Bitcoin (BTC) has just lately rallied to the $72,000 resistance of a 3-month worth vary and all of a sudden dropped again to $67,000. This volatility created imbalances within the derivatives market, now weighted towards Bitcoin short-sellers, presumably resulting in an impending quick squeeze.

Notably, since late February, Bitcoin has saved the $12,000 worth vary from $60,000 to $72,000. Within the meantime, two deviations from the vary marked a rally to $73,805 for a brand new all-time excessive and a sudden crash to $56,537.

On Could 21, the main cryptocurrency exactly reached $72,000 once more, and Bitcoin short-sellers jumped in betting within the sample. As developed, BTC certainly revered the 3-month vary and at the moment misplaced 6.4% from this degree, buying and selling at $67,315.

Quick squeeze goal over Bitcoin short-sellers positions

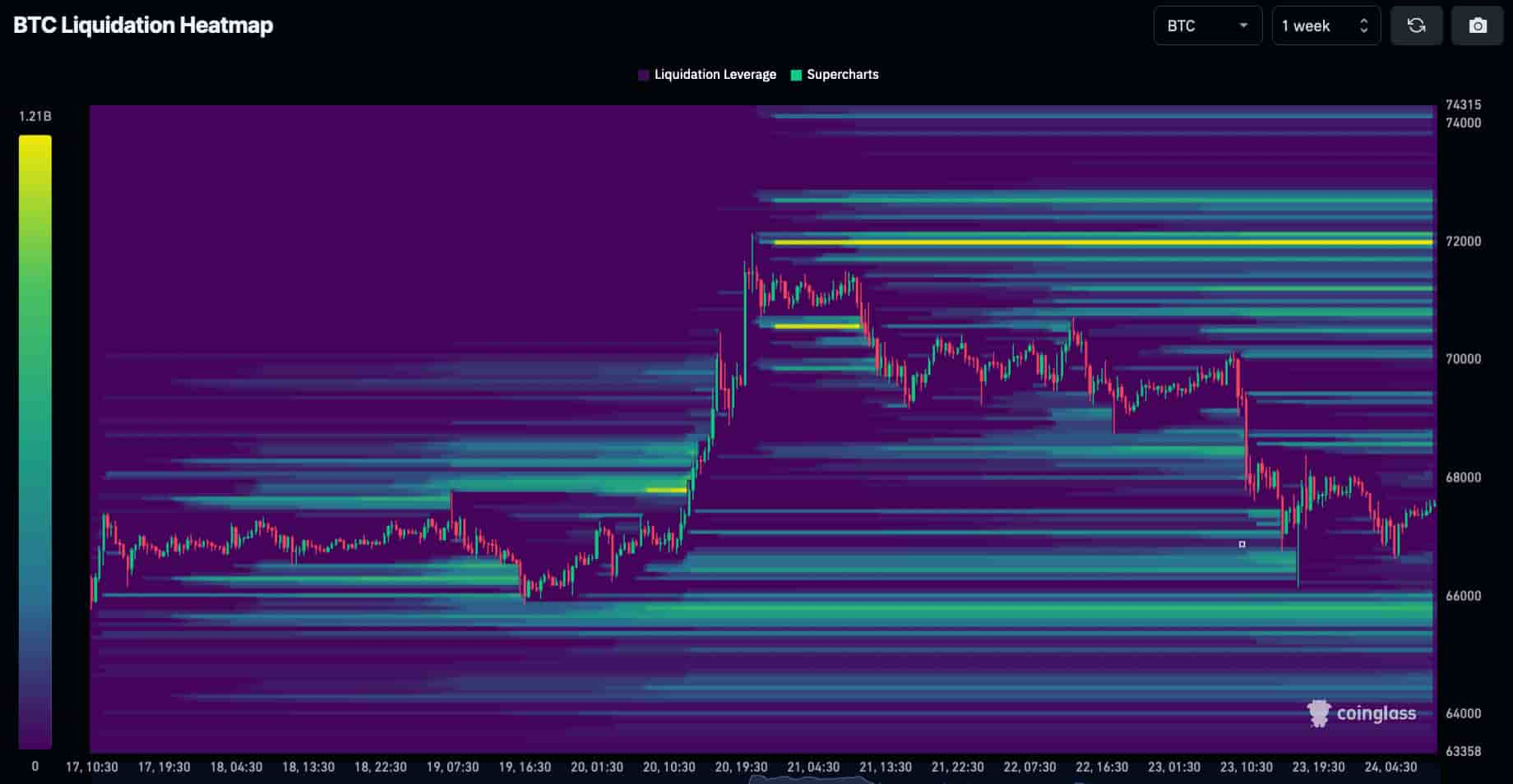

Nevertheless, such exercise might make the short-sellers a goal, as Bitcoin’s future contracts and leverage buying and selling accumulate liquidations upwards. Ought to these liquidity swimming pools develop into a goal, BTC might face a brief squeeze within the coming days.

Finbold gathered knowledge from CoinGlass on Could 24 to realize insights into the present state of the derivatives market.

Particularly, over $1.2 billion of liquidations have accrued within the $72,000 vary resistance. Market makers {and professional} merchants might see this as a possibility to come across gas for a doable vary breakout.

That is due to the specter of a brief squeeze, which might liquidate these short-seller’s positions and create synthetic demand, pumping Bitcoin’s worth above its present all-time excessive.

Alternatively, cryptocurrency merchants consistently reevaluate their positions because the market adjustments. Subsequently, if merchants shut their quick positions, this reported liquidity pool might not exist within the following days.

Bitcoin whale exercise

As a validation of a doable quick squeeze, Ali Martinez reported an elevated Bitcoin whale exercise with a bullish bias. In keeping with Martinez, these whales purchased the dip to $67,000 for 20,000 BTC bought, price $1.34 billion.

#Bitcoin whales are shopping for the dip! These massive #BTC holders have bought over 20,000 $BTC within the final 24 hours, price $1.34 billion, as costs dropped beneath $67,000. pic.twitter.com/8CNXkhZeZK

— Ali (@ali_charts) Could 24, 2024

The constructive sentiment might propel Bitcoin short-sellers future liquidation because the spot market might face a provide shock. However, buyers ought to stay cautious and keep away from overexposure to cryptocurrencies, contemplating their inherent dangers and volatility.

Disclaimer: The content material on this website shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger