Bitcoin (BTC) lastly crossed the long-awaited $100,000 mark on December 5, solely to shortly lose it in a 24-hour “pump and dump.” The value motion has moved a whole bunch of billions of {dollars} up and down inside a day, liquidating almost $500 million.

In a outstanding present of volatility, Bitcoin pumped from $98,100 to $104,100, dumped to $91,950 and pumped once more above $98,000 – all in 24 hours. From the brand new all-time excessive (ATH) to the pump-and-dump native backside, BTC moved roughly $240 billion in market cap.

As of this writing, the main cryptocurrency trades at $98,296, returning to its consolidation vary earlier than the motion.

Almost $500 million in BTC liquidations inside a 24-hour pump and dump

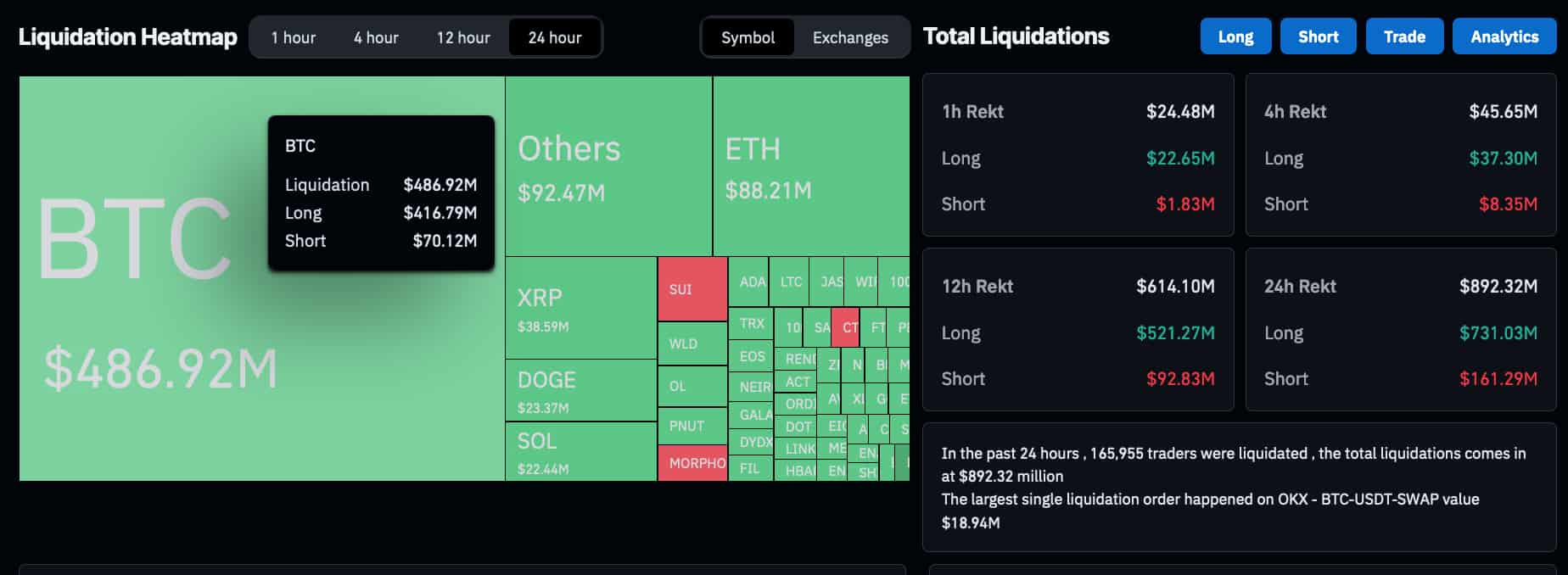

Notably, Bitcoin’s 24-hour pump and dump across the $100k mark has liquidated $486.92 million value of buying and selling positions. The bulls (long-position merchants) had been probably the most affected throughout the motion, shedding $416.79 million of BTC in 24 hours.

In response to knowledge from CoinGlass, the most important single liquidation order was a $18.94 million BTC-USDT-SWAP order on OKX.

Furthermore, Bitcoin dominated the crypto liquidations by 54.5%, and altcoins held robust throughout BTC’s 24-hour pump and dump. However, a complete of 165,955 merchants had been affected within the leveraged market, shedding over $892 million to liquidations.

Bitcoin value prediction shifting ahead the volatility

As issues develop, Finbold has reported completely different value predictions for Bitcoin, which align for an general bullish outlook. So, regardless of the latest pump and dump that recommended weak point above $100,000, analysts are optimistic about what’s subsequent.

First, an unique Finbold report analyzed Bitcoin’s month-to-month historic value motion in December since 2013, forecasting a optimistic outlook. In response to this prediction, BTC will commerce between $94,782 and $101,273 by the tip of 2024.

Wanting additional, TradingShot recognized a chart sample that might put Bitcoin at $140,000 by February 2025. In the meantime, the monetary big Normal Chartered sees BTC buying and selling at $200,000 by the tip of 2025 after appropriately calling the $100k this 12 months.

Nonetheless, Bitcoin’s volatility can nonetheless trigger buyers to see extra “pump and dump” occasions, comparable to yesterday’s. On that be aware, the best-selling creator Robert Kiyosaki believes that these BTC crashes provide alternatives for accumulation. But, buyers and merchants ought to be cautious and keep away from shedding cash to market liquidations, having a stable plan on Bitcoin.

Featured picture from Shutterstock.