With Bitcoin (BTC) experiencing a value rally partly triggered by the Federal Reserve’s rate of interest lower, a cryptocurrency analyst is warning that the momentum is perhaps short-lived.

On this case, Bitcoin is approaching key value ranges, as market momentum might shift triggered by technical elements and upcoming financial occasions, RLinda noticed in a TradingView put up on September 21.

Whereas highlighting how this momentum would possibly stall, the buying and selling knowledgeable raised issues concerning the “conglomeration of robust resistances” between the $64,000 and $65,000 value vary, which might create a roadblock. The evaluation highlighted that this zone, which has but to be absolutely examined, might halt Bitcoin’s advance.

Additional resistance is anticipated from $68,000 to $69,000, growing the possibilities of a stall in upward momentum. RLinda famous that the present value motion exhibits a double high formation, a possible sign that the rally could also be working out of steam.

Whereas Bitcoin’s world outlook on the upper timeframes stays considerably bullish, displaying potential for continued progress, the native view is much less optimistic. Within the shorter time period, RLinda acknowledged that Bitcoin appears to be going through growing strain because it nears the essential resistance zones.

This divergence between the worldwide and native outlooks creates uncertainty, notably as merchants eye key financial studies due subsequent week. Financial occasions, corresponding to a speech from the Federal Reserve chair, might considerably affect market sentiment. The specialists acknowledged that the present “bullish fervor” might evaporate rapidly if these indicators provide surprises.

“Trades might get nervous forward of subsequent week’s new information: SP PMI, DGP, DGO and Fed chief’s speech. If the symptoms grow to be sharply unpredictable, all of the speculators’ bullish fervor might quiet down in a short time and in that case we might meet the correction section amid profit-taking,” the analyst mentioned.

Bitcoin value ranges to observe

For now, patterns noticed by the knowledgeable point out that Bitcoin is consolidating above the $62,750 stage, pointing to some short-term stability. Nevertheless, ought to promoting strain push the value beneath this stage, a pointy transfer towards decrease liquidity zones might observe, doubtlessly bringing Bitcoin right down to $61,300 and even additional to $59,400 and $57,730.

With Rlinda acknowledging that Bitcoin is at present in a consolidation section, one other crypto analyst with the pseudonym Dealer Tardigrade noticed in an X put up on September 21 that the present formation is an anchor for notable positive aspects.

The analyst illustrated that the consolidation is occurring inside a symmetrical triangle sample, and Bitcoin has surged by way of key resistance ranges, signaling a serious breakout. Traditionally, the sample breakouts have preceded robust value actions, and this newest improvement isn’t any exception.

Notably, the cryptocurrency’s value has already rallied considerably, reaching positive aspects of over 70% from earlier consolidation patterns. Now, the knowledgeable predicted that if historical past repeats, Bitcoin’s subsequent goal can be $100,000 based mostly on the measured transfer of the technical sample.

Bitcoin value evaluation

By press time, Bitcoin was buying and selling at $63,214, with every day positive aspects of lower than 0.5%. On the weekly chart, the maiden cryptocurrency has rallied over 5%.

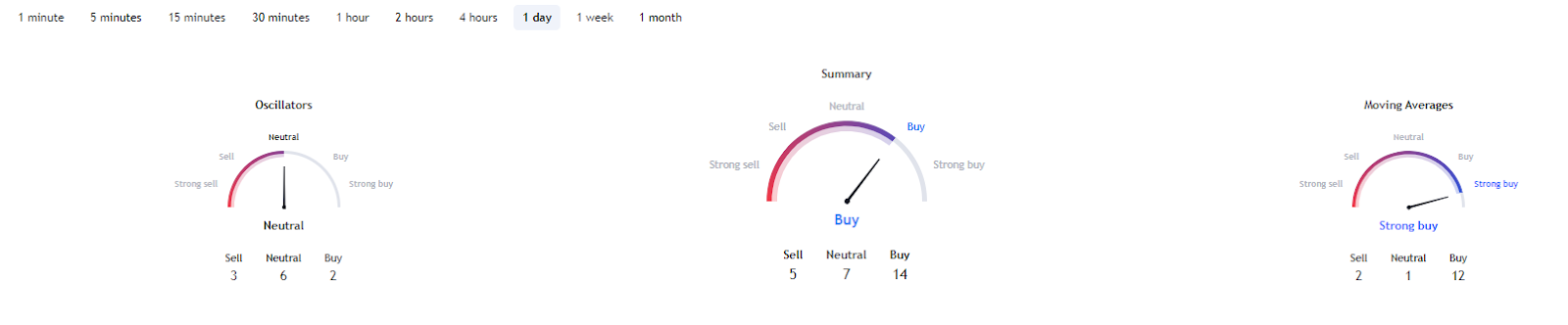

In the meantime, Bitcoin’s technical indicators are bullish, with a abstract of the one-day gauges retrieved from TradingView aligning with the ‘purchase’ sentiment at 14. However, shifting averages are for a ‘robust purchase’ at 12, whereas oscillators are ‘impartial’ at 6.

In abstract, Bitcoin is presenting each alternatives and challenges in the intervening time, therefore, buyers ought to stay cautious as a failure to interrupt by way of the highlighted resistances might set off a value correction.

Disclaimer: The content material on this website shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.