The lower of bitcoin’s provide on exchanges may result in larger worth volatility, market maturity, and elevated affect from institutional buyers.

Bitcoin Traders Are Not Promoting Anytime Quickly

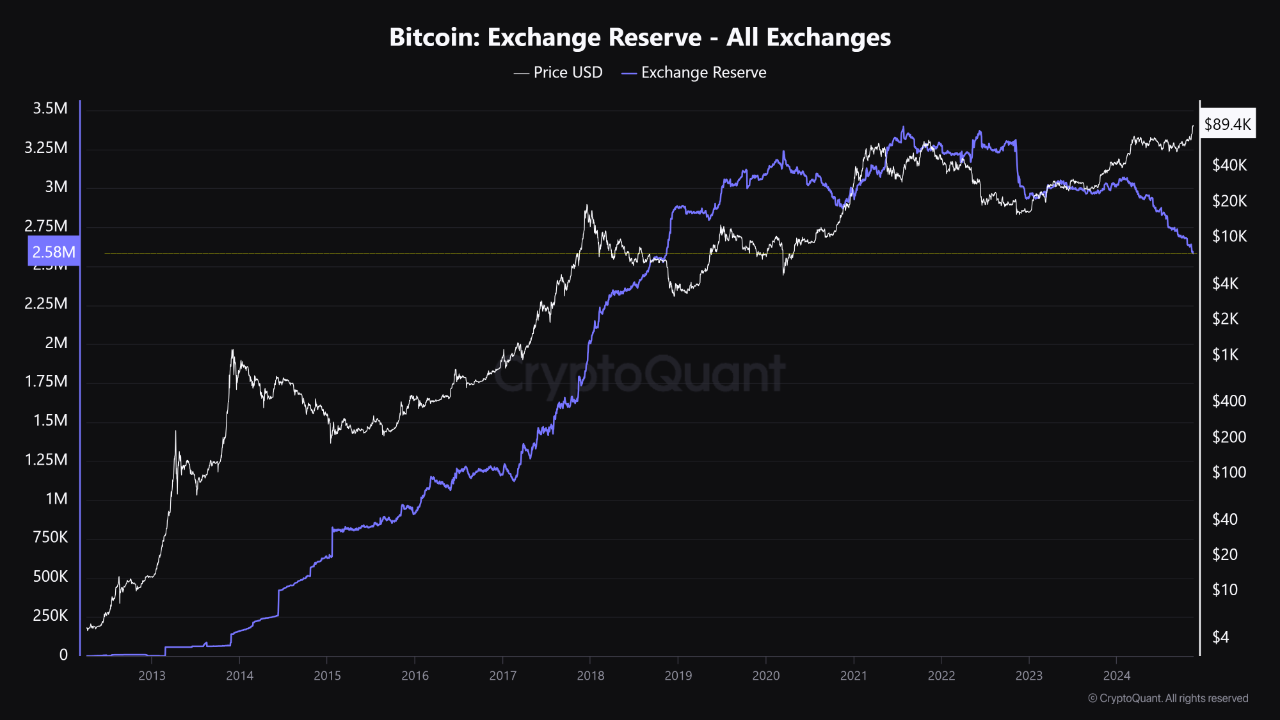

Bitcoin has seen a major decline in its provide on cryptocurrency exchanges, reaching its lowest degree since November 2018. This development signifies that buyers are more and more opting to carry bitcoin long-term, moderately than actively buying and selling it.

In response to knowledge from Cryptoquant, the quantity of bitcoin held on exchanges has dropped to roughly 2.58 million cash. This represents a considerable lower from the height ranges noticed in 2021 in the course of the earlier bull run.

The discount of bitcoin obtainable on exchanges places strain on patrons by decreasing the quantity of bitcoin that’s available on the market. Because of this, if demand stays the identical or will increase, bitcoin’s upward development will likely be sustained.

This additionally means that buyers are placing extra religion in bitcoin as a retailer of worth, because of unpredictable international financial insurance policies and rising inflation.

Sharing his ideas, Gaah, creator at Cryptoquant remarked:

This state of affairs alerts a probably extra risky however extra resilient bitcoin market, with much less promoting strain and a rising dominance of long-term holders, which may open up area for brand spanking new worth peaks.

One of many components actively contributing to a decline of bitcoin on exchanges is institutional adoption. Institutional buyers, reminiscent of Microstrategy, Semler Scientific, and Metaplanet are more and more allocating a portion of their portfolios to bitcoin. These large-scale buyers have a tendency to carry bitcoin in chilly storage, additional lowering the availability on exchanges.

This shift in method largely pushed by institutional adoption together with potential regulatory readability on digital belongings may see this development persist, shaping the way forward for bitcoin and the broader digital belongings ecosystem.