Analysts at ARK Make investments say that a number of on-chain indicators are at the moment reflecting optimistic market well being for Bitcoin (BTC).

In a brand new report, ARK says that BTC remains to be in a state of being oversold after large-scale promoting from the German authorities, which liquidated cash this month that it confiscated from an unlawful film streaming web site.

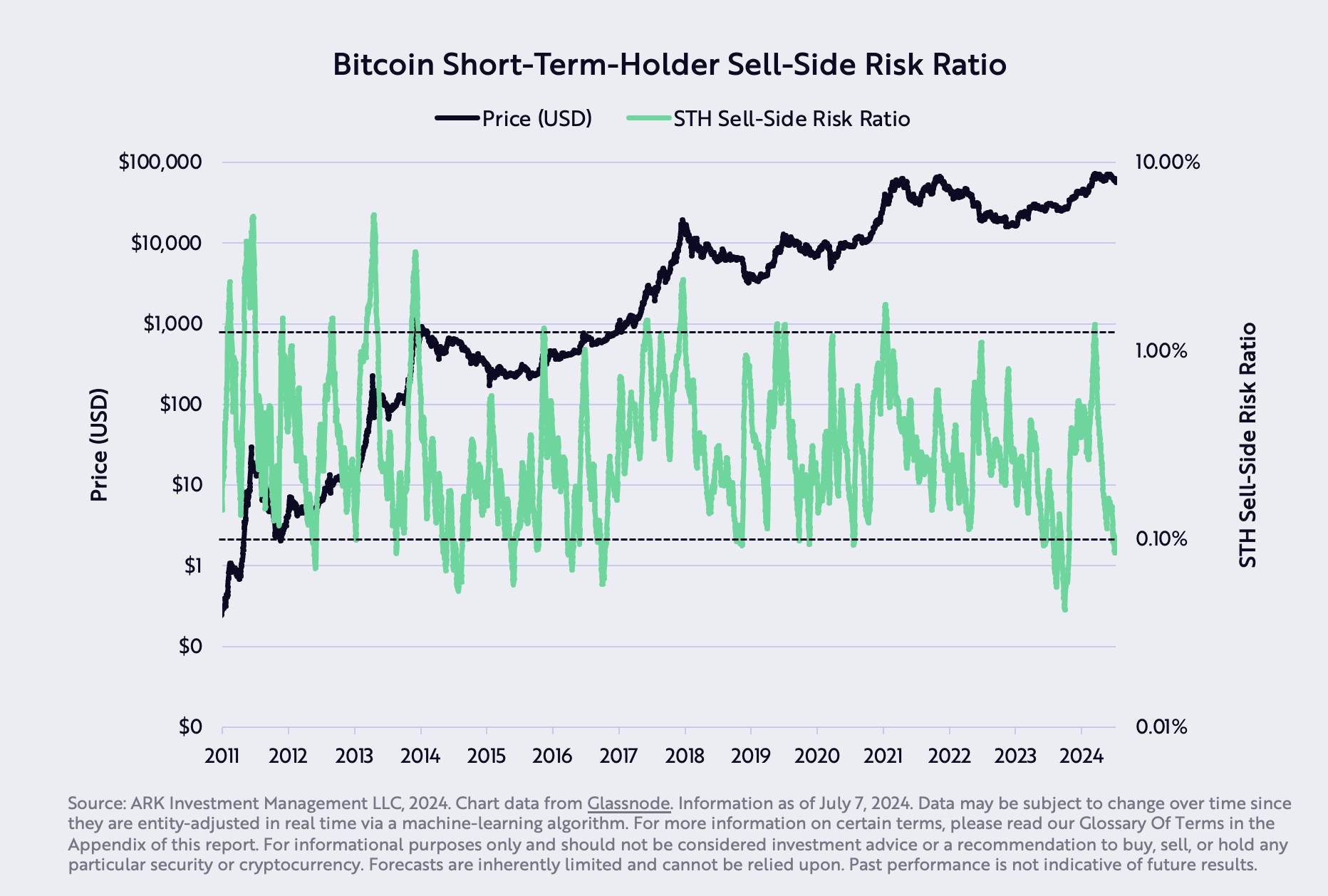

In response to ARK analyst David Puell, Bitcoin’s sell-side danger ratio for short-term holders (STHs) is now in a “deep worth” zone following the multi-month correction.

The short-term holder sell-side danger ratio indicator goals to foretell whether or not STHs are about to unload their cash and doubtlessly set off a correction.

Says Puell,

“One other metric in obvious deep worth was the sell-side danger ratio of short-term holders, printing values as oversold as in late 2023.”

