It is a section from the Empire publication. To learn full editions, subscribe.

Gary Gensler. The IMF and the World Financial Discussion board. Inflation.

If crypto had been Arya Stark from Recreation of Thrones, these boogeymen would excessive up on her loss of life listing.

Why not pour gas on the fireplace?

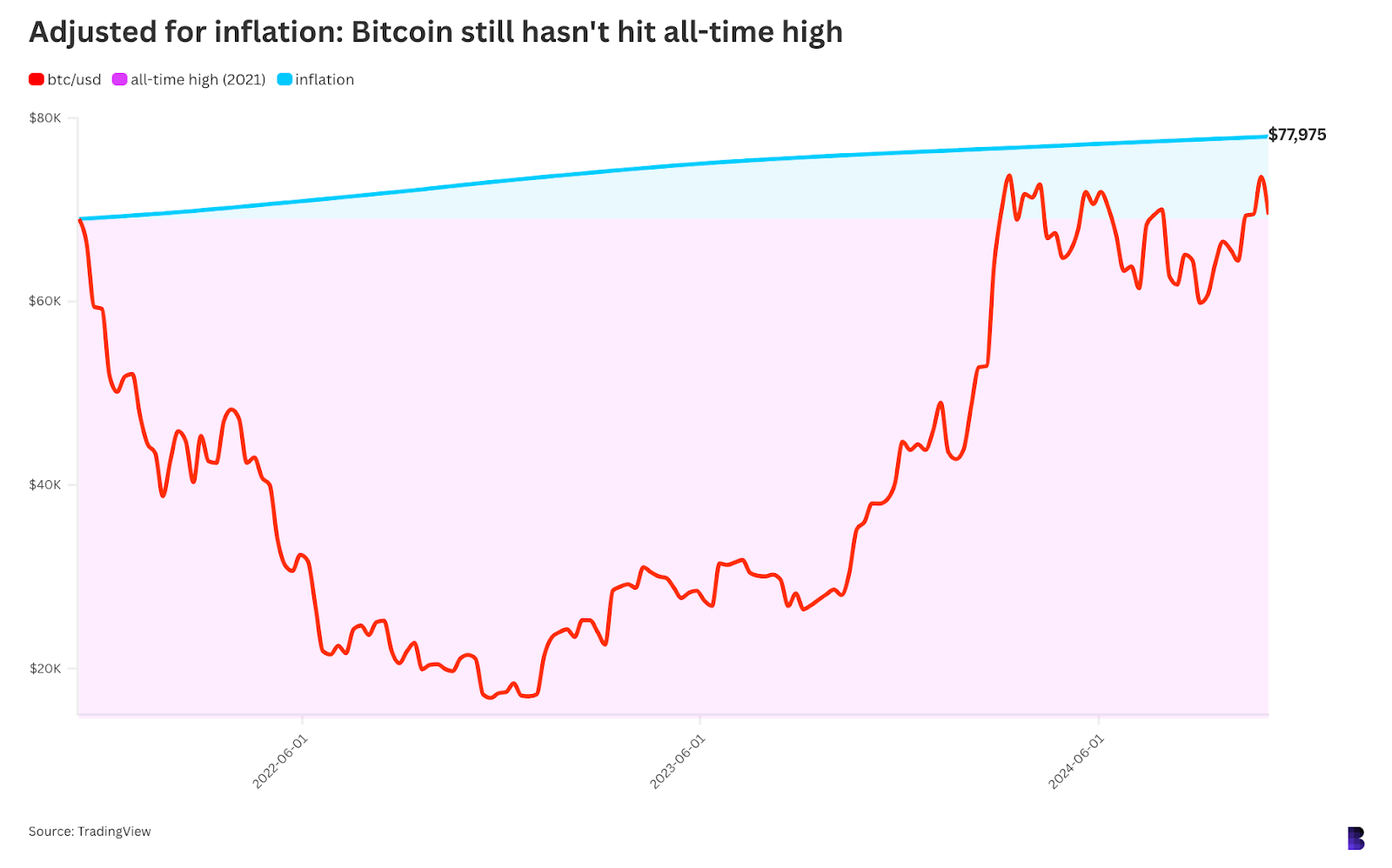

Regardless of standard perception, bitcoin has not truly returned to its all-time excessive set in November 2021, all due to inflation.

What was a bitcoin all-time excessive of $68,998 again then can be the equal of $77,975 in as we speak’s cash.

That’s 13% cumulative inflation throughout almost three years, per US shopper worth index information.

So, after adjusting for inflation, bitcoin nonetheless must rally by greater than $9,100 to interrupt that worth document — a 14% bounce.

Earlier than adjusting for inflation, bitcoin is just $4,900 away, or 6.7%.

The purple space exhibits the traditional all-time excessive whereas the blue space accounts for inflation since that peak

Inflation by no means stops, so bitcoin’s inflation-adjusted all-time excessive continues to rise as time goes on.

