After present process a interval of consolidation, the value of Bitcoin (BTC) is exhibiting indicators of a restoration.

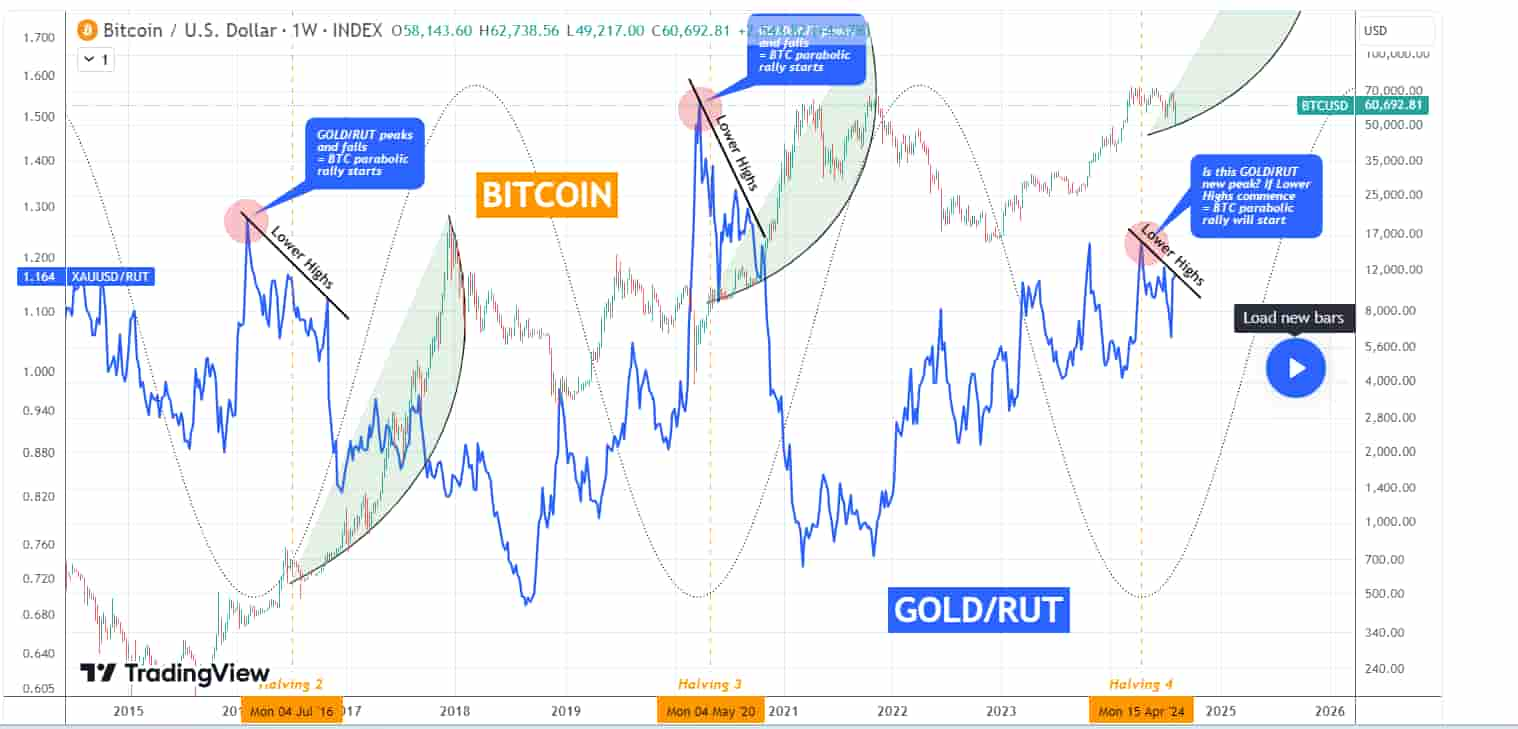

On August 9, a outstanding crypto buying and selling knowledgeable, TradingShot, shared a Bitcoin value forecast on TradingView, leveraging the ‘Golden Ratio’ correlation. This highly effective sign, derived from the connection between Bitcoin and the Gold/Russell 2000 (GOLD/RUT) ratio, has traditionally been a dependable predictor of Bitcoin’s parabolic rallies.

The ‘Golden Ratio’ correlation and its historic significance

In accordance with the evaluation, the chart sample is starting to unfold once more, suggesting {that a} substantial upward motion may very well be imminent.

The sample highlights a major correlation between Bitcoin’s value actions and the GOLD/RUT ratio, which measures the connection between Gold and the Russell 2000 Index.

Traditionally, when the GOLD/RUT ratio peaks and subsequently begins to type Decrease Highs, Bitcoin tends to enter a parabolic rally. This cyclical sample means that the GOLD/RUT ratio serves as a number one indicator for Bitcoin’s value trajectory, with every decline within the ratio doubtlessly signaling the beginning of a robust upward transfer in BTC.

After the 2016 halving, Bitcoin started a major upward transfer that culminated within the 2017 bull market, the place costs reached an all-time excessive of practically $20,000.

Equally, the 2020 halving was adopted by an much more dramatic rally, propelling Bitcoin to its earlier all-time excessive of roughly $68,000 in late 2021.

These patterns present the potential for an additional main rally if the present cycle follows the established historic precedent.

Present market evaluation and future projections

In accordance with the most recent information, the GOLD/RUT ratio might have peaked in April 2024. If the ratio now begins to type Decrease Highs, because it has achieved in earlier cycles, Bitcoin might quickly enter probably the most aggressive section of its bull cycle, characterised by a steep and speedy value improve.

Since Bitcoin’s parabolic rally may very well be imminent, an affordable short-term goal can be $80,000 to $85,000. This vary is simply above the earlier all-time excessive of $73,000 and aligns with the anticipated steep rise in the course of the aggressive section of the bull cycle.

In the long run, if the parabolic rally good points vital momentum, Bitcoin may doubtlessly attain $100,000 to $120,000 throughout this cycle. This goal relies on the historic magnitude of Bitcoin’s value actions throughout earlier parabolic phases, particularly following halving occasions.

Bitcoin value evaluation

For the time being, Bitcoin is buying and selling at $60,637, having rallied about 0.02% within the final 24 hours.

If Bitcoin follows the sample indicated by the chart, the following main value goal may vary from $80,000 to $120,000. Nevertheless, this projection depends on the GOLD/RUT ratio persevering with to type decrease highs, signaling the start of Bitcoin’s subsequent parabolic transfer.

Given the present scenario, Bitcoin is predicted to reclaim the $70,000 resistance stage, doubtlessly paving the way in which for a brand new all-time excessive. Nevertheless, it’s essential to keep in mind that previous efficiency just isn’t indicative of future efficiency, and the cryptocurrency market is extremely risky.

Traders ought to stay vigilant and take into account market circumstances and different exterior elements that might affect Bitcoin’s value trajectory.

Disclaimer: The content material on this web site shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger