BTC’s value surge would not compensate for the worth volatility dangers, a chart by Goldman Sachs exhibits.

Gold’s comparatively greater risk-adjusted returns explains its secure haven attraction.

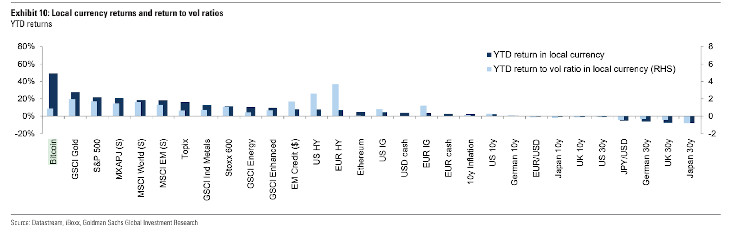

Bitcoin (BTC) has surged over 40% this yr, outshining main fairness indices, fixed-income securities, gold and even oil, which not too long ago rose on the again of geopolitical tensions.

Nonetheless, in accordance with information tracked by Goldman Sachs, its stellar efficiency in absolute phrases is just not ample to compensate for its volatility.

Bitcoin’s year-to-date return to volatility ratio is underneath 10%, considerably decrease than gold’s industry-leading risk-adjusted return of almost 20%. The ratio gauges the return an funding generates per unit of threat/volatility. The yellow metallic has gained 28% in absolute phrases.

Actually, Ethereum’s native token ether, Japan’s TOPIX index, and the S&P GSCI Power Index are the one non-fixed revenue growth-sensitive investments with return to volatility ratios decrease than bitcoin, the chart from Goldman’s Oct. 7 be aware titled “Oil on the boil” exhibits.

That comparatively low risk-adjusted efficiency validates crypto skeptics’ long-held view that bitcoin is just too risky to grow to be a secure haven like gold.

It additionally helps clarify why gold rose and bitcoin tumbled alongside fairness markets final week after Iran launched missiles at Israel, ratcheting up tensions within the Center East.

The low risk-adjusted returns make directional bets unattractive and certain clarify the recognition of the bitcoin money and carry arbitrage amongst conventional establishments. The arbitrage technique permits merchants to bypass value volatility dangers whereas taking advantage of value discrepancies between spot and futures markets.