- Bitcoin value holds above the $54,000 help stage examined on Friday.

- US spot Bitcoin ETFs registered outflows final week, whereas CryptoQuant’s Bitcoin Coinbase Premium Index noticed a light rise.

- On-chain knowledge paints a bearish image, with falling each day energetic addresses and a destructive Open Curiosity-weighted funding Fee.

Bitcoin (BTC) recovered barely on Monday, extending the weekend’s restoration after costs bounced from key help at $54,000 on Friday. This slight restoration amid the delicate enhance within the Coinbase Premium Index throughout the weekend. Nonetheless, the restoration may very well be short-lived as on-chain knowledge continues to lean to the draw back, as proven by falling each day energetic addresses and a destructive OI-weighted funding Fee.

Every day digest market movers: BTC institutional demand wanes

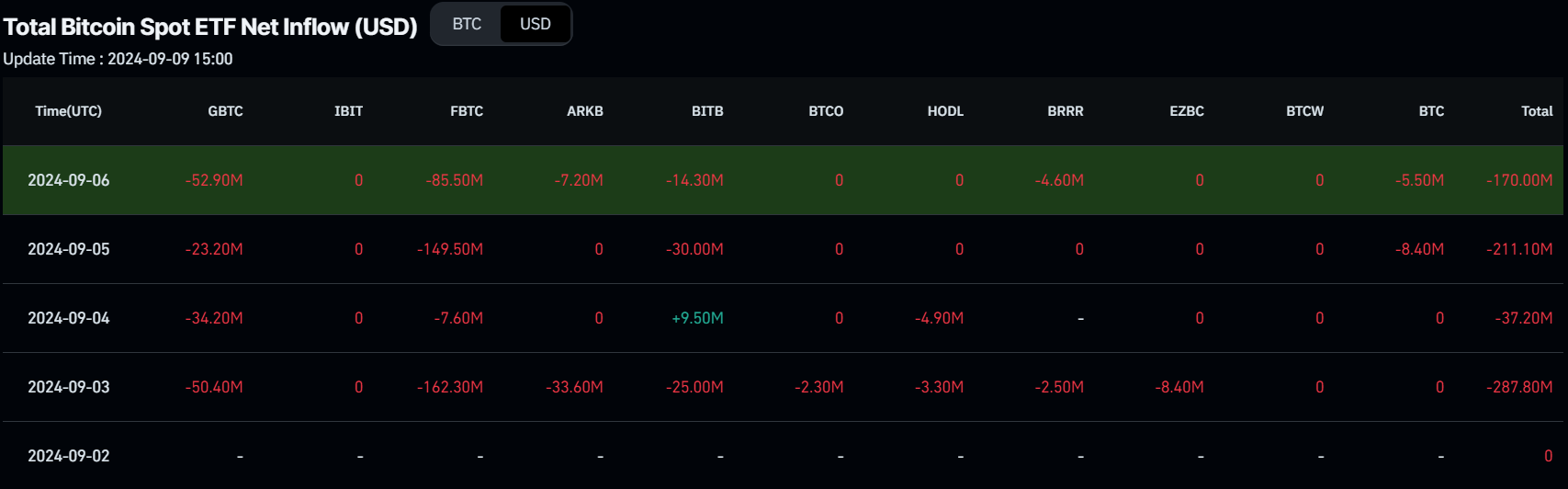

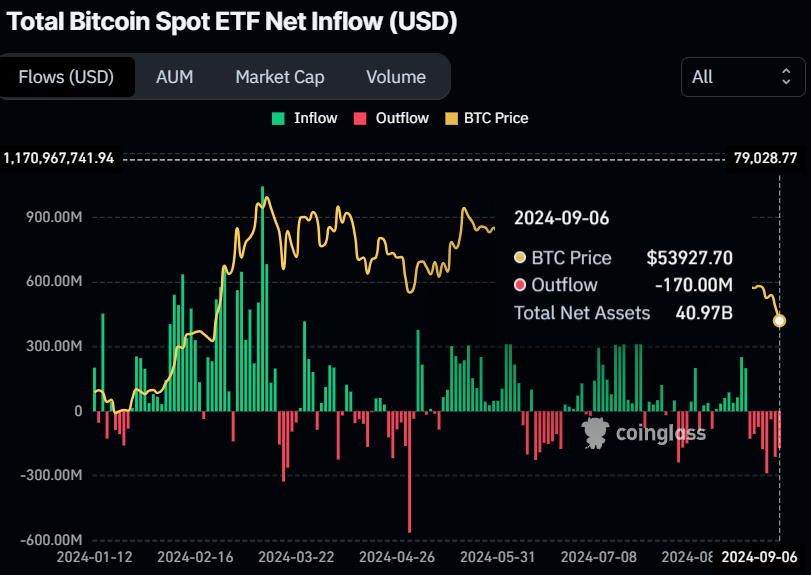

- In line with Coinglass knowledge, US spot Bitcoin ETFs recorded a complete web outflow of $706.1 million final week, an indication of waning market sentiment. The mixed Bitcoin reserves held by the 11 US spot Bitcoin ETFs stands at $40.97 billion, down from $41.68 billion every week earlier.

Bitcoin Spot ETF Web Influx chart

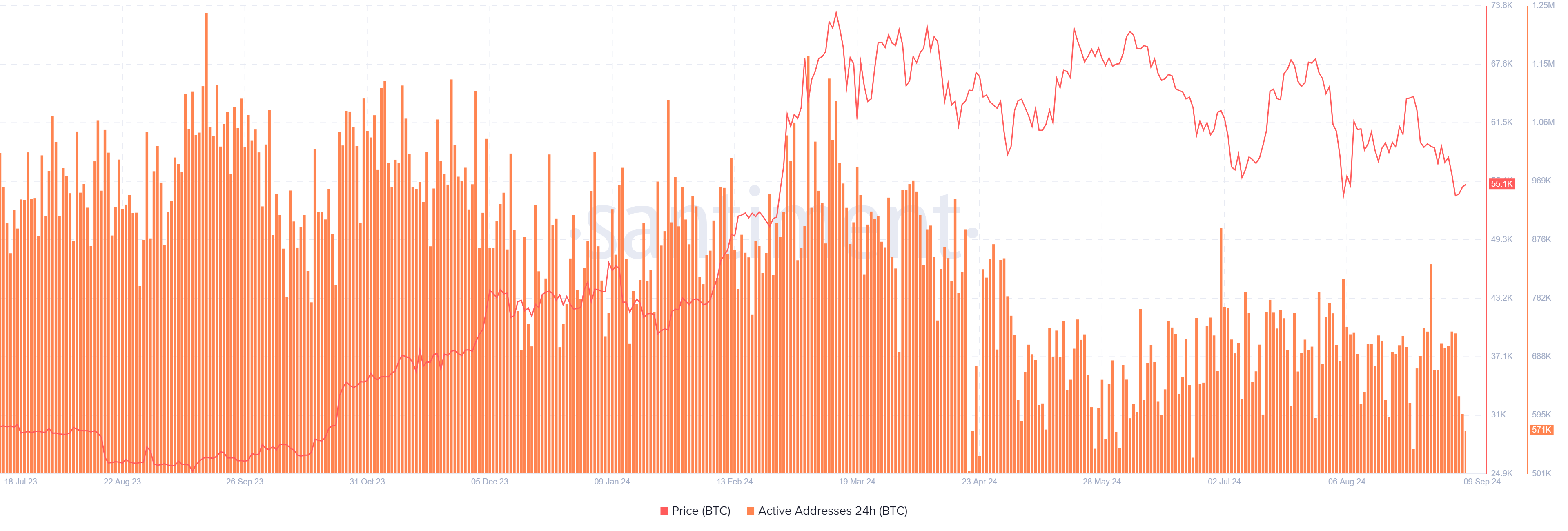

- Santiment’s Every day Lively Addresses index, which tracks community exercise over time, additionally paints a bearish image for Bitcoin. An increase within the metric alerts higher blockchain utilization, whereas declining addresses level to decrease demand for the community.

In BTC’s case, Every day Lively Addresses fell from 726,380 on September 6 to 597,560 on Sunday, extending a downtrend that began in mid-March. This means that demand for BTC’s blockchain utilization is lowering, which doesn’t bode properly for Bitcoin value.

Bitcoin each day energetic addresses chart

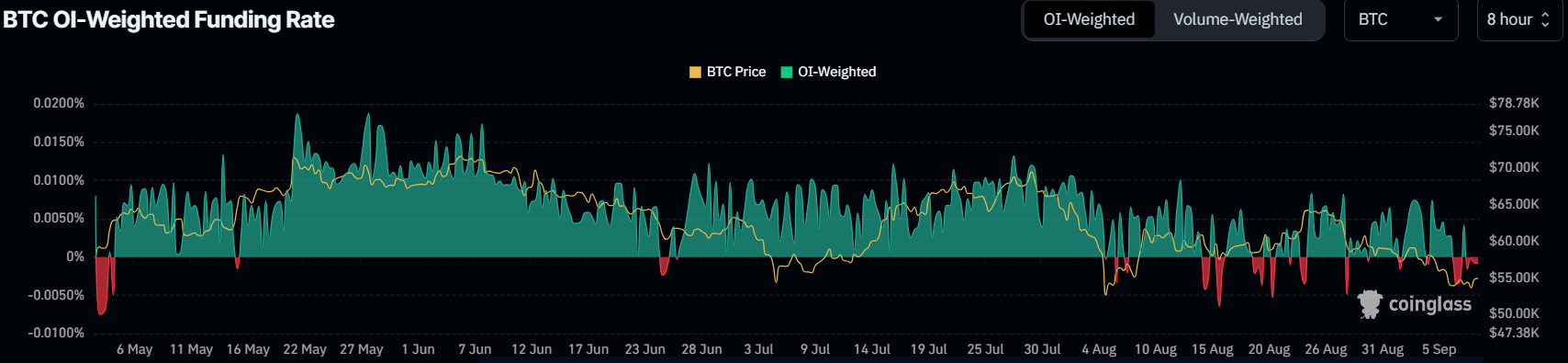

- In line with Coinglass’s OI-Weighted Funding Fee knowledge, the variety of merchants betting that the worth of Bitcoin will slide additional is larger than that anticipating a value enhance. This index relies on the yields of futures contracts, that are weighted by their open rates of interest. Usually, a constructive charge (longs pay shorts) signifies bullish sentiment, whereas destructive numbers (shorts pay longs) point out bearishness.

Within the case of Bitcoin, this metric stands at -0.0008%, reflecting a destructive charge and indicating that shorts are paying longs. This state of affairs usually signifies bearish sentiment available in the market, suggesting potential downward stress on Bitcoin’s value.

Bitcoin OI-Weighted Funding Fee chart

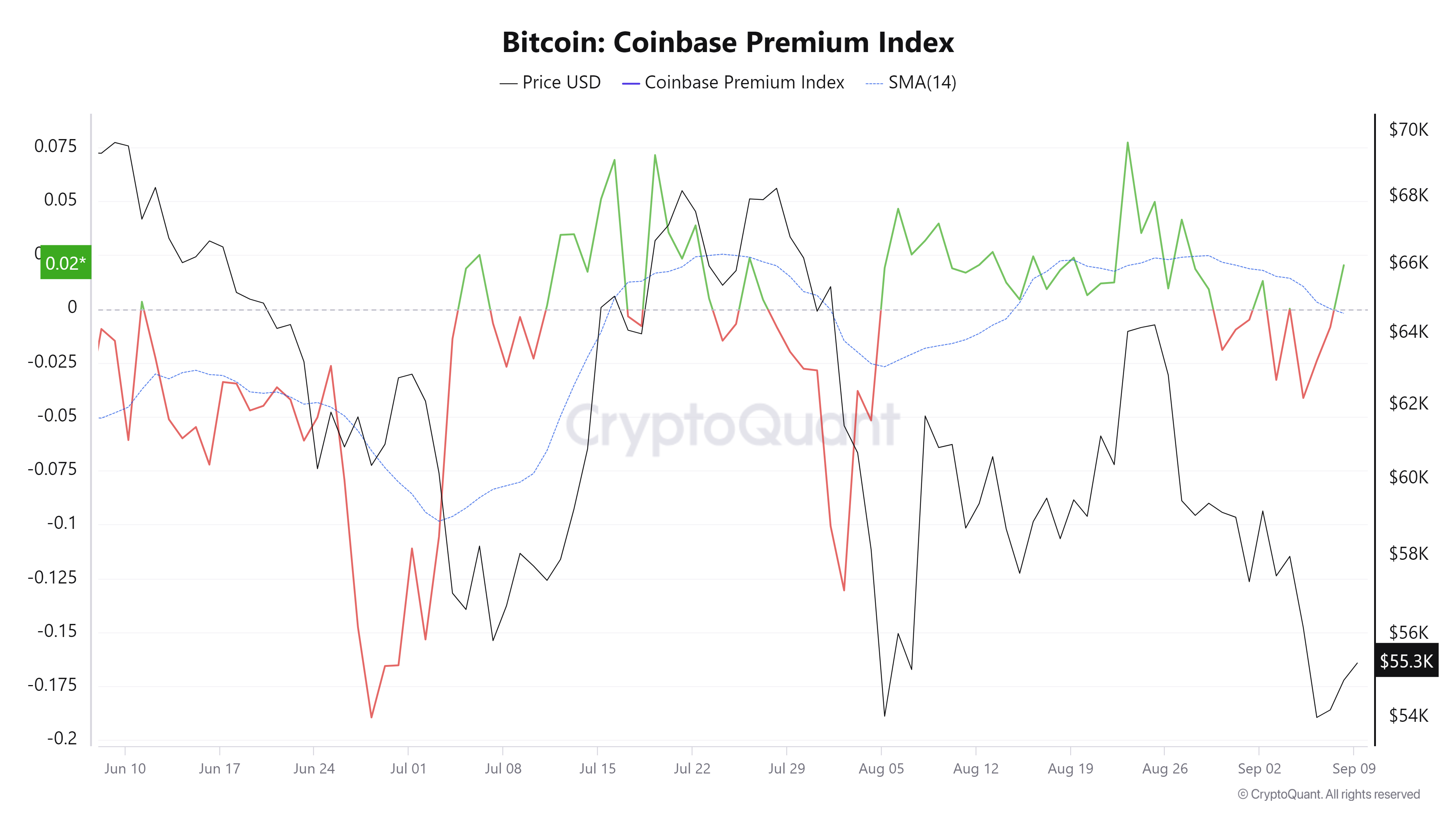

- CryptoQuant’s Bitcoin Coinbase Premium Index, a key indicator of how large-wallet buyers behave, suggests growing curiosity from whales within the high crypto. The indicator exhibits the hole between the Coinbase Professional value (USD pair) and the Binance value (USDT pair). Coinbase Premium knowledge is likely one of the indicators that exhibits an indication of whale accumulation, because the Coinbase Professional platform is taken into account the gateway for institutional buyers to buy cryptocurrencies.

Within the case of Bitcoin, the index rose from -0.008 to 0.020 from Saturday to Monday, buying and selling above its 14-day Easy Transferring Common (SMA) at -0.009. This delicate rise signifies that whales present some signal of accumulation. As well as, buyers’ curiosity in and exercise in Coinbase have additionally elevated barely.

Bitcoin Coinbase Premium Index chart

Technical evaluation: BTC holds above $54,000

Bitcoin was rejected at $59,560, its 50% value retracement stage, on September 2 (drawn from a excessive in late July to a low in early August) and dropped 8.7% within the subsequent 4 days. On Saturday, it discovered help across the $54,000 stage, buying and selling barely above $55,316 on Monday.

If BTC closes beneath the $54,000 stage, it might decline 7% to retest the subsequent each day help at $49,917.

The Relative Power Index (RSI) and the Superior Oscillator (AO) momentum indicators on the each day chart commerce beneath their respective impartial ranges of fifty and nil, respectively. Each indicators recommend weak momentum and a continuation of the downward development.

BTC/USDT each day chart

Nonetheless, the bearish thesis can be invalidated if Bitcoin’s value breaks above the $56,022 resistance. On this state of affairs, BTC might lengthen the constructive transfer by 6% to revisit its 50% value retracement stage at $59,560.