Based on the most recent on-chain remark, the Bitcoin merchants’ realized losses have reached a stage that has confirmed crucial to the coin’s motion a number of occasions in recent times. This begs the query — is the Bitcoin worth bottoming out?

Merchants’ Realized Losses Under -12 Once more — What Occurred Final Time?

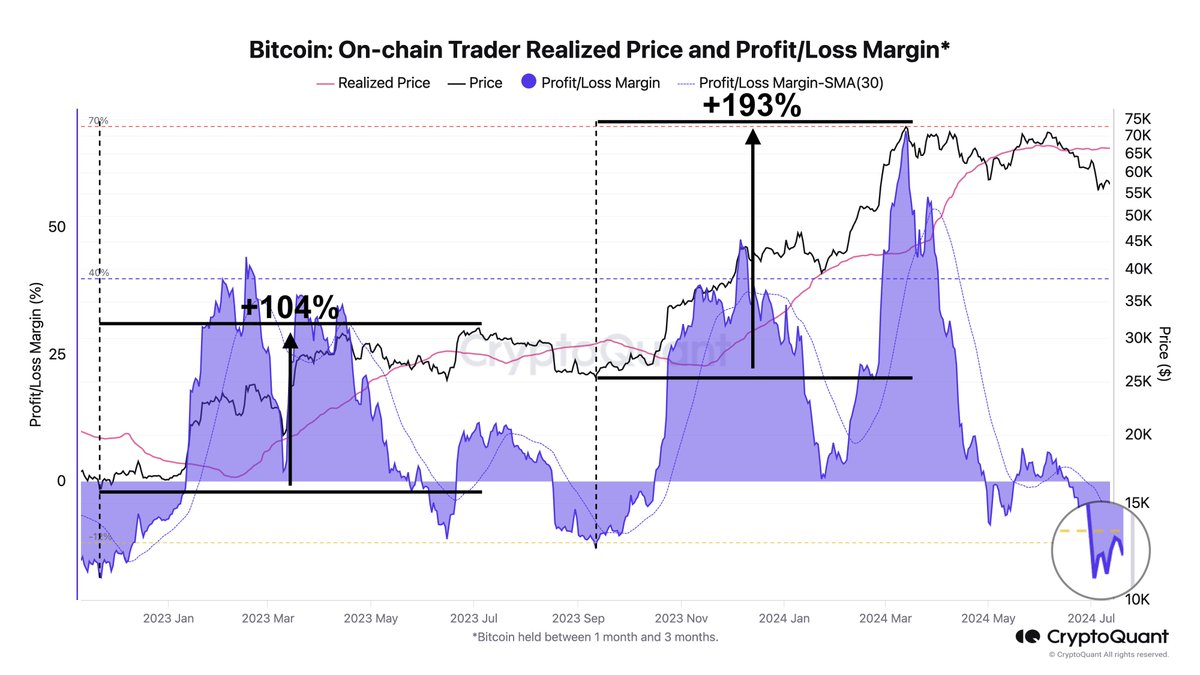

In a current submit on the X platform, outstanding crypto analyst Ali Martinez identified that the quantity of losses being realized by Bitcoin merchants has been growing in current weeks. This on-chain revelation relies on the CryptoQuant Revenue/Loss Margin metric, which aggregates income and losses from all Bitcoin transactions.

The Revenue/Loss Margin mainly assesses the general profitability of buyers of a selected cryptocurrency (Bitcoin, on this situation). When the metric’s worth is optimistic, it implies that extra BTC is being bought at a revenue. A damaging Revenue/Loss Margin, then again, signifies that extra Bitcoin is being bought at a loss.

Based on information from CryptoQuant, the Revenue/Loss Margin is at present beneath the -12 mark, which means that merchants are realizing extra losses than good points available in the market in the intervening time. Traditionally, this stage is extra vital, contemplating that the metric has been under the -12 mark up to now cycles.

Curiously, the current occasions during which the Revenue/Loss Margin has fallen under -12 has been adopted by durations of serious bullish worth motion. As proven within the chart and highlighted by Martinez, the final two occasions the metric fell beneath this stage had been marked by 104% and 193% worth rallies, respectively.

Supply: Ali_charts/X

If this historic sample is something to go by, then there’s a probability that the value of Bitcoin would possibly expertise notable bullish exercise within the close to future. Furthermore, remark of serious losses available in the market can counsel the underside of a bearish cycle and the beginning of a extra optimistic part.

Bitcoin Worth To Surge? Right here Are Vital Ranges To Watch

If the historic sample does maintain true and the Bitcoin worth goes on a rally, there are a few worth zones to be careful for. Based on Martinez, the premier cryptocurrency has main resistance ranges across the $61,340 and $64,620 zones.

This revelation relies on the fee foundation of Bitcoin buyers and the distribution of the BTC provide throughout numerous worth ranges. The scale of the dots within the chart under displays the energy of the resistance and assist and the quantity of BTC bought at every worth zone.

Key resistance ranges for #Bitcoin to observe are $61,340 and $64,620. The essential assist stage to look at is $57,670! pic.twitter.com/YrBPkJmWzn

— Ali (@ali_charts) July 13, 2024

As of this writing, the value of Bitcoin stands round $59,467, reflecting a 2.7% enhance within the final 24 hours. Based on CoinGecko information, the flagship cryptocurrency is up by 2% up to now week.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Pexels, chart from TradingView