A brand new Bernstein Analysis report signifies that the cryptocurrency market, notably Bitcoin (BTC), might expertise a big shift based mostly on the result of the upcoming United States presidential election.

The evaluation suggests {that a} potential victory for Donald Trump might catalyze a backside in Bitcoin costs, resulting in development within the value of the main cryptocurrency.

“We imagine the Bitcoin value would backside, provided that the crypto market catches a bid on a probable Trump win, given [the] crypto market persevering with to interpret solely a Republican win as optimistic for crypto coverage,” the report states.

This perception comes as cryptocurrency costs stay range-bound, or uneven inside two explicit value factors, which Bernstein attributes to uncertainty surrounding the U.S. election.

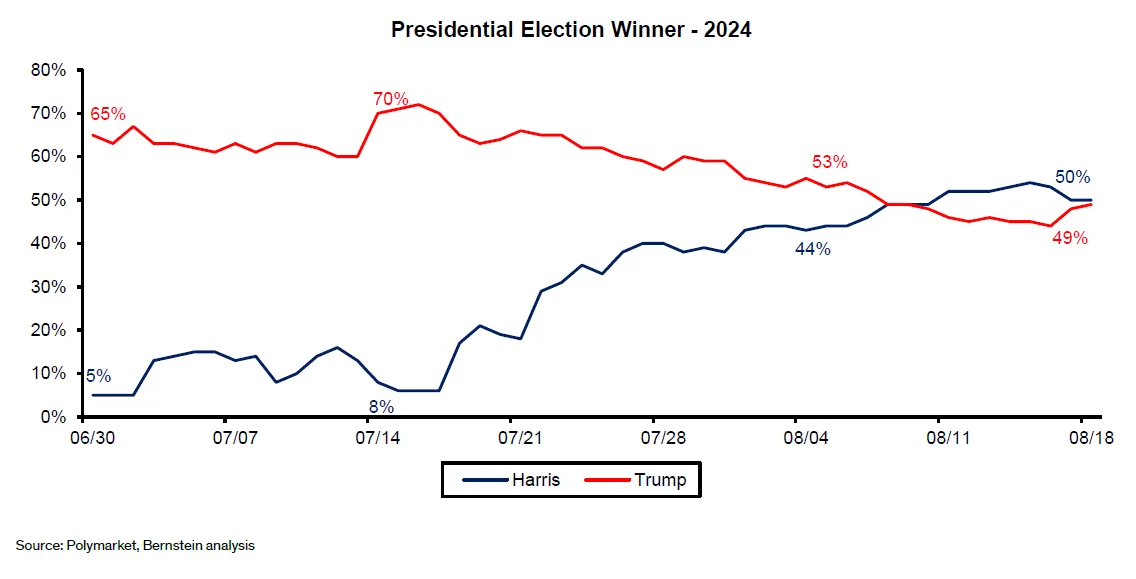

Recent developments from Polymarket, the main crypto prediction markets platform, present Republican candidate Trump and his anticipated Democratic challenger Kamala Harris in a detailed race, with Trump’s shares rebounding in current days following adverse reactions to Harris’ financial bulletins. Harris has regained the lead on Polymarket during the last day, nonetheless, main with a 51% likelihood in comparison with 47% for Trump.

Picture: Bernstein Analysis

Alongside election insights, the report highlights important capital-raising actions amongst main U.S.-listed Bitcoin mining corporations.

Marathon Digital Holdings (MARA) raised $300 million in convertible notes partially to buy Bitcoin for its steadiness sheet, and final week confirmed that it bought $249 million price of BTC.

In the meantime, Riot Platforms (RIOT) just lately introduced a $750 million at-the-market fairness providing, and Core Scientific (CORE) secured $400 million in convertible notes for debt retirement and AI knowledge middle acquisitions. Bernstein’s Gautam Chhugani wrote that public U.S. miners have a leg up within the business.

“U.S. listed Bitcoin miners have a pure benefit vs. personal unlisted miners,” he wrote. “Whether or not miners pursue Bitcoin mining or AI knowledge middle development, having the ability to increase debt/fairness on the earth’s deepest capital markets presents a pure benefit versus non-U.S. miners, notably in a capital intensive business, poised for market consolidation.”

The report additionally mentioned the rising “mullet technique” amongst miners, the place corporations are pivoting in direction of AI knowledge facilities whereas sustaining Bitcoin mining operations. This method is gaining traction with institutional buyers, the report notes, as they’re extra aware of knowledge middle economics than cryptocurrency mining.

Edited by Andrew Hayward