Unspent transaction outputs (UTXOs) are an integral part of Bitcoin’s construction, primarily serving because the constructing blocks of the blockchain. As its title suggests, every unspent transaction output represents a discrete unit of Bitcoin that hasn’t been spent, originating from the conclusion of a earlier transaction. They type the inspiration of Bitcoin’s ledger, monitoring the precise outputs of transactions till they’re utilized in a brand new one.

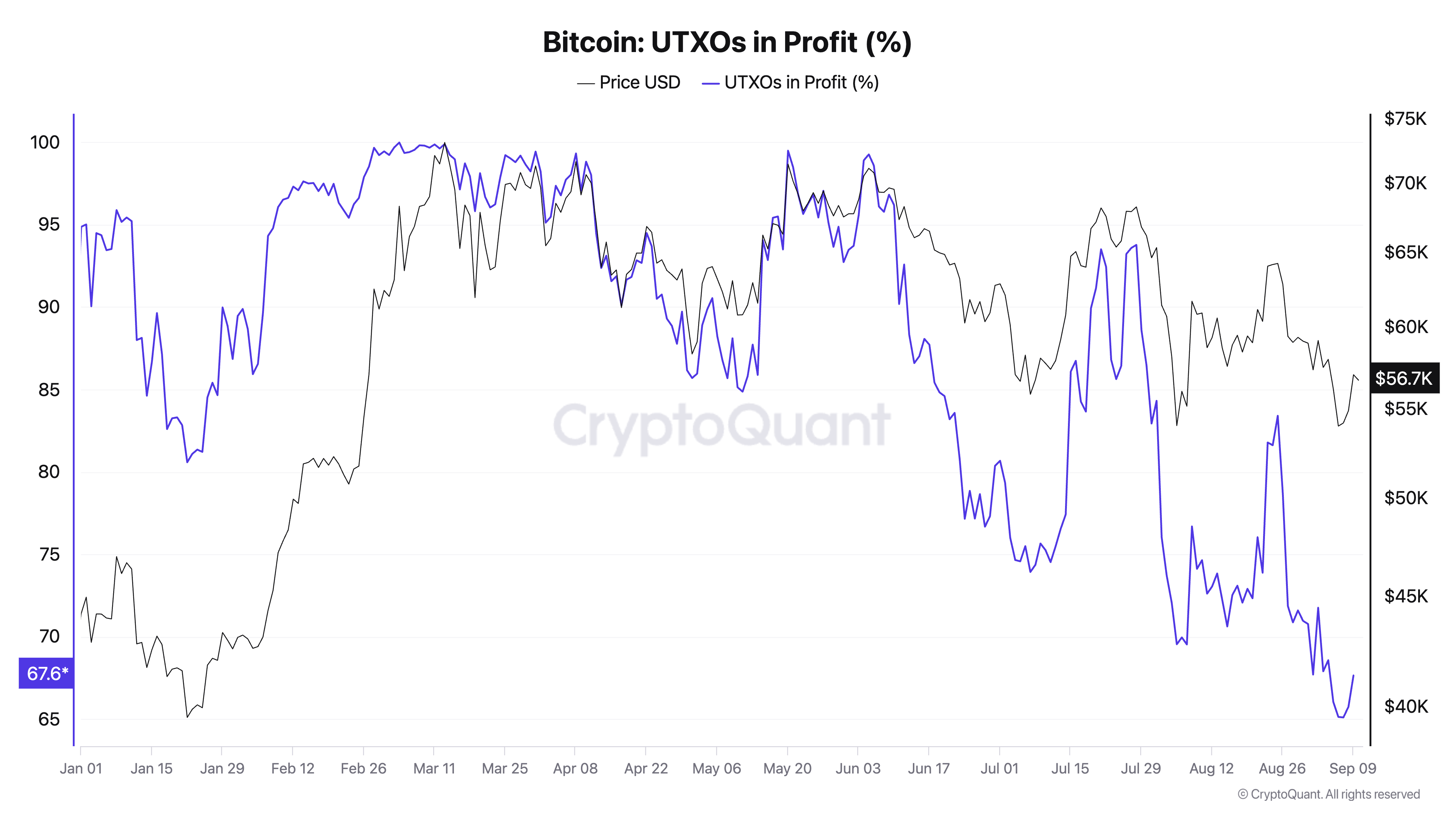

Analyzing UTXOs normally entails monitoring whether or not they’re in revenue, which means the BTC related to them was acquired at a value decrease than its present worth. Thus, the share of UTXOs in revenue is an important indicator of market sentiment and the general profitability of Bitcoin holders. A excessive proportion alerts a powerful market the place most buyers see positive aspects, whereas a decrease proportion factors to losses and displays a extra bearish surroundings.

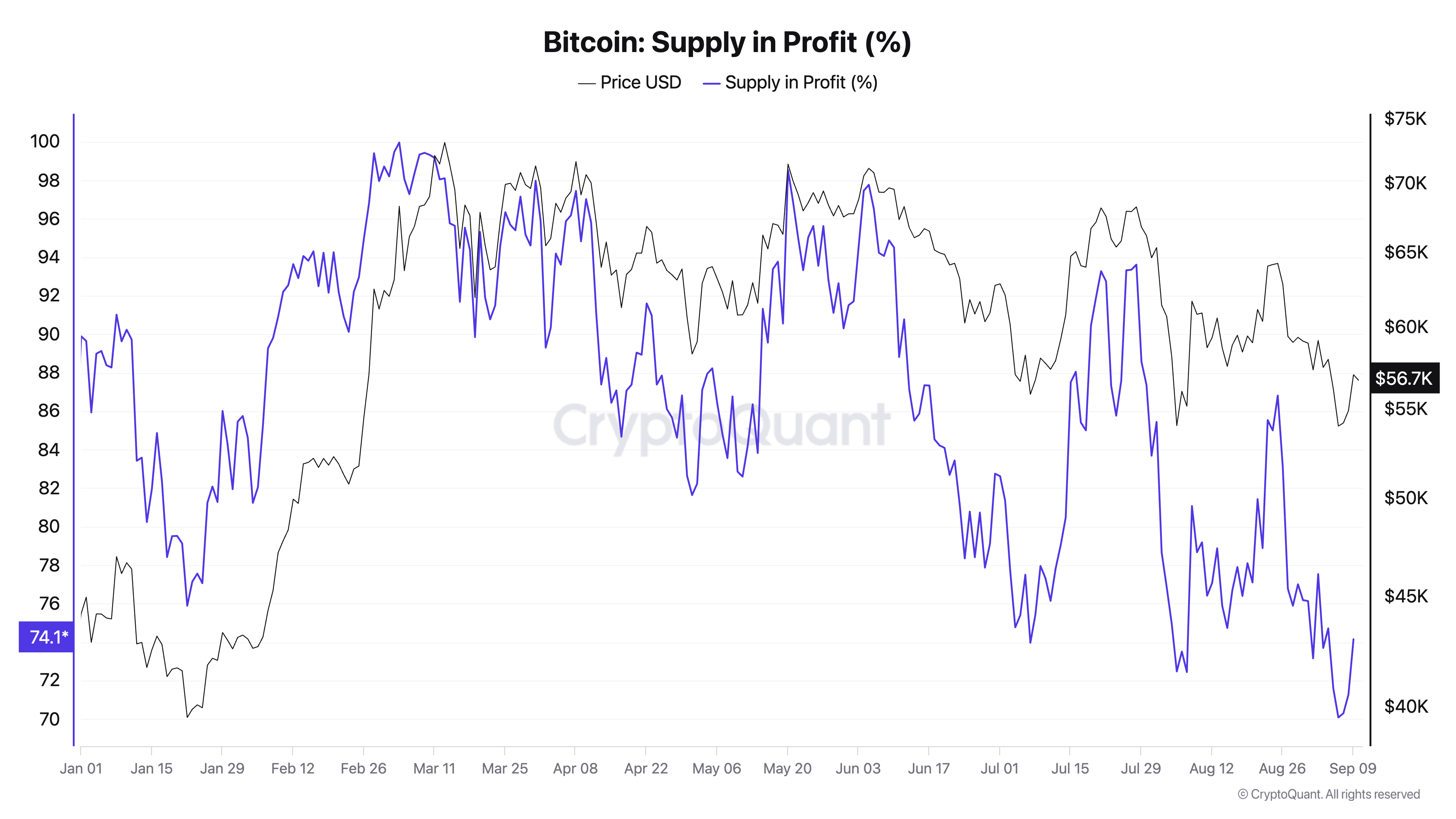

UTXOs differ from Bitcoin’s complete provide in a vital method. Whereas the p.c of UTXOs in revenue tracks particular person transaction outputs, the p.c of Bitcoin’s provide in revenue seems to be on the complete Bitcoin provide and whether or not the cash are at the moment above or under their acquisition value. UTXOs will be quite a few and replicate varied sizes of Bitcoin holdings, from small fractions to bigger quantities.

