- Bitcoin value has surged 5.6%, hitting a three-week excessive of $61.1K on Tuesday morning.

- Altcoins like Celestia, Immutable X, and Close to have seen double-digit proportion beneficial properties.

- Crypto shares have risen modestly forward of the Fed’s anticipated price lower announcement.

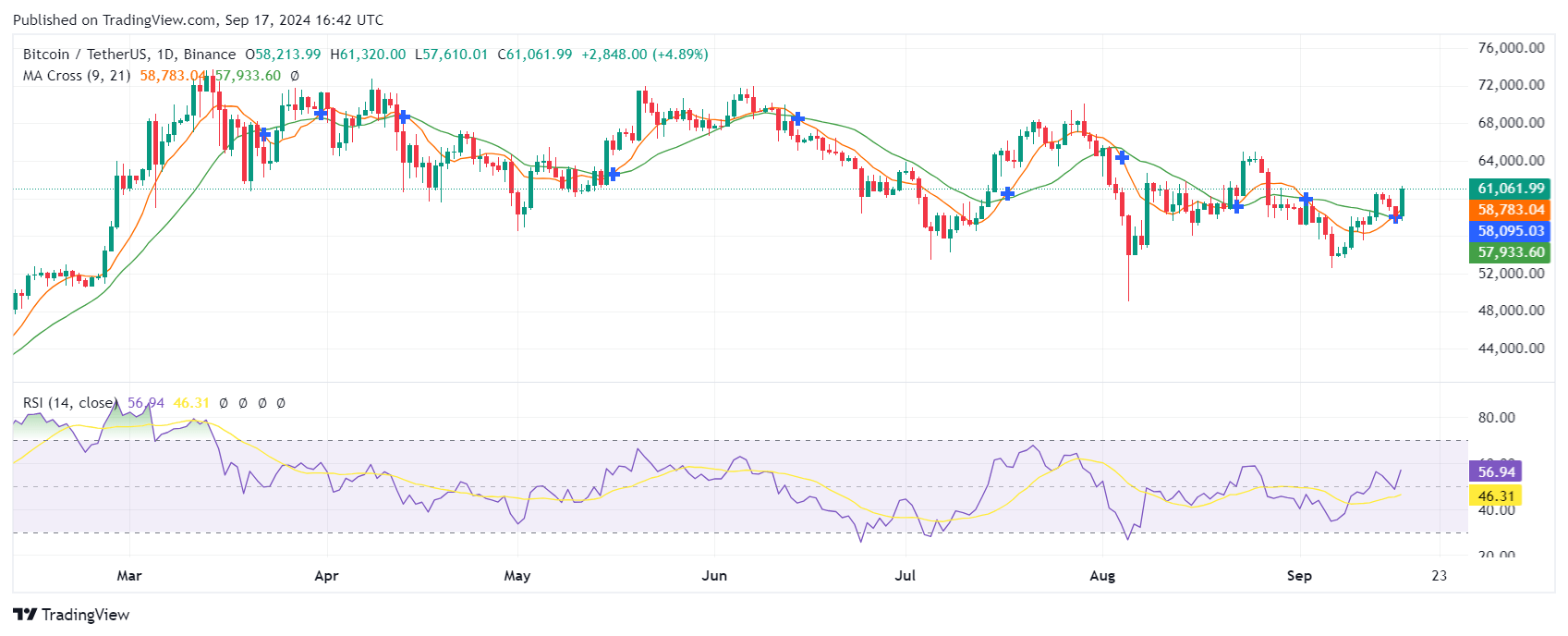

Bitcoin value has surged to its highest stage in three weeks, triggering beneficial properties throughout the cryptocurrency sector and associated shares. It soared 5.6%, reaching $61.1K by 11:55 a.m. ET earlier than pulling again to round $61k.

The surge marks a pointy reversal from the quiet begin to the week, signalling renewed curiosity in digital belongings.

Altcoins and Bitcoin value hovering forward of Fed cuts

In addition to Bitcoin, different main cryptocurrencies have additionally seen important beneficial properties, with Ethereum (ETH) advancing 4.2% to $2.38K.

Notably, some altcoins have outpaced the bigger tokens. For instance, Celestia (TIA) has seen a 15.7% improve, Immutable X (IMX) has risen by 14.8%, Close to Protocol (NEAR) is up 9%, Uniswap (UNI) has climbed 8.9%, and Sui (SUI) has gained 8.1%.

The rally comes simply forward of the Federal Reserve’s extremely anticipated determination on rates of interest.

Market analysts extensively anticipate the central financial institution to decrease charges for the primary time in 4 years. With inflation largely beneath management and the labour market exhibiting indicators of cooling, many imagine the Fed will undertake a extra accommodative stance.

Decrease rates of interest are sometimes bullish for cryptocurrencies, as diminished borrowing prices make conventional financial savings and funding automobiles much less enticing. Consequently, traders usually flip to riskier belongings like cryptocurrencies in the hunt for increased returns.

Crypto-focused shares additionally surge

Crypto-focused shares have additionally benefited from Bitcoin’s rally, although their beneficial properties have been typically extra modest in comparison with digital tokens.

MicroStrategy (MSTR), an organization identified for holding massive reserves of Bitcoin, inched up by 0.6%.

Crypto alternate platform Coinbase International (COIN) has risen by 3%, whereas crypto funding agency Galaxy Digital (OTCPK) has gained 5.4%.

Within the crypto mining sector, Riot Platforms (RIOT) has superior 2.4%, MARA Holdings (MARA) has risen by 1.9%, and HIVE Digital Applied sciences (HIVE) has climbed 4.3%. Bit Digital (BTBT) noticed the most important bounce, gaining 13%, adopted by Hut 8 (HUT) with a 6.6% rise and CleanSpark (CLSK) up 3.1%.

Because the broader inventory market additionally expertise shopping for stress forward of the Federal Reserve’s pivotal determination, the crypto sector continues to trip the wave of optimism surrounding the potential for decrease charges and elevated funding in digital belongings.