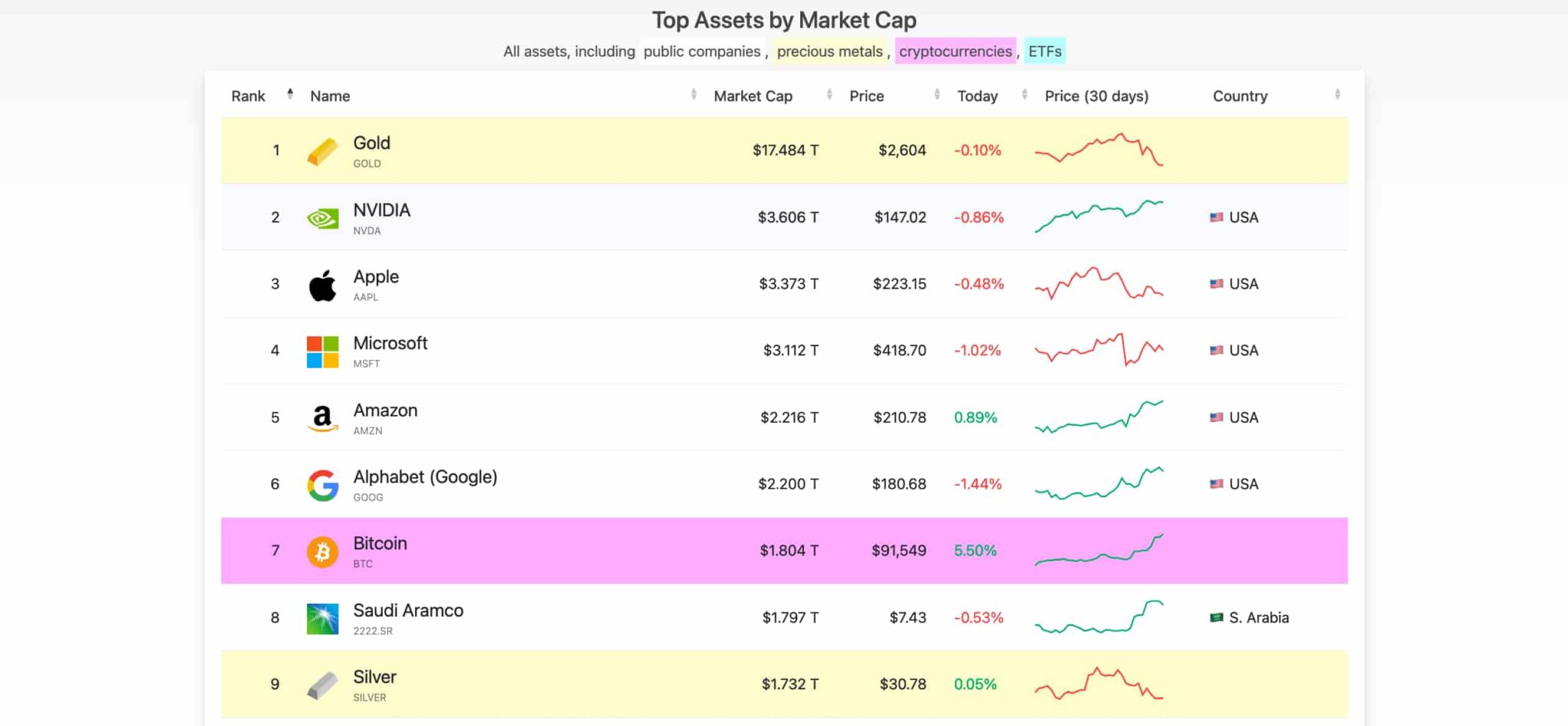

Bitcoin’s (BTC) fast ascent continues, marking yet one more milestone in its exceptional monetary journey. The main cryptocurrency has now develop into the seventh-largest asset globally, boasting a market capitalization exceeding $1.8 trillion.

This meteoric rise positions Bitcoin at precisely half the market worth of Nvidia (NASDAQ: NVDA), the world’s largest public firm by market capitalization of $3.60 trillion. Notably, Bitcoin has just lately overtaken giants like Saudi Aramco, the biggest oil firm on the earth, and silver.

Bitcoin’s surge fueled by election outcomes and institutional inflows

Since Election Day, Bitcoin has skilled unprecedented inflows, with buyers pouring into the market at report ranges. Apparently, the cryptocurrency additionally outpaced the mixed market caps of Tesla (NASDAQ: TSLA) and Netflix (NASDAQ: NFLX). Up to now week alone, Bitcoin has seen $145 billion of inflows, excluding at the moment’s information.

“The professional-crypto insurance policies anticipated from the latest election outcomes are anticipated to drive additional crypto adoption,” famous analysts at The Kobeissi Letter in a latest thread.

Certainly, Bitcoin seems to be one of many largest winners of the 2024 election. Total, 50 out of 58 pro-crypto candidates received their races for the US Congress, altering the political panorama. This political shift means that cryptocurrency is more likely to see extra favorable regulatory insurance policies and legal guidelines within the close to future.

Furthermore, Bitcoin exchange-traded funds (ETFs) have performed a major function on this rally. Bitcoin ETFs, together with crypto-related shares like Coinbase (NASDAQ: COIN) and MicroStrategy (NASDAQ: MSTR), collectively noticed a staggering $38 billion in buying and selling quantity on Monday alone. This degree of exercise marks a brand new excessive, with no earlier day in historical past coming near such volumes.

“Bitcoin ETFs, Coinbase, and MicroStrategy noticed a whopping $38 billion in buying and selling quantity on Monday alone. No day in historical past has even come remotely near such excessive buying and selling volumes,” noticed The Kobeissi Letter.

Specifically, BlackRock’s (NYSE: BLK) iShares Bitcoin belief IBIT surpassed gold’s ETF in quantity this week, as Finbold reported.

