Bitcoin has skilled a major value surge since Tuesday, following the Federal Reserve’s announcement of a 50 bps rate of interest reduce. This transfer pushed BTC previous the important $62,000 mark, a psychological degree that has turn out to be a turning level for investor sentiment. With Bitcoin now testing native provide, market members are carefully waiting for additional upside potential.

As the worth continues to push greater, analysts are pointing to essential information indicating a possible shift in Bitcoin’s pattern after months of downtrend value motion. Glassnode metrics reveal a notable pattern change, suggesting BTC could also be getting into bullish territory as soon as once more. This resurgence is drawing elevated consideration from each retail and institutional traders as they consider whether or not Bitcoin’s rally has endurance or if the market will face resistance at greater ranges.

With renewed momentum, the approaching days will likely be important in figuring out if Bitcoin can maintain this upward trajectory and absolutely escape of its earlier bearish section.

Bitcoin Indicators A Bullish Return

Bitcoin traders have seen sentiment shift dramatically from fearful to hopeful in only a few days. Following the Federal Reserve’s charge reduce announcement on Wednesday, Bitcoin surged over 8%, breaking important ranges and testing native provide. This sudden value motion has sparked renewed optimism within the broader crypto market, giving traders hope for a recent begin after months of bearish value motion.

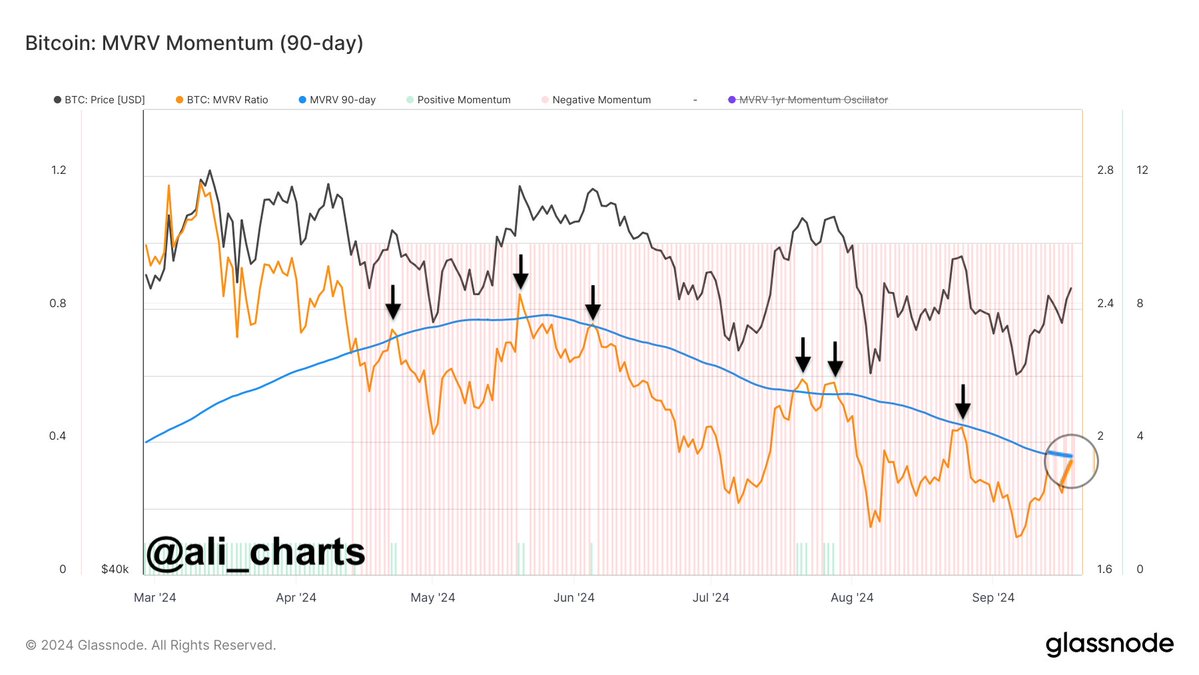

Distinguished crypto analyst Ali Martinez has shared invaluable insights on X, drawing consideration to key information from Glassnode that means a major shift in Bitcoin’s value pattern. Particularly, Ali highlights the Market Worth to Realized Worth (MVRV) ratio, which tracks the distinction between BTC’s market value and its precise worth.

The MVRV ratio, which had been in a downtrend since April, is now rising, signaling that Bitcoin could also be regaining energy. Ali notes that the MVRV is a important indicator for assessing momentum, and the present upward pattern hints at a possible return to bullish territory.

The analyst additional explains that if the MVRV can shut above its 90-day shifting common, it will affirm a stronger bullish outlook for Bitcoin. Given the aggressive value surge and the rising demand mirrored in current value motion, this state of affairs appears more and more probably. Buyers are actually watching carefully, as Bitcoin’s subsequent strikes might mark the start of a brand new bull section.

Technical Ranges To Watch

Bitcoin (BTC) is buying and selling at $63,024 after days of constant “solely up” value motion since hitting native lows. The value lately broke above the every day 200 exponential shifting common (EMA) at $59,350 and is now testing the important every day 200 shifting common (MA) at $63,954.

This every day 200 MA is a key long-term indicator, signaling total market energy. If Bitcoin can reclaim this degree as help, it will probably set off a major value surge, bolstering the bullish outlook.

For bulls to take care of momentum, the following goal could be round this important degree, with a possible push towards $65,000, a value final examined in late August. Nonetheless, ought to BTC fail to carry above $60,000 within the coming days, traders may even see a retracement to decrease demand ranges. The flexibility to remain above key help zones will decide the following section of value motion.

Featured picture from Dall-E, chart from TradingView