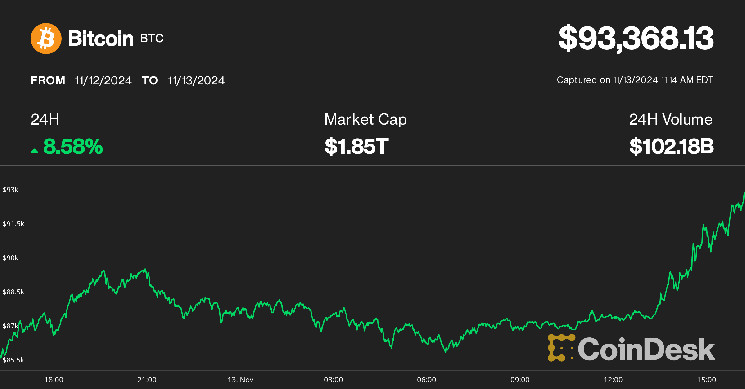

Bitcoin blasted by means of the $90,000 resistance stage early within the U.S. buying and selling day after which shortly pushed even greater to prime $93,000.

The surge was fueled by heavy demand, with the Coinbase Premium Index at its highest stage since April.

Blackrock’s iShares Bitcoin ETF (IBIT) was the fourth-most traded product throughout all ETFs, with $1.2 billion quantity within the first hour of the session.

After bouncing off the $90,000 stage a number of events earlier this week, bitcoin {BTC}} moved by means of that resistance throughout U.S. morning hours Wednesday. As soon as by means of, additional features ensured, with the value shortly rising previous $93,000.

The breakthrough over the important thing worth stage occurred proper as U.S. conventional markets opened at 9:30 am E.T., indicating that robust demand from U.S. traders propelled costs greater.

Bitcoin’s Coinbase Premium Index, a key gauge of U.S. demand, has jumped to 0.2, its highest studying since April, CryptoQuant information confirmed, underscoring the heavy shopping for strain coming from U.S. gamers.

The metric measures the value distinction for the main crypto asset on Coinbase, extensively utilized by U.S.-based traders and establishments, in comparison with costs on off-shore Binance, the preferred international alternate by buying and selling quantity.

Whereas it was not instantly clear what kind of market contributors are shopping for, U.S.-listed spot bitcoin exchange-traded funds (ETF) began the day with robust buying and selling volumes. Shares of BlackRock’s iShares Bitcoin Belief ETF, IBIT, the most important spot ETF with $40 billion of belongings, traded round $1.2 billion within the first hour of the session, making it the fourth most-traded product throughout all ETFs, per Barchart information.

Bitcoin at press time had pulled again a bit and was altering arms at $92,200, up nearly 7% over the previous 24 hours and main over the broad-market CoinDesk 20 Index’s 3.5% rise. Ethereum’s ether (ETH) and solana (SOL) gained 1.6% and a pair of.7%, respectively, throughout the identical interval.

Spot shopping for drives the rally

Spot cumulative quantity delta (CVD) — outlined as the web distinction between shopping for and promoting commerce volumes — continues to indicate robust flows with the vast majority of the web quantity coming from consumers. Every time there’s been a spike in spot CVD, it has corresponded to an increase within the asset’s worth, which suggests this rally is extra sustainable because the shopping for isn’t futures-market primarily based, stated CoinDesk analyst James Van Straten.

BITCOIN BULL RUN CYCLE EXPLAINED! | MARK YUSKO

BITCOIN BULL RUN CYCLE EXPLAINED! | MARK YUSKO