Since February 2024, Bitcoin (BTC) has traded in a value vary between $60,000 and $72,000, with two deviations. This has carved a largely impartial momentum for the main cryptocurrency, now seeing its buying and selling and transaction quantity fade away.

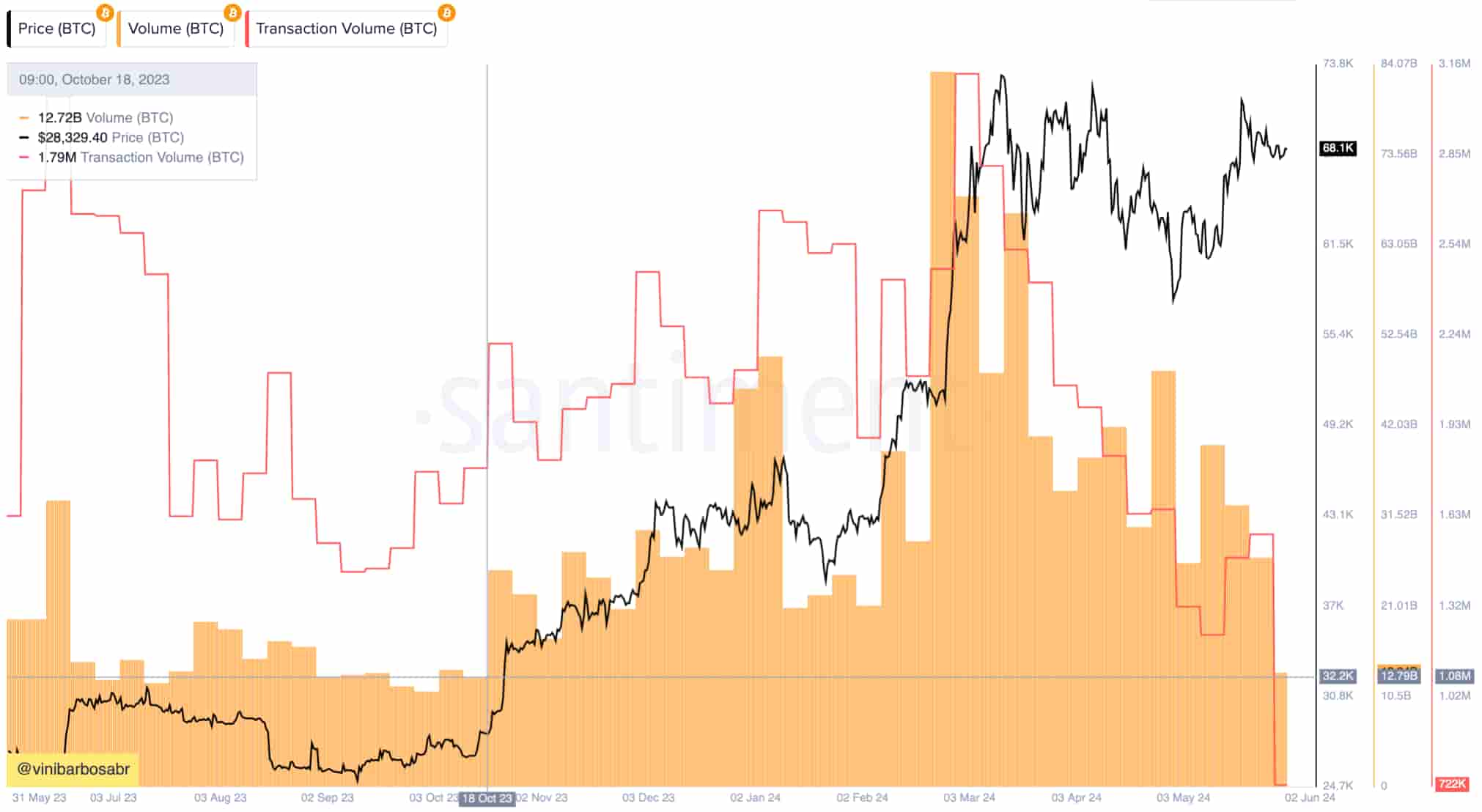

Finbold retrieved knowledge from Santiment on June 2 displaying each metrics with the BTC value, at the moment at $68,100. Specifically, the seven-day buying and selling quantity plummeted beneath $14 billion to the identical degree as 2023, when Bitcoin traded beneath $30,000.

Furthermore, the chart evidences an absence of curiosity in Bitcoin buying and selling and on-chain transaction volumes, with the second remarkably low. As noticed, the community registered solely 722,000 BTC moved in seven days. This contrasts with the 1.79 million BTC in October 2023, with an analogous buying and selling quantity and half the value.

