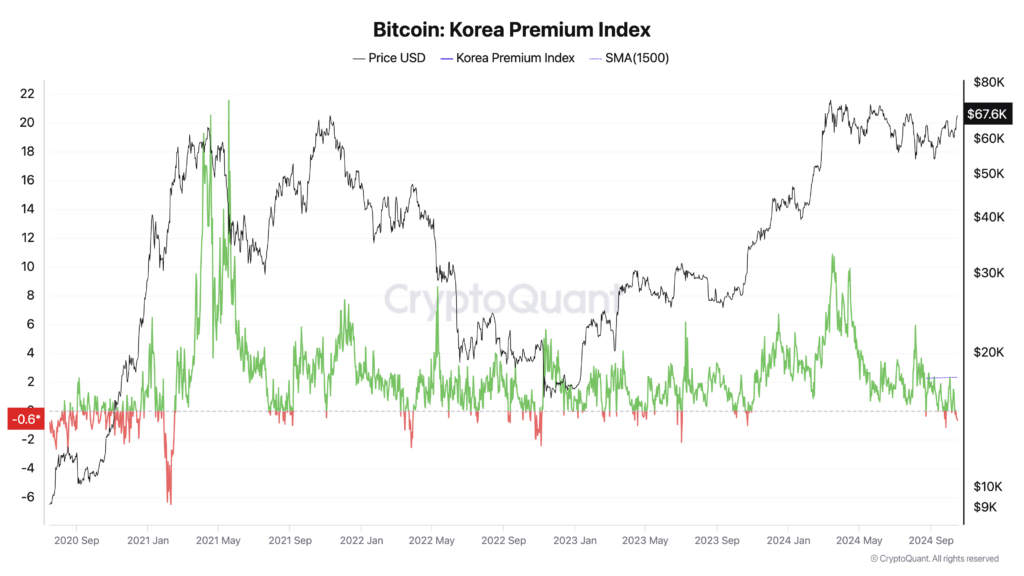

Bitcoin is buying and selling at a reduction on South Korean exchanges, reversing the normal “kimchi premium” that has traditionally signaled bullish market sentiment.

Per The Korea Occasions, the cryptocurrency is priced roughly 700,000 gained ($511.73) decrease domestically in comparison with international exchanges, leading to a damaging premium (low cost) of -0.74% as of Thursday afternoon.

This shift seems to counsel a bearish outlook amongst South Korean buyers. Usually, a better kimchi premium signifies sturdy native demand and optimistic sentiment, typically resulting in Bitcoin costs exceeding international charges. In distinction, a decrease or damaging premium displays weakened enthusiasm and decreased shopping for stress, probably signaling a market correction or alignment with international valuations.

Analysts attribute this uncommon discrepancy to subdued investor sentiment in South Korea and better demand for digital belongings on overseas platforms. KP Jang, head of Xangle Analysis, instructed the Korea Occasions that restrictions forestall overseas and institutional buyers from accessing home exchanges, amplifying the affect of declining retail investor demand.

A shift in dealer preferences towards altcoins can be influencing the market. As Bitcoin surged globally, Korean merchants started accumulating undervalued different cryptocurrencies, anticipating a stable fourth-quarter rally, as reported by Enterprise Insider. These altcoins, together with Tao, Sei Community, Aptos, Sui, NEAR Protocol, and The Graph, are perceived as providing increased returns, probably diverting consideration away from Bitcoin.

Declan Kim, a analysis analyst at DeSpread, additionally instructed the Korea Occasions that the altcoin market, which includes a good portion of home buying and selling, continues to wrestle amid transitional phases of latest rules. The implementation of the Digital Asset Person Safety Act is affecting market forces. Many altcoins stay unlisted on home exchanges in comparison with overseas ones, and the ban on market-making makes securing liquidity difficult.

The kimchi premium has traditionally been a trademark of South Korea’s crypto market. When Bitcoin surpassed the 100 million gained mark domestically in March, the premium briefly spiked to as a lot as 10%. The next premium typically signifies sturdy native demand and bullish sentiment, typically coinciding with or previous Bitcoin value rallies. Conversely, a decrease or damaging premium suggests bearish sentiment and decreased shopping for stress.

Knowledge signifies a notable decline in Bitcoin-Korean gained (BTC/KRW) buying and selling quantity over the previous 40 days, reflecting a shift in investor focus.

Analysts count on the reverse kimchi premium to be short-term. Jang anticipates that the discrepancy will resolve quickly, as such premiums have not often continued for lengthy durations. He talked about that ongoing discussions about laws to allow company investments in digital belongings may enhance liquidity on home exchanges and progressively scale back the worth hole with overseas markets.

The present buying and selling situations mirror a posh interaction of home rules, investor behaviors, and international market traits, signaling vital shifts inside South Korea’s crypto panorama. The damaging kimchi premium, although uncommon, might finally result in a extra balanced and mature market because it aligns extra intently with international digital asset valuations.

The final time the Kimchi Premium fell damaging was in Oct. 2023, simply earlier than Bitcoin’s ETF-fueled bull run.