When bitcoin hit its native prime in March, that determine was $76,744, which implies it actually stopped about 4% quick when it peaked at $73,738.

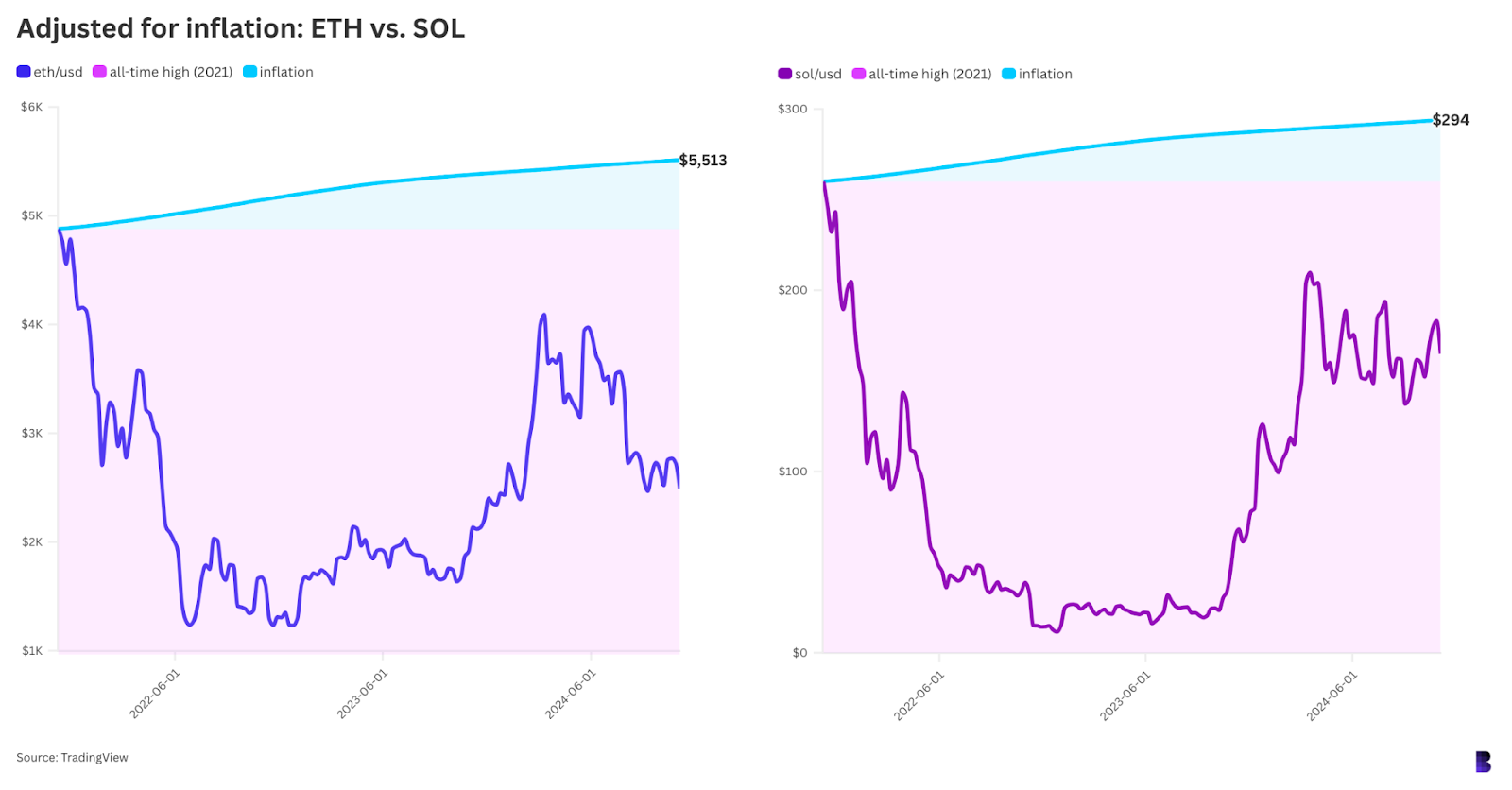

The identical goes for ether and solana. ETH at $2,490 is definitely a gut-wrenching 55% under its present inflation-adjusted worth document of $5,513.

ETH needed to have reached $5,426 to interrupt an all-time excessive in March. So, when it hit $4,090, that was truly 22% under the mark, moderately than 14%.

Proper now, SOL is in any other case 44% under its personal adjusted all-time excessive of $294, and was 28% under in March.

Inflation is right down to 2.4% however it could actually by no means undo what has been

What does all of it imply? It’s unlikely that crypto will break from the remainder of the finance world and contemplate solely inflation-adjusted costs because the true worth of property.

Though, there’s an argument to take action in periods of excessive inflation, as was the case within the years throughout and after the worst of the pandemic.

Extra critically, it’s simply additional proof that inflation actually sucks the enjoyable out of all the things — bitcoin all-time highs included.