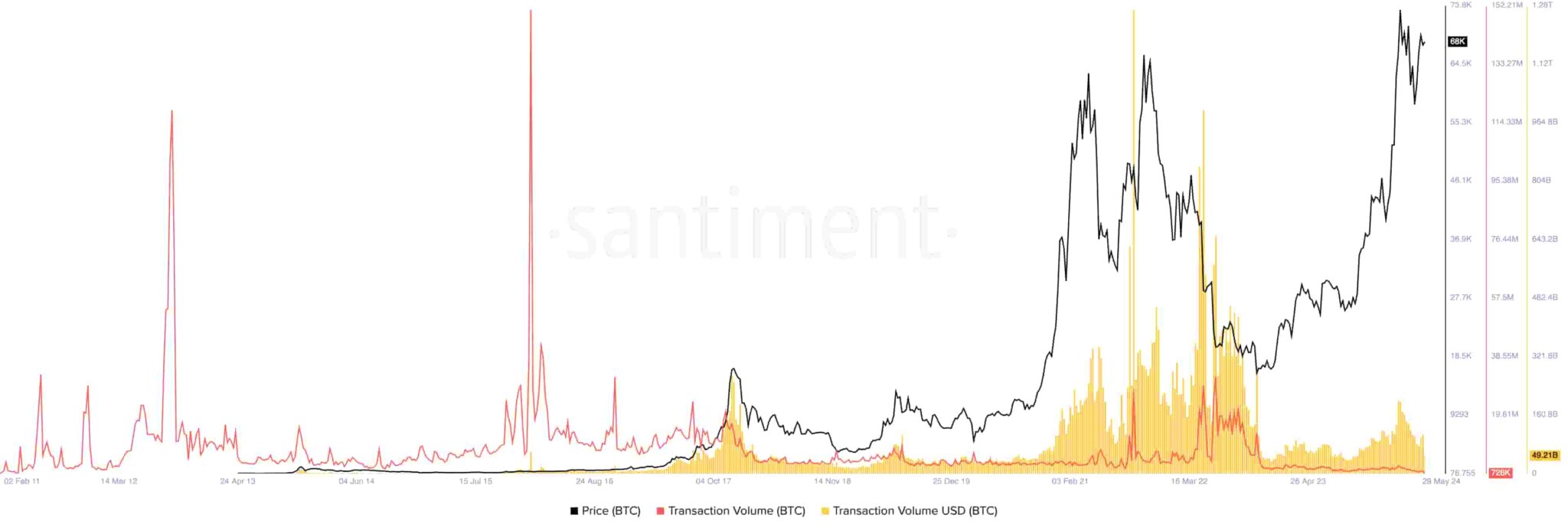

If we zoom out of the chart, Bitcoin’s present on-chain transaction quantity exhibits its lowest worth for the reason that starting. This highlights a remarkably low community exercise, which has not adopted the elevated demand for speculative BTC over time.

Bitcoin ETFs and derivatives quantity

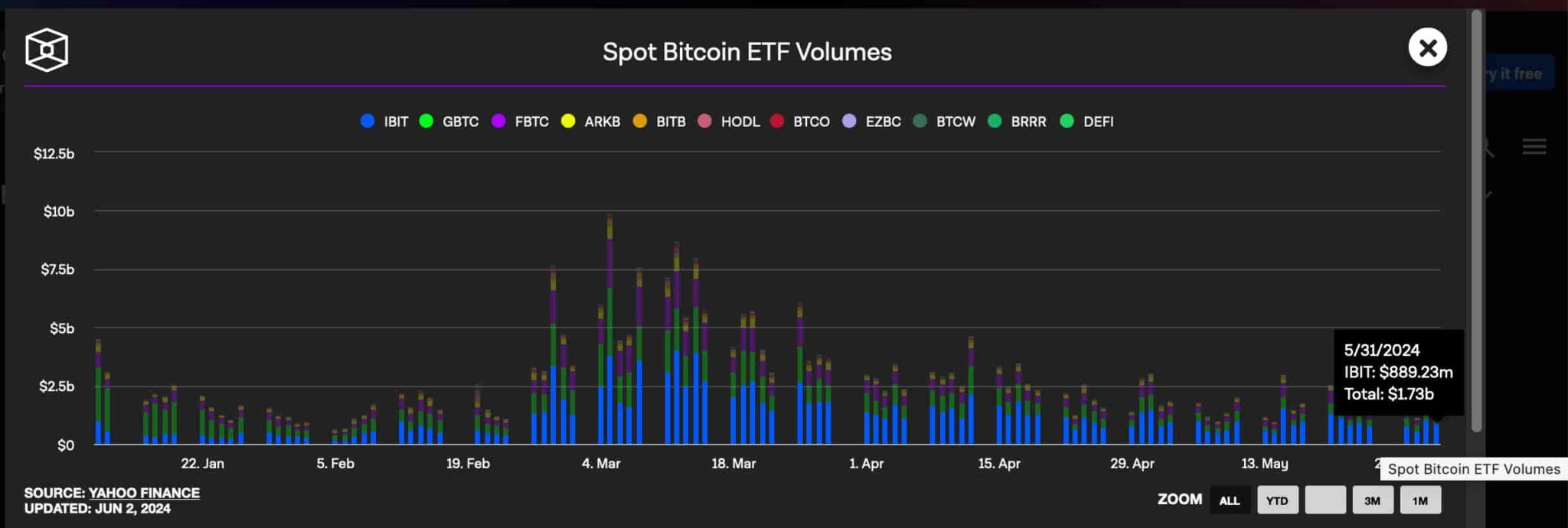

In the meantime, this 12 months’s accredited Bitcoin spot ETFs have made $1.73 billion, based on knowledge retrieved from IntoTheBlock and Yahoo. General, these ETFs‘ final seven buying and selling days totaled $12 billion in quantity, much like BTC’s spot quantity on crypto exchanges.

This implies an elevated curiosity in buying and selling the regulated and custodial exchange-traded funds as a substitute of Bitcoin itself.

The derivatives quantity additionally highlights the elevated curiosity in purely speculative demand for the main cryptocurrency. Knowledge from CoinGlass exhibits a each day quantity superior to $34 billion—almost thrice the seven-day quantity for spot buying and selling.

Notably, the exchanged quantity of futures contracts and different Bitcoin derivatives monetary merchandise has remained secure after peaking in March 2024.

In conclusion, these indicators recommend a better market curiosity in BTC value hypothesis by way of Bitcoin ETFs and derivatives. That is against buying Bitcoin for self-custody or long-term maintain from cryptocurrency exchanges or utilizing the permissionless blockchain for actual peer-to-peer transactions.

Disclaimer: The content material on this website shouldn’t be thought-about funding recommendation. Investing is speculative. When investing, your capital is in danger.