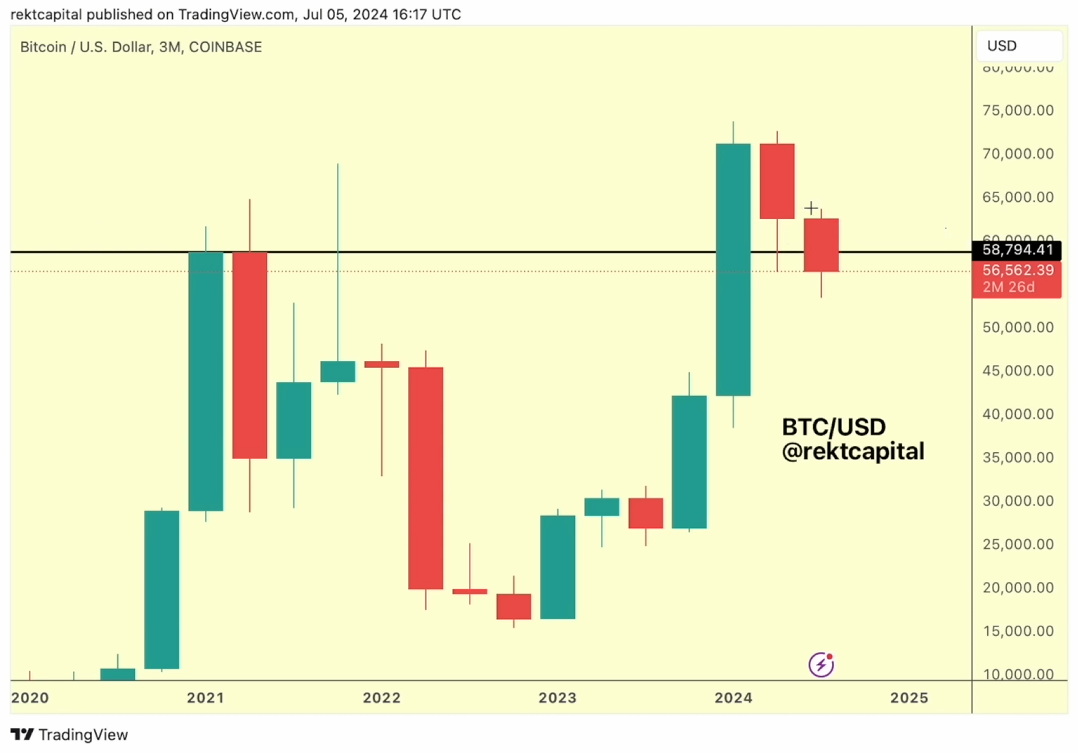

Bitcoin (BTC) is at present in its deepest retrace of the present cycle, nearing a 26% pullback in 46 days. In response to a latest video by the dealer recognized as Rekt Capital, the $58,000 value space could be risky all quarter, serving as a baseline for BTC to take off into an upward motion.

“We’re nonetheless making an attempt to hammer that base out. We’re grabbing liquidity at decrease costs, so we want patrons to get attracted into the market, to purchase into the market, to draw that purchasing strain at cheaper price ranges to provoke a reversal again above $58,800,” the dealer defined.

Nonetheless, the weekly timeframe nonetheless holds necessary indicators that should be noticed. Rekt Capital identified the assorted accumulation ranges fashioned on this cycle, and all of them had their assist damaged for a quick second as merchants looked for liquidity. Nonetheless, the weekly candle closed throughout the vary each time.

“So it’s actually necessary for the value, month-to-month or no less than weekly, to shut above $60,600 earlier than the weekly candle closes. By the tip of the week, we have to see Bitcoin weekly candle shut above $60,600 to guard this vary primarily,” he added.

Notably, if Bitcoin fails to take action, earlier assist can be become resistance. A race then begins for the following two weeks, the place BTC should break the $60,600 resistance and keep above it.

Moreover, on the day by day timeframe, Bitcoin is reaching decrease areas under its regular clusters. Rekt Capital highlights that BTC should convincingly reclaim the $56,500 area to get additional value improvement throughout the $57,000 to $65,000 value vary.

If Bitcoin can match all these requisites, a brand new value cluster could be fashioned in a better vary between $65,000 and $73,000. Thus, the sample of earlier halvings of consolidation adopted by a parabolic upward motion could possibly be at play.