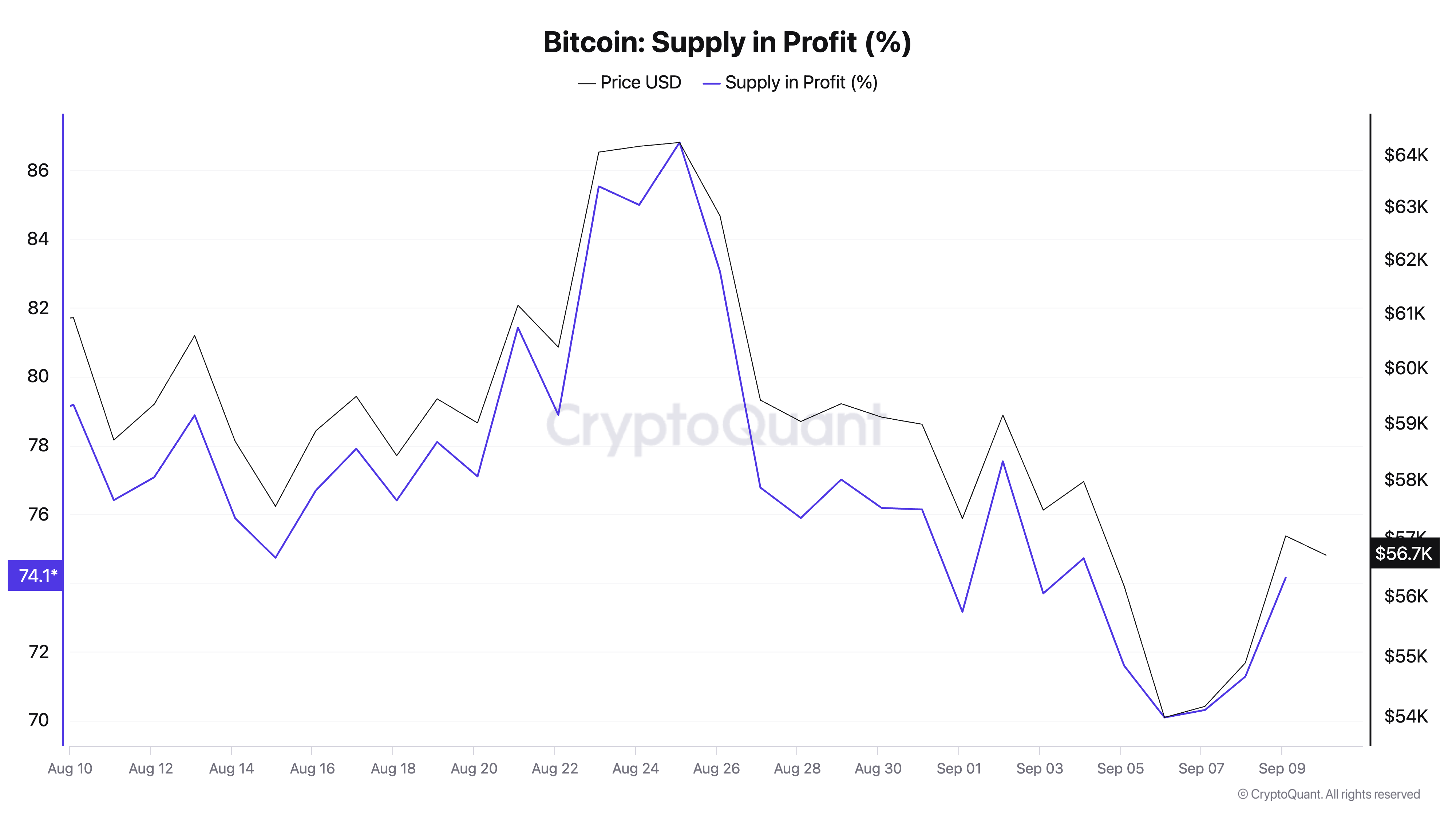

Conversely, when measuring provide in revenue, the main target is on the combination quantity of Bitcoin, treating the entire provide as an entire somewhat than particular person items of the blockchain ledger. This distinction explains why the p.c of UTXOs in revenue can diverge from the p.c of provide in revenue—UTXOs, as smaller items, is likely to be skewed by the exercise of smaller merchants. In distinction, provide in revenue offers a broader image of the general state of the market.

