Bitcoin (BTC) retraced under the $100,000 psychological degree, bringing uncertainty for some and a shopping for alternative for others. As a show of the latter, exchanges registered over $2 billion in BTC outflow from their accounts in per week – the biggest Bitcoin outflow this 12 months.

Finbold retrieved information from CoinGlass on December 24, trying on the alternate’s spot markets during the last seven weeks. From December 15 to in the present day, exchanges noticed a $2.12 billion outflow in BTC, which is at the moment buying and selling at $95,177.

This marks the biggest weekly spot outflow year-to-date in greenback worth, in keeping with CoinGlass, surpassing Could’s $2.03 billion. Notably, the beforehand largest 2024 outflow triggered a Bitcoin worth crash from $58,240 right down to $31,778.

Traditionally, vital spot outflows occur throughout bull rallies, fueled by huge retail demand, shopping for and withdrawing the BTC to self-custody. Nonetheless, this elevated demand by retail buyers might often sign a worth high for Bitcoin and different property, requiring warning.

Almost $1 billion of Bitcoin left Binance alone in per week

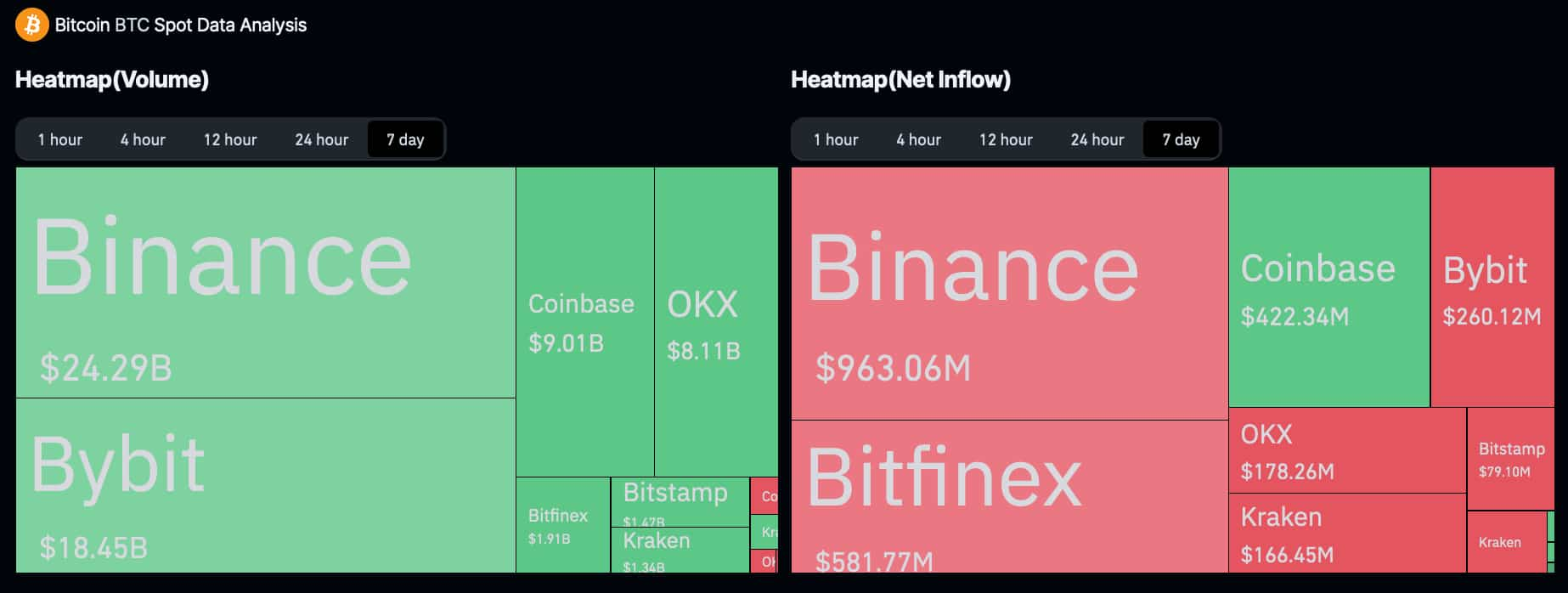

On this context, Binance is by far the alternate with the biggest particular person outflow amongst its rivals.

Almost $1 billion in Bitcoin left the main crypto alternate within the final seven days, adopted distantly by Bitfinex. The second-largest weekly outflow was barely above $500 million from Tether’s mother or father firm.

Curiously, the third largest circulation was a inexperienced one, with Coinbase registering $422 million in Bitcoin deposits influx. Different exchanges like Bybit, OKX, Kraken, and Bitstamp additionally registered BTC outflows between $79 million and $260 million.

Normally, Bitcoin web inflows imply most buyers are depositing BTC with the intention of promoting. In the meantime, web outflows would recommend the alternative, with bullish buyers withdrawing what they’ve already purchased.

It’s notable that, given its nature, inflows can often precede large worth drops, as buyers must deposit earlier than they will promote, being a proactive measurement. Then again, buyers can solely withdraw what they’ve already purchased, so the outflows are a reactive metric and don’t essentially imply the value will improve after a big Bitcoin web outflow.

As seen within the historic chart, outflows are a helpful sentiment indicator that generally alerts an upcoming reversal.

Featured picture from Shutterstock.