Bitcoin (BTC) thrives during times of financial growth, outperforming different property. As BTC heads right into a yr of decrease Fed charges, financial coverage might add to its efficiency.

Bitcoin (BTC) might have favorable help from a extra dovish Fed, because the asset thrives during times of financial growth and low rates of interest. After the most recent Fed fee reduce by 1 / 4 level to 4.5-4.75 vary, BTC began its post-election rally, retesting all-time excessive costs a number of instances within the span of a day.

A day after the speed reduce, BTC rallied once more throughout US buying and selling hours, breaking into value discovery above $77,252,77, one of many sequence of all-time highs. Though the November 7 fee reduce was anticipated, BTC nonetheless added the issue to its newest bullish transfer.

BTC additionally depends on liquidity inside to the crypto world, based mostly on stablecoin inflows and extremely lively buying and selling pairs. Nonetheless, elevated cash provide might convey again retail shopping for and establishments searching for the possibility of value discovery and outperformance.

The speed reduce was amongst many components affecting the value, however financial coverage and cash provide could also be components for BTC to carry out within the last months of 2024 and into 2025.

Fed’s Chair Jerome Powell already signaled the speed cuts might not be as steep and speedy as throughout the 2020 pandemic. Because of a recovering financial system, the Fed might reduce charges regularly, with a 3.25% goal by the tip of 2025. As BTC already makes forays into mainstream finance, the speed cuts might act as a background issue to cost appreciation.

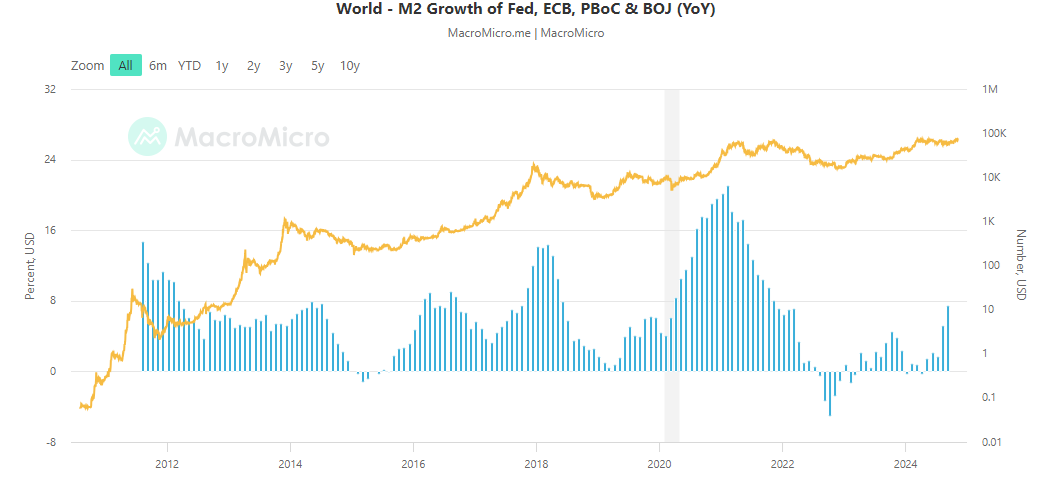

Within the case of an extended interval of financial growth, the place liquidity flows into all property, BTC outperforms the inventory market by 4x and gold by as a lot as 20x, reveals analysis by Coinrank. The precise timing and period of the BTC rally might differ, and the value motion might lag between the rate of interest cuts and M2 growth.

Bitcoin (BTC) rallies as a lagging indicator following durations of M2 growth. | Supply: MacroMicro

BTC might retain its correlation with gold, as within the case of gold, however nonetheless retain its quicker mechanisms for value discovery and outperform within the brief time period.

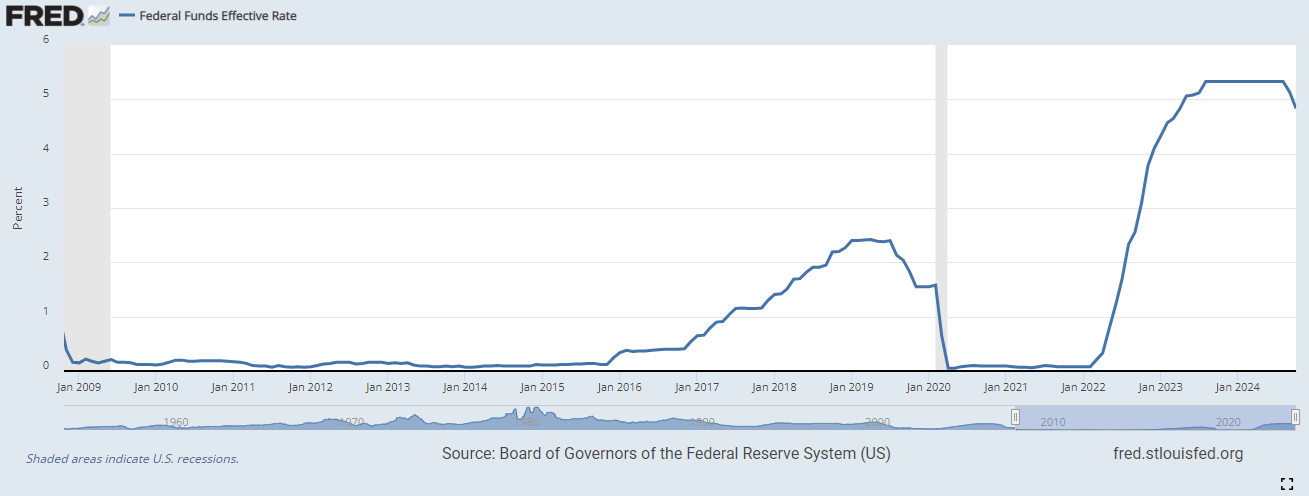

BTC emerged in a low rate of interest atmosphere

The primary dramatic bull marketplace for BTC in reality occurred after a sequence of fee hikes, which have been meant to curb the liquidity growth from 2008 to 2014. The 2008 monetary disaster, which helped spawn BTC, additionally led to a protracted interval of extraordinarily low charges. Later rallies coincided with far more dynamic Fed insurance policies and shifts in options to inflation or recession threats.

BTC is now getting ready to enter a interval of fee cuts, in addition to a brand new growth cycle of M2 cash provide worldwide. Expansions within the M2 cash provide precede BTC rallies by weeks to months.

BTC has reacted to fee cuts prior to now. Its first few years of progress coincided with a protracted streak of low rates of interest worldwide. Between 2020 and 2024, BTC grew in a local weather of rock-bottom charges. Nonetheless, this didn’t forestall BTC from additionally rising throughout the newest sequence of fee hikes.

Bitcoin’s improvement occurred throughout years with extraordinarily low Fed charges. | Supply: FRED Financial Knowledge

In October, BTC was additionally tightly correlated to fairness index S&P500. BTC can behave each as a risk-on asset, monitoring basic financial growth, and return to its fundamental operate as a device towards cash debasement and inflation. BTC works as an inflation hedge as a consequence of its potential for outperforming different property however shouldn’t be a secure haven, as a consequence of surprising crashes and drawdowns.

On the optimistic aspect, entry to simpler liquidity at a decrease fee might increase demand for investments. BTC already has the potential to soak up mainstream shopping for by means of one in every of its ETFs.

On the draw back, a number of crypto tasks are holding T-Payments as their reserves and may even see their revenues lower with decrease rates of interest.