The Bitcoin open curiosity has been a topic of debate over the previous week, with numerous on-chain platforms revealing its current record-breaking surge. Nonetheless, funding analytics agency Alphractal disputed that the open curiosity in BTC had reached a brand new all-time excessive.

Apparently, a distinguished crypto analytics platform has put ahead new information on the Bitcoin open curiosity, disclosing that this indicator certainly solid a document excessive over the previous week. Right here is its potential implication on the worth of BTC.

Are Bitcoin Merchants Taking Extra Threat?

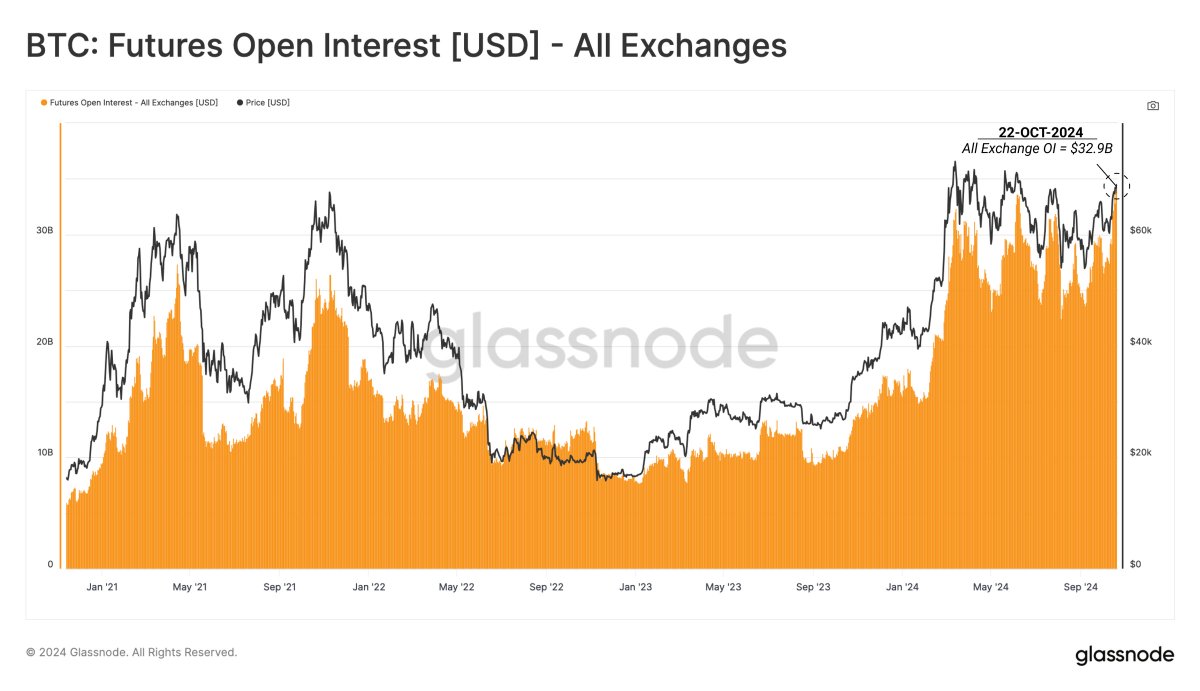

In a brand new put up on the X platform, Glassnode revealed that open curiosity in Bitcoin throughout all exchanges reached a brand new all-time excessive.

Glassnode wrote on X:

Open Curiosity throughout each perpetual and fixed-term futures contracts has recorded a brand new ATH of $32.9B this week, suggesting a marked enhance in combination leverage getting into the system.

For context, open curiosity is an indicator that measures the entire quantity of futures or derivatives contracts of a selected cryptocurrency (BTC, on this state of affairs) available in the market at a given time. It usually affords perception into the quantity of funds being invested into Bitcoin futures in the meanwhile. Rising open curiosity additionally suggests a shift in investor sentiment and a rise in market speculations, with many merchants gearing up for market motion.

Supply: Glassnode/X

With the Bitcoin open curiosity surging to a brand new all-time excessive of $32.9 billion up to now week, it exhibits that contemporary capital is flowing into essentially the most precious market within the cryptocurrency trade. Though the metric doesn’t present data on whether or not these new futures positions are bearish or bullish, it does point out the probability of upper volatility available in the market.

As Glassnode highlighted on X, there’s a important enhance in combination leverage getting into the Bitcoin derivatives market. From a historic standpoint, the market tends to witness important and spontaneous worth swings each time there’s heightened risk-taking conduct from merchants.

This market outlook units up an attention-grabbing subsequent few weeks for the worth of Bitcoin, which has not significantly impressed within the month of October. After forming a robust bullish momentum within the earlier week, the premier cryptocurrency has didn’t capitalize up to now few days.

BTC Value At A Look

As of this writing, the worth of Bitcoin lies simply beneath the $67,000 degree, reflecting a 2.1% decline up to now 24 hours. In the meantime, the premier cryptocurrency is down by about the identical determine on the weekly timeframe, in accordance with information from CoinGecko.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView