The crypto market is present process a big correction as traders withdrew $584 million from crypto-related funding merchandise final week, based on CoinShares’ newest report.

Moreover, international buying and selling volumes for crypto ETPs hit their lowest ranges for the reason that US Securities and Change Fee permitted the launch of a number of spot Bitcoin exchange-traded funds (ETFs) in January, totaling simply $6.9 billion for the week.

This decline continues a development from the earlier week, the place traders pulled out round $600 million, bringing the two-week complete to just about $1.2 billion in outflows.

James Butterfill, the top of analysis at CoinShares, commented:

“We imagine that is in response to the pessimism amongst traders concerning the prospect of rate of interest cuts by the FED this yr.”

Bitcoin and US lead outflows

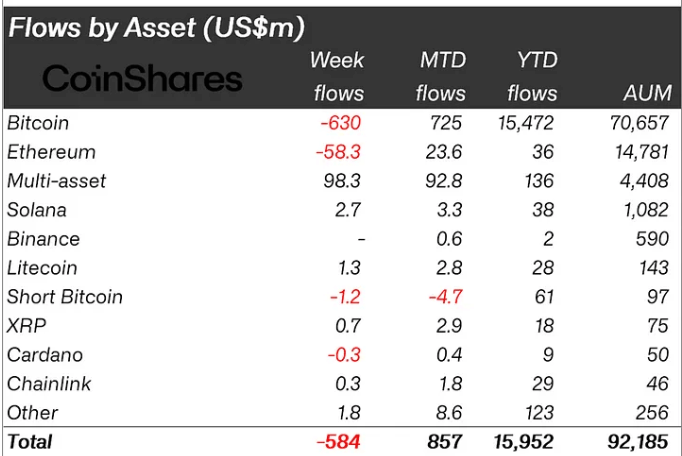

Bitcoin funding merchandise noticed probably the most important outflows, totaling $630 million. Bitcoin ETPs skilled six consecutive days of outflows within the US, primarily from Grayscale Bitcoin ETF and Constancy’s FBTC.

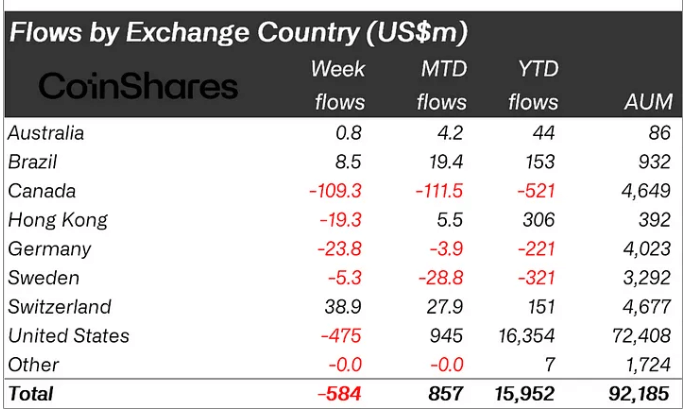

Canada additionally witnessed substantial outflows from crypto ETPs, with $109 million withdrawn. This was adopted by Germany and Hong Kong, which noticed outflows of $24 million and $19 million, respectively.

Conversely, Switzerland and Brazil recorded inflows of $39 million and $48.5 million, respectively, serving to to offset the general outflows.

Buyers with bearish sentiments additionally withdrew about $1.2 million from brief Bitcoin merchandise.

In the meantime, Ethereum joined the outflow development, seeing its first withdrawals in weeks, totaling roughly $58 million. This lowered its month-to-date move to round $23 million from $82 million.

Altcoins show engaging

Regardless of the outflows from the most important digital asset, multi-asset funding merchandise and a few altcoins noticed important inflows.

Based on CoinShares, multi-asset merchandise attracted over $98 million, whereas Solana, Litecoin, and Polygon acquired $2.7 million, $1.3 million, and $1 million, respectively.

Butterfill defined that these inflows point out a brand new investor concentrate on altcoins. He said:

“[These inflows] recommend traders view the weak point within the altcoin market as a shopping for alternative.”

Talked about on this article