A Bitcoin (BTC) investor, analyst, and bestselling creator has began an experiment together with his now crypto-friendly financial institution. He invested $1,100 within the 11 cryptocurrencies the financial institution made accessible to its prospects and shared the 4-month outcomes of the crypto portfolio.

The Bitcoin investor is Marco Bühler, who goes by sunnydecree on X, the place he shared how his expertise goes.

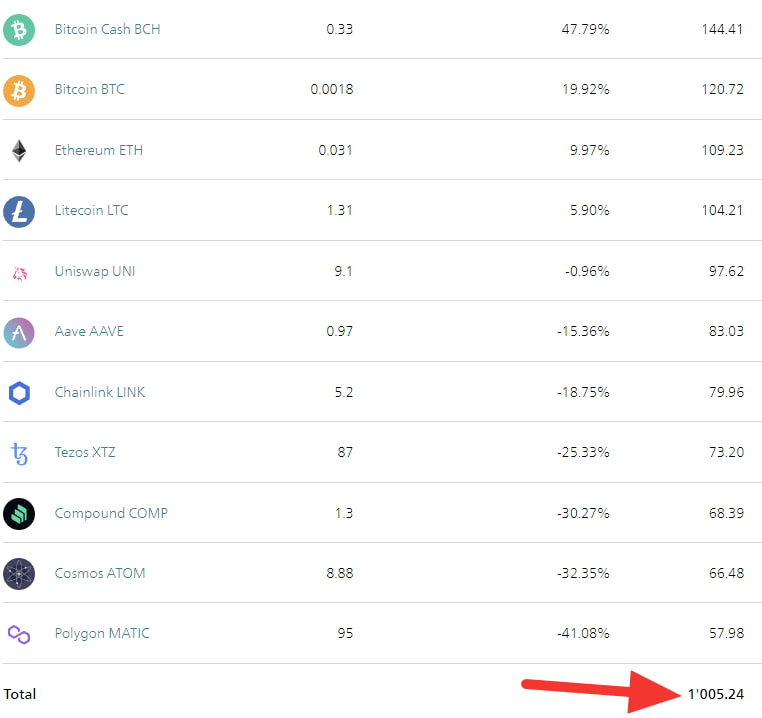

“4 months in the past, my financial institution began providing cryptocurrencies. For enjoyable, I “invested” $100 in every coin for a complete of $1,100. That is the way it’s going.”

Notably, the shared picture exhibits a crypto portfolio value $1,005.24, down $95, or 8.6%, in 4 months. Polygon (MATIC) is the largest loser, down 41%, whereas Bitcoin Money (BCH) is the highest gainer, up 47.8%.

The $1,100 crypto portfolio by a Bitcoin investor

Wanting on the crypto portfolio 4 months after the $100 buy of 11 totally different cryptocurrencies, we see the next outcome.

First, BCH, BTC, Ethereum (ETH), and Litecoin (LTC) positions are the one ones with unrealized positive aspects, totaling a $478.57 nominal worth. The highest 4 cryptocurrencies signify 36% of the property’ rely and 47.6% of the portfolio valuation by posting time.

Then, Uniswap (UNI), Aave (AAVE), Chainlink (LINK), Tezos (XTZ), Compound (COMP), Cosmos (ATOM), and MATIC full the 11-crypto choice, totaling a $526.67 nominal worth.

Curiously, the Bitcoin Money place shocked different buyers who would count on a special outcome, contemplating the cryptocurrency’s low market cap.

The experiment demonstrates the unpredictable nature of cryptocurrency investments, even over a brief interval. Whereas diversification can mitigate threat, it doesn’t assure earnings within the unstable market. In closing, the experiment means that choosing the right initiatives could possibly be a greater play than choosing all initiatives accessible.

However, buyers ought to fastidiously contemplate their threat tolerance and funding methods when venturing into cryptocurrencies.

Disclaimer: The content material on this web site shouldn’t be thought-about funding recommendation. Investing is speculative. When investing, your capital is in danger.