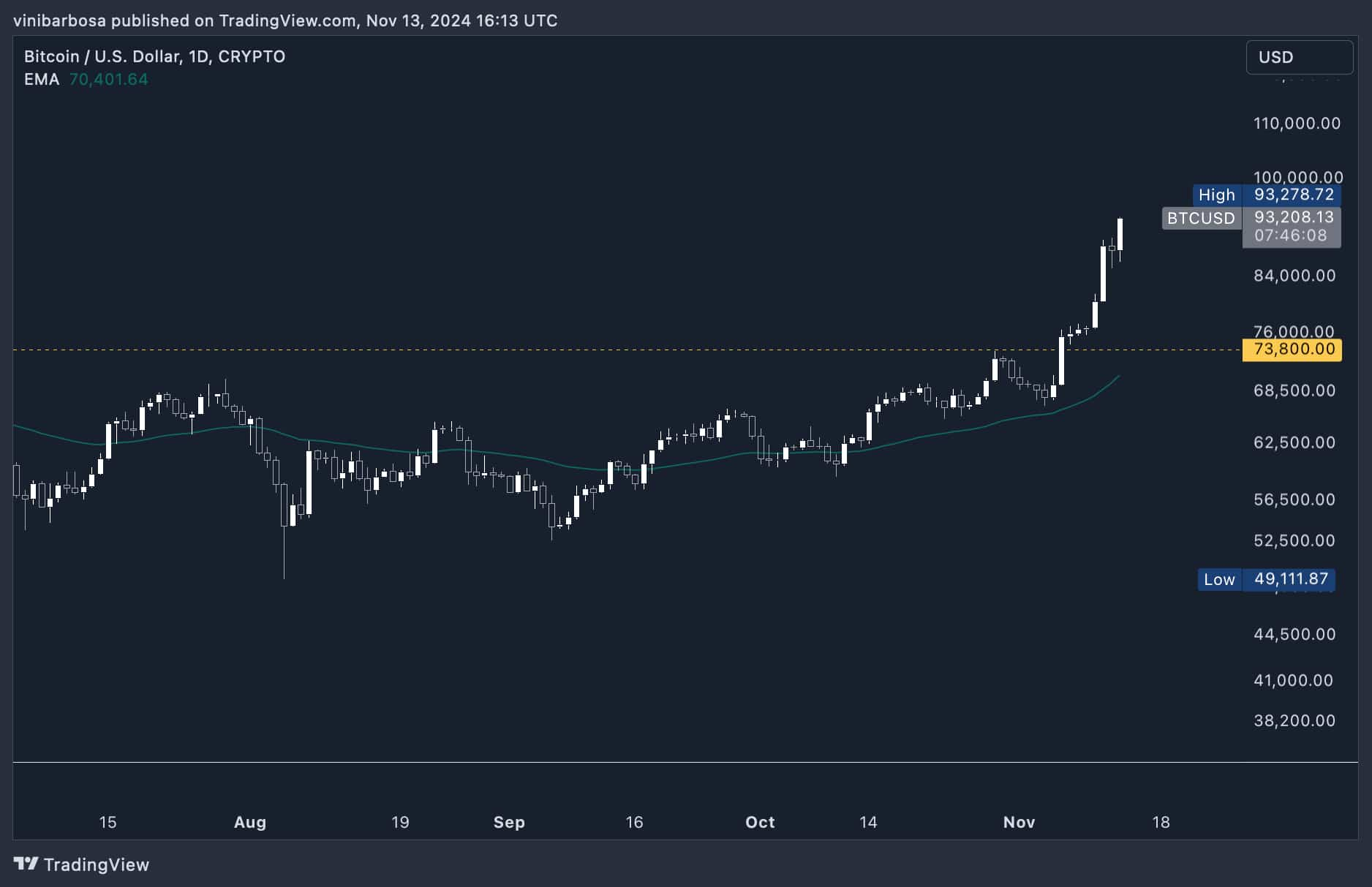

Bitcoin (BTC) and Nvidia (NVDA) inventory value evaluation

The latest value motion signifies that each technical components and market sentiment are fueling Bitcoin’s ascent. Breaking above the $73,800 resistance on November 6 triggered a bullish technical setup, propelling the worth to new heights.

As of this writing, BTC trades at $93,208, barely beneath its just lately made new all-time excessive.

On the present tempo, some analysts, together with The Kobeissi Letter, counsel that Bitcoin might attain $100,000 this week. This optimism is echoed by many within the crypto neighborhood, who imagine that the mixture of technical catalysts and favorable regulatory prospects is creating the proper storm for Bitcoin’s development to $100,000 – with a few of these analyses coated on Finbold.

Apparently, whereas Bitcoin’s market cap is now precisely half that of Nvidia’s, the tech large itself has been on an upward trajectory. Nvidia’s inventory has reached all-time highs, closing at $147.63 on November 11, with analysts revising their NVDA targets. Morgan Stanley just lately elevated Nvidia’s value goal from $150 to $160, sustaining an “Obese” ranking.

“Whereas Nvidia’s gross margins are anticipated to point out beneficial properties within the upcoming quarter, the eagerly anticipated ramp of Blackwell—Nvidia’s next-gen AI chip—might introduce some margin uncertainties,” famous Joseph Moore, Morgan Stanley’s seasoned tech analyst.

Closing ideas

Even with this exceptional development, Bitcoin stays dwarfed by gold, which remains to be ten instances bigger in market worth. Nonetheless, the hole is starting to shut. Eric Balchunas, senior ETF analyst for Bloomberg, noticed that the latest inflows into Bitcoin and Ethereum ETFs counsel a shifting notion on Wall Avenue, as Finbold reported earlier this morning.

“[The market is] trending in the fitting course. Sunny days forward, though nonetheless a number of nation miles behind BTC ETFs,” Balchunas remarked, referring to the elevated investor curiosity in Ethereum ETFs.

As Bitcoin approaches the $2 trillion mark, market watchers speculate whether or not it might finally surpass all public corporations in market worth. Whether or not this momentum will proceed stays to be seen, however one factor is obvious: Bitcoin’s function within the world monetary panorama is turning into more and more important.