For instance, when Bitcoin’s value surged originally of March, each UTXOs in revenue and the provision in revenue hit their year-to-date highs, with each metrics nearing 100%. At this level, almost all Bitcoin, no matter the way it was distributed throughout UTXOs or in complete provide, was in revenue, reflecting the bullish surroundings that got here with Bitcoin nearing $73,000. This era represents an optimum state for holders, with minimal losses and most market confidence.

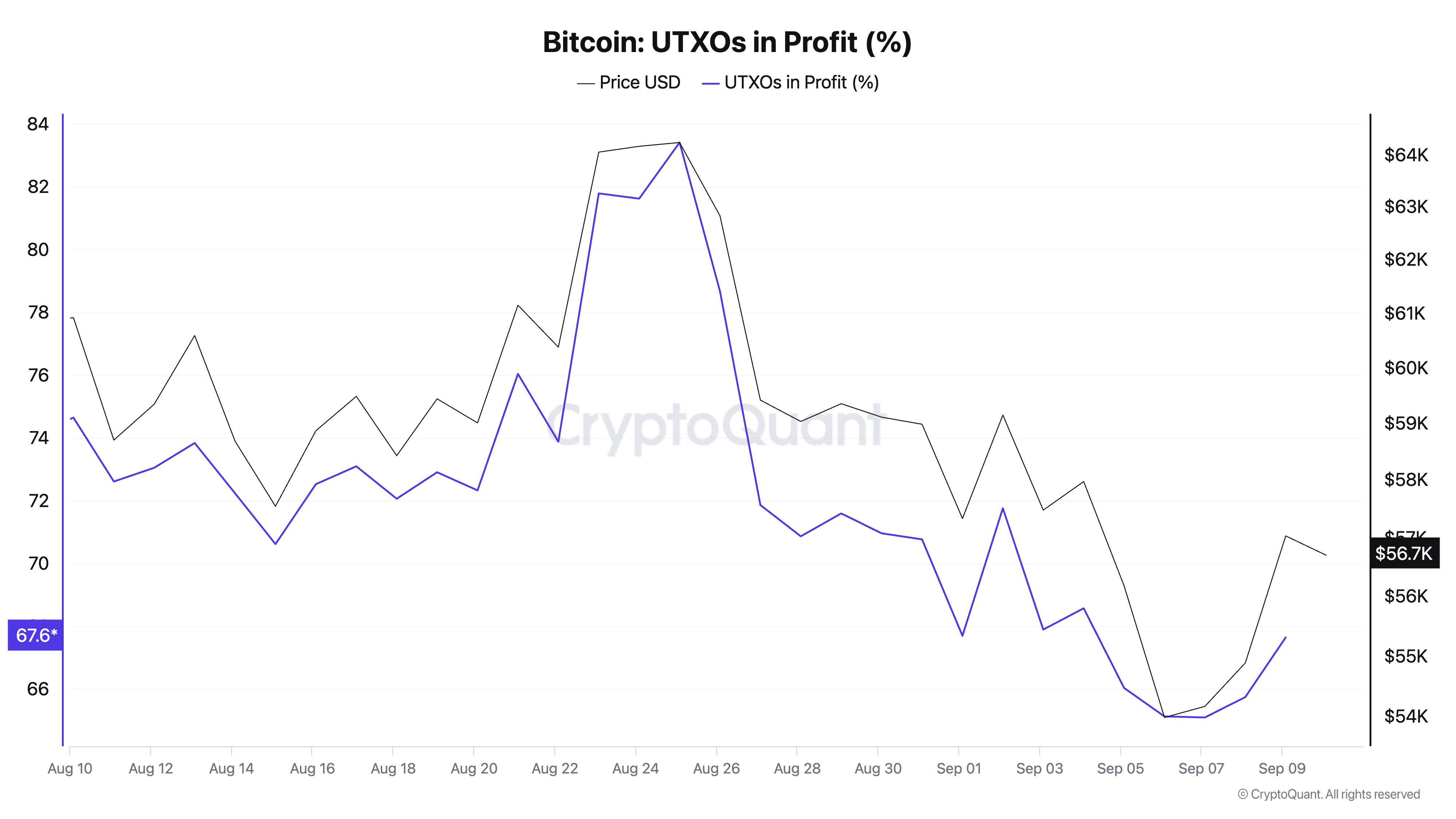

In the meantime, drops in Bitcoin’s value led to a drop within the proportion of UTXOs and provide in revenue. The share of UTXOs in revenue hit a YTD low of 65.09% on Sep. 7 when Bitcoin dropped to $54,170, whereas the provision stood barely larger at simply over 70%.

The divergence between these two metrics during times of value volatility is telling. Given their sensitivity to transaction measurement and the frequency of motion in smaller quantities, UTXOs fluctuate extra dramatically.

As costs drop, smaller holders or frequent merchants who acquired Bitcoin at various ranges will seemingly see their UTXOs fall out of revenue shortly. Alternatively, the entire provide in revenue metric stays considerably extra secure as bigger long-term holders who acquired Bitcoin throughout earlier phases of the cycle should see their positions in revenue. This distinction highlights the excellence between short-term market exercise and the broader view of Bitcoin’s total valuation.

All year long, each metrics have carefully adopted Bitcoin’s value motion, peaking when costs are excessive and dropping sharply throughout pullbacks. The autumn to yearly lows on Sep. 7, the place the share of UTXOs in revenue and the provision in revenue hit vital lows, displays a shift in market sentiment.

The sharp decline alerts elevated stress available in the market, with a considerable portion of latest consumers now going through losses. This might point out an surroundings the place capitulation turns into extra seemingly, as holders who bought in the course of the peak of the value surge might start to promote to chop their losses. On the identical time, a decrease proportion of UTXOs in revenue suggests elevated volatility as smaller holders turn into extra inclined to promoting stress.

The present values for UTXOs in revenue, provide in revenue, and Bitcoin’s value paint a nuanced image of the market. With UTXOs in revenue sitting at 67.64% and provide in revenue at 74.15% as of Sep. 10, along side Bitcoin’s value of $57,035, the market seems to be in a part of cautious consolidation. These values point out that whereas a considerable portion of Bitcoin holders are nonetheless in revenue, many latest consumers, significantly those that entered the market in the course of the later levels of the value surge, at the moment are underwater or near it.

The disparity between UTXOs in revenue and provide in revenue gives perception into how totally different teams of market contributors are faring. With provide in revenue being larger, it means that bigger or longer-term holders, who seemingly purchased at decrease costs, are higher positioned in comparison with smaller or newer consumers.

UTXOs, that are extra delicate to smaller transactions, present that newer or frequent market contributors are going through losses. This means that there was a latest shift in market sentiment, the place short-term merchants or smaller buyers are feeling the stress of Bitcoin’s pullback from its highs.

Since Bitcoin’s value is now larger than its latest low of $54,170 on Sep. 7, however each UTXOs in revenue and provide in revenue stay comparatively low in comparison with earlier within the 12 months, the information suggests the market is in a restoration part however has not but totally regained confidence. The decrease percentages replicate that whereas Bitcoin’s value has rebounded barely, the injury from earlier value declines continues to be evident available in the market construction.

This mix of things sometimes factors to a market in consolidation, the place some contributors are ready for extra evident indicators of a sustained value restoration earlier than re-entering or committing to holding their positions. The market appears to be in a transitional part — now not in full bull market territory however not in a complete capitulation zone both.

If costs stabilize or rise from present ranges, the share of UTXOs and provide in revenue ought to begin to improve, signaling renewed confidence. Nevertheless, if Bitcoin’s value dips additional, significantly under key psychological ranges, it may push extra holders into loss territory, heightening the chance of additional sell-offs.

The submit Bitcoin value stabilizes however profitability hole factors to unease appeared first on cryptoteprise.