-

BTC has skilled a breakout from a descending trendline and is now heading towards a resistance stage of $58,000.

-

BTC’s worth may soar one other 10% to the $62,000 stage if it breaks out the $58,000 stage.

-

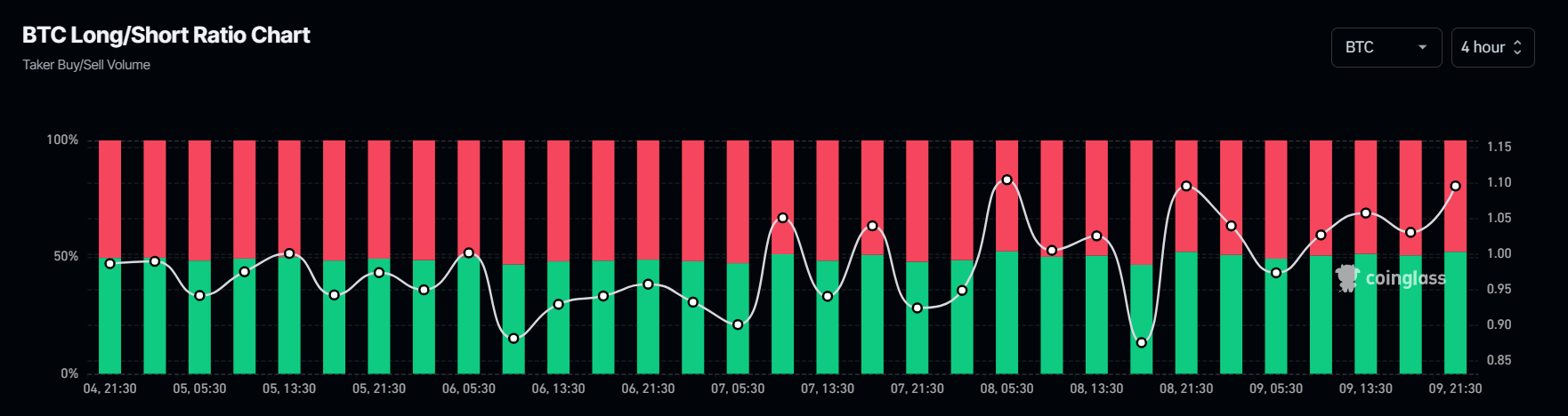

Coinglass’s BTC Lengthy/Quick ratio presently stands close to 1.095, which is a bullish sign.

Bitcoin (BTC), the world’s largest cryptocurrency by market cap seems to be recovering after its worth hitting a month-to-month low of $55,500. In current days, the BTC worth has fallen by greater than 10%, however over the previous three days, it has jumped greater than 5%, which may very well be thought-about an indication of a worth reversal.

Bitcoin Value Reversal

With a current worth surge, BTC has skilled a breakout from a descending trendline and is now heading towards a powerful resistance stage of $58,000.

At press time, BTC has buying and selling close to the $56,740 stage and has skilled a worth surge of greater than 4.5% within the final 24 hours. In the meantime, merchants’ and traders’ curiosity has skyrocketed as its buying and selling quantity has elevated by 86% throughout the identical interval.

Bitcoin Technical Evaluation

In response to knowledgeable technical evaluation, regardless of buying and selling beneath the 200 Exponential Shifting Common (EMA) in each four-hour and a day by day timeframe, BTC seems bullish. Moreover, the value surge occurred following the formation of a bullish divergence on its Relative Energy Index (RSI) on a day by day timeframe.

Based mostly on the historic worth momentum, there’s a excessive risk that the BTC worth may soar one other 10% to the $62,000 stage within the coming days.

Bullish On-chain Metrics

Apart from this technical evaluation, on-chain metrics additionally help this present bullish outlook. Coinglass’s BTC Lengthy/Quick ratio presently stands close to 1.095, which is a bullish sign (a price above 1 signifies bullish sentiment amongst merchants). Moreover, BTC’s future open curiosity has elevated by 6% within the final 24 hours and continues to rise.

Merchants and traders typically use this mixture to construct lengthy/brief positions.

Key Liquidation Areas

As of now, the key liquidation areas are close to $55,900 on the decrease aspect and $57,000 on the higher aspect, as merchants at these ranges are over-leveraged, in response to coinglass knowledge.

If the present bullish market stays unchanged and the BTC worth reaches to $57,000 stage, practically $71 million price of lengthy positions can be liquidated. Conversely, if the sentiment adjustments and the value drops to the $55,900 stage, roughly $91.2 million price of lengthy positions can be liquidated.

This knowledge means that now the bulls are presently dominating and have the potential to liquidate extra brief positions within the coming days.