Bitcoin (BTC) has just lately skilled a major increase, reaching over $71,000 on account of constructive macroeconomic indicators and rising curiosity from institutional buyers.

This surge, the longest in three months for the cryptocurrency, stems from anticipation of potential price cuts by the Federal Reserve. Such changes may favor speculative property like Bitcoin.

Institutional Confidence Bolsters Bitcoin’s Resurgence

Market optimism has grown concerning the Federal Reserve’s potential reducing of rates of interest this 12 months. Merchants now see the next chance of a price lower as early as November.

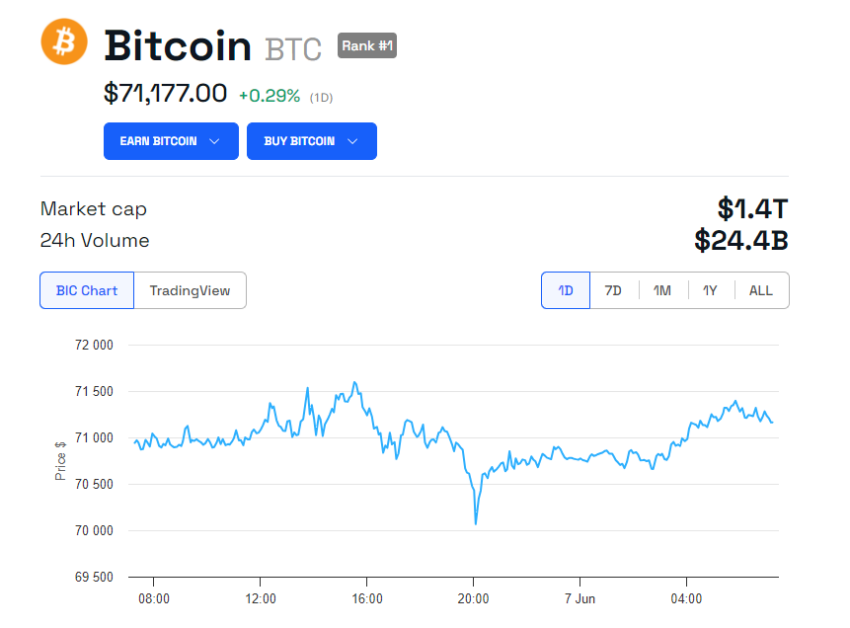

This shift follows stories indicating slowing US inflation and a weaker jobs market, alongside notable dips in some Treasury yields. Monetary circumstances appear easing, which may gain advantage speculative investments, together with cryptocurrencies. On the time of writing, Bitcoin’s worth hit $71,177, an over 4% enhance over the past week.

Learn extra: 7 Greatest Crypto Exchanges within the USA for Bitcoin (BTC) Buying and selling

BTC Worth Efficiency. Supply: BeInCrypto

Banks resembling JPMorgan Chase & Co. and Citigroup Inc. predict the Federal Reserve may cut back charges as quickly as subsequent month. Regardless of earlier skepticism in April, merchants now count on steady charges till November.

Nonetheless, the current development suggests a attainable faster adjustment. The globe’s bond market has additionally seen its most extended rally since December.

This Friday’s employment knowledge launch is pivotal earlier than subsequent week’s Fed rate-setting assembly. It can reveal whether or not merchants or banking forecasters higher align with the Fed’s financial coverage path.

Amid these developments, Bitcoin attracts institutional patrons like Semler Scientific (SMLR). Pending market circumstances, the healthcare firm determined to make Bitcoin its major treasury asset.

It acquired 581 Bitcoin for $40 million, bringing its complete holdings to 828 Bitcoin price $57 million. Semler Scientific views Bitcoin as a steady worth retailer and worthwhile funding. The corporate appreciates its shortage and potential as an inflation hedge.

“We consider that Bitcoin’s distinctive attributes mentioned above not solely differentiate it from fiat cash, but additionally from different cryptocurrency property, and for that cause, we have now no plans to buy cryptocurrency property apart from Bitcoin,” the corporate acknowledged.

Moreover, crypto-focused corporations are additionally exhibiting optimism. Bybit, a world crypto alternate, reportedly would enable Chinese language expatriates to open accounts and commerce.

This transfer goals to fulfill the rising demand for safe and user-friendly crypto buying and selling options among the many Chinese language diaspora and worldwide Chinese language communities. The event occurred following stories on Wednesday suggesting that Bybit could have facilitated signup and verification processes for customers positioned in China regardless of the nation’s well-known ban on Bitcoin.

Learn extra: How To Purchase Bitcoin (BTC) and Every little thing You Want To Know

These actions are a part of a broader sample during which main monetary organizations and crypto corporations strategically place themselves to reap the benefits of Bitcoin’s potential. This can be a robust indication of the rising optimism concerning the way forward for this cryptocurrency.