Bitwise CIO Matt Hougan highlighted a notable improve in institutional investments in Bitcoin exchange-traded funds (ETFs) in the course of the second quarter regardless of BTC worth declining 12% over the three months.

Hougan highlighted the elevated curiosity in his newest Aug. 20 word to traders, the place he said:

“Bitcoin’s worth fell 12% in Q2 2024 and lots of puzzled if that might spook establishments out of the market. The reply was a powerful ‘no.’”

Historic adoption fee

Hougan emphasised that institutional adoption of Bitcoin ETFs is happening at an unprecedented tempo.

