Bitcoin (BTC) misplaced a four-month value vary with a three-day 14.74% crash to $53,540 on July 5. Within the final 30 days, BTC misplaced over 25% of its market worth, ending an all-time “longest successful streak.”

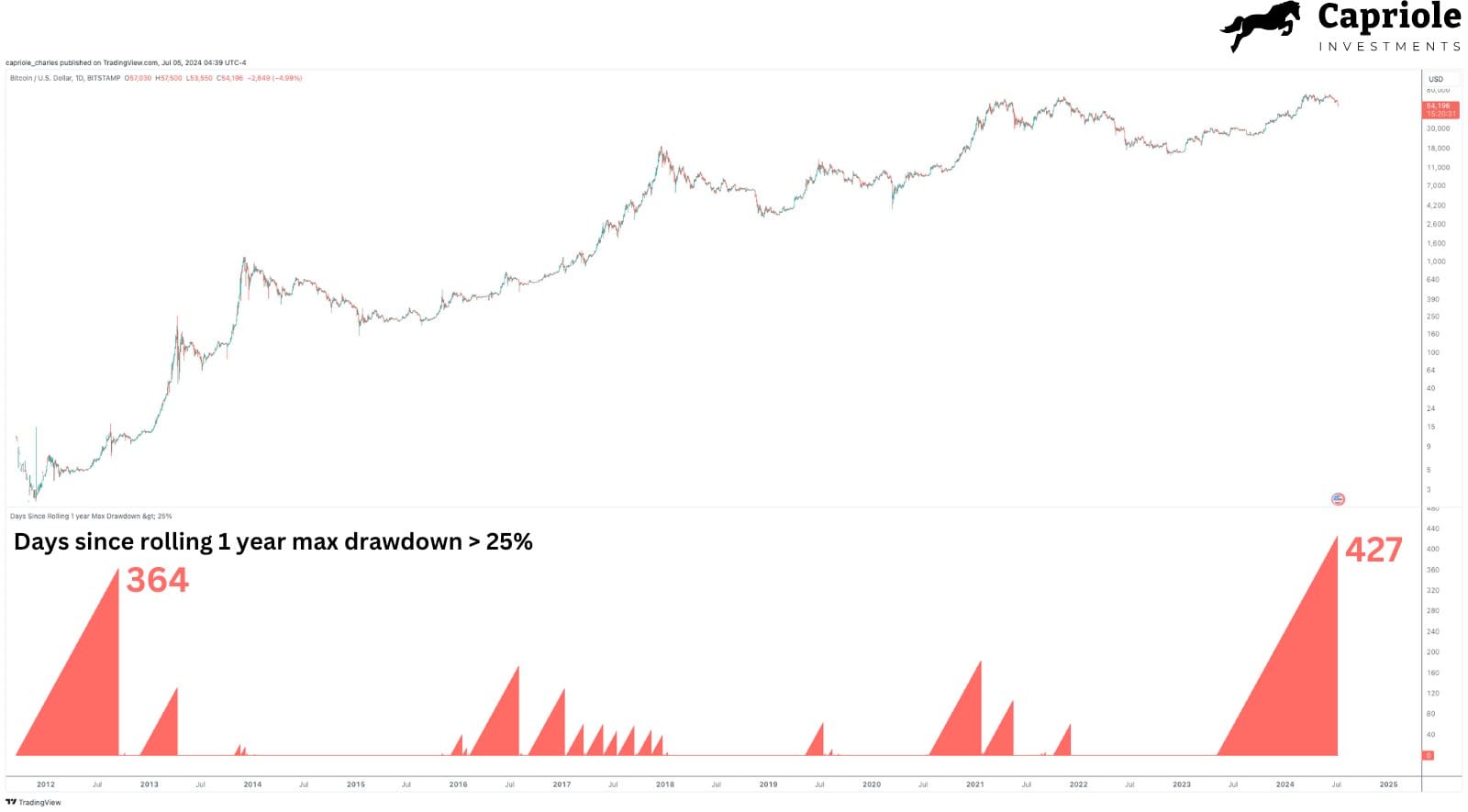

Capriole Investments‘ crypto analyst Charles Edwards reported this milestone on X, highlighting Bitcoin’s 427-day successful streak with out a 25% drawdown. Basically, it’s the first time in historical past that Bitcoin has gone with out such a correction for 427 days.

Edwards referred to as it a “fairly unbelievable run” and a “nicely overdue correction” for the main cryptocurrency.

Beforehand, Bitcoin went by way of 364 days (one yr) with out retracing greater than 25% in 2012. It’s price noting that, after this earlier successful streak and correction, Bitcoin entered an much more aggressive bull rally, making document highs.

Crypto market crash and liquidations

As reported by Finbold, cryptocurrency merchants have misplaced greater than $662 million in liquidations from July 4 to five. Of that, 85% had been long-position liquidations, and Bitcoin dominated these by 35%.

Notably, the crash began on July 3, with the crypto whole market cap index by TradingView (TOTAL) marking a $2.25 trillion capitalization again then and going as little as $1.90 trillion this morning as merchants began panic promoting.

The drop represents a $311 billion market cap loss in roughly 60 hours, being one of many worst hits lately.

Bitcoin value evaluation, macroeconomics, and sell-offs

Total, Bitcoin went from $72,000 28 days in the past to as little as $53,542 this Friday. The cryptocurrency misplaced 25.67% after a resistance rejection and broke down from the four-month vary’s assist of $60,000.

As of this writing, BTC trades at $55,270 and can retest the value vary.

Curiously, the printed United States macroeconomic information suggests a weakening labor market. Non-farm payrolls present 206,000 new jobs added this month, 12,000 lower than in June. Furthermore, the unemployment fee got here above expectations at 4.1%. This fuels fears of an impending recession within the U.S., which might make the Federal Reserve evaluation its aggressive rate of interest coverage.

Thus, Bitcoin may benefit from this information, renewing buyers’ confidence amid huge sell-offs from Mt. Gox and Germany that triggered panic gross sales over the market.

As all this developed, merchants anticipate elevated volatility for crypto property within the coming days, requiring additional warning with leverage positions transferring ahead.

Disclaimer: The content material on this website shouldn’t be thought-about funding recommendation. Investing is speculative. When investing, your capital is in danger.