Supply: David Puell/X

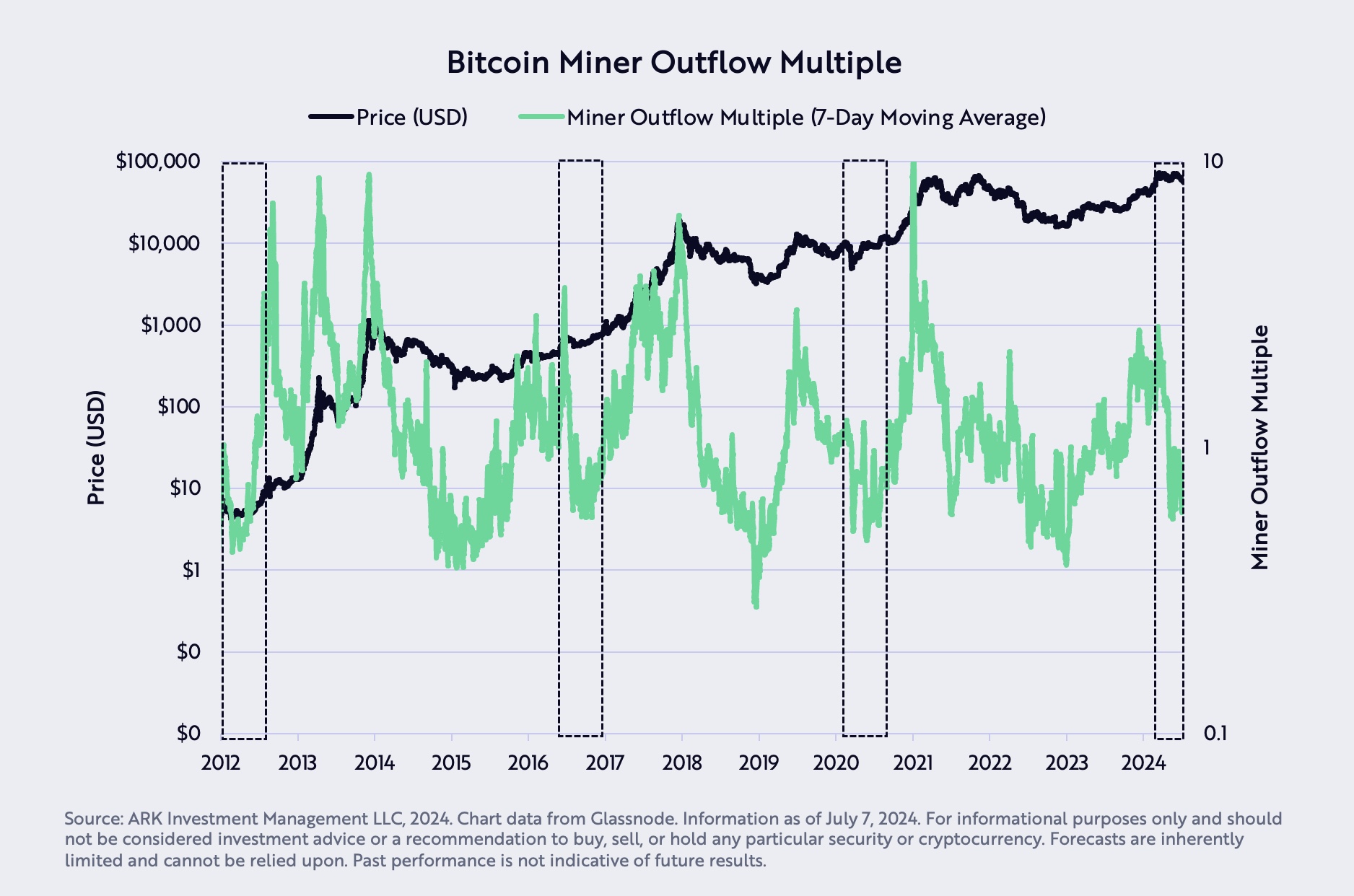

Puell additionally says that the miner outflow a number of indicator, which data intervals the place the quantity of BTC flowing out of miner addresses is excessive relative to its historic common, is now at a degree that has beforehand correlated with optimistic market strikes.

“The miner outflow a number of, used to gauge miner capitulation within the Bitcoin ecosystem, traded at 80% its yearly common, normally correlated to optimistic market reversals.”

Supply: David Puell/X

In response to Puell, ARK believes that incoming financial information will doubtless pressure the Federal Reserve to chop rates of interest and assist increase Bitcoin, opposite to the Fed’s present hawkish sentiment.

At time of writing, Bitcoin is buying and selling at $67,383.

Generated Picture: Midjourney