Bitcoin, ether (ETH) superior 2%-3% over the previous 24 hours on robust day for cryptos.

BTC bottomed final week and may rise additional primarily based on each day cycles concept, in response to chartist Bob Loukas.

The Federal Reserve is predicted to decrease rates of interest subsequent week, however market contributors are divided on the dimensions of the minimize.

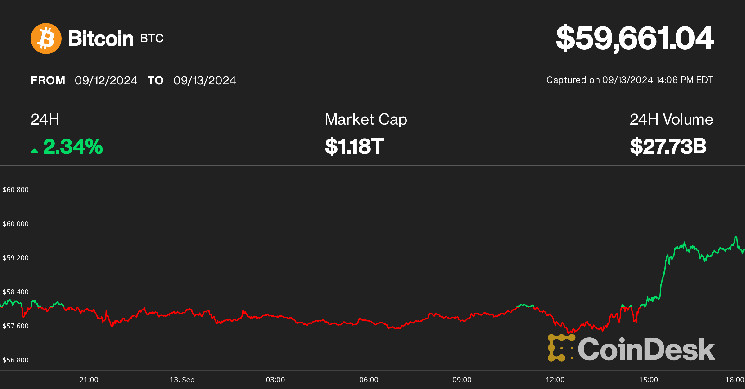

Cryptocurrencies rallied on Friday with bitcoin (BTC) nearing the $60,000 stage, buoyed by robust positive factors throughout the board on conventional markets.

Bitcoin tumbled some 1% to $57,600 earlier in the course of the day after software program firm MicroStrategy introduced the acquisition of 18,300 BTC for $1.1 billion. The most important crypto shortly recovered the losses and rose sharply later within the session, up 2.2% over the previous 24 hours at $59,700.

Ethereum’s ether (ETH) reclaimed the $2,400 stage, up 2.7% throughout the identical interval. Crypto analytics agency famous that Ethereum’s revenues from charges rose practically 60% up to now week as blockchain exercise picked up.

The broad-market benchmark CoinDesk 20 Index superior 2.5%, led by double-digit positive factors of Polygon’s native crypto (MATIC) as Binance added spot and perpetual buying and selling of the just lately upgraded POL token.

The worth motion occurred as U.S. shares climbed larger, with the S&P 500 lower than 1% away from its July file excessive just a few hours earlier than the market shut. Gold continued to interrupt file highs, hitting $2,600 per ounce for the primary time ever. A decline within the U.S. greenback towards main currencies supported the rally throughout asset courses.

Learn extra: Bitcoin’s Dilemma: Observe Gold’s Market Beating Rally or Stick With Know-how Shares?

Extra room to run

Bitcoin’s rally might have extra gas within the tank primarily based on the asset’s each day cycles evaluation, well-followed dealer and analyst Bob Loukas famous. Cycles concept in technical evaluation argues that costs transfer in waves and have sure periodicity between native peaks and troughs.

In response to a chart shared on X, bitcoin seemingly discovered an area backside under $53,000 on September 6 and is barely on its seventh day in a recent cycle. The earlier each day cycle lasted over sixty days and topped on the twenty fourth day, leaving loads of time for BTC to make information highs earlier than rolling over.

“These cycles have time left ought to stay robust into FOMC,” Loukas stated.

Subsequent week’s key occasion to observe will probably be Wednesday’s Federal Open Market Committee (FOMC) assembly, which is able to most definitely mark the Federal Reserve’s first rate of interest minimize since 2020. Observers are nonetheless divided concerning the dimension of the minimize, with chances nearly evenly cut up between a 25 foundation level and a bigger, 50 bps minimize, in response to CME FedWatch Device.

Regardless of the prospect of looser financial coverage, which might in concept be useful to threat property, lingering issues of a forthcoming recession weigh in the marketplace, crypto funding agency Ryze Labs stated in a Friday report.

“The important thing variable right here is the state of the U.S. economic system,” the report stated. “If it stays resilient and avoids a recession, threat property are more likely to proceed their upward trajectory. If not, then we’re in for a bumpy experience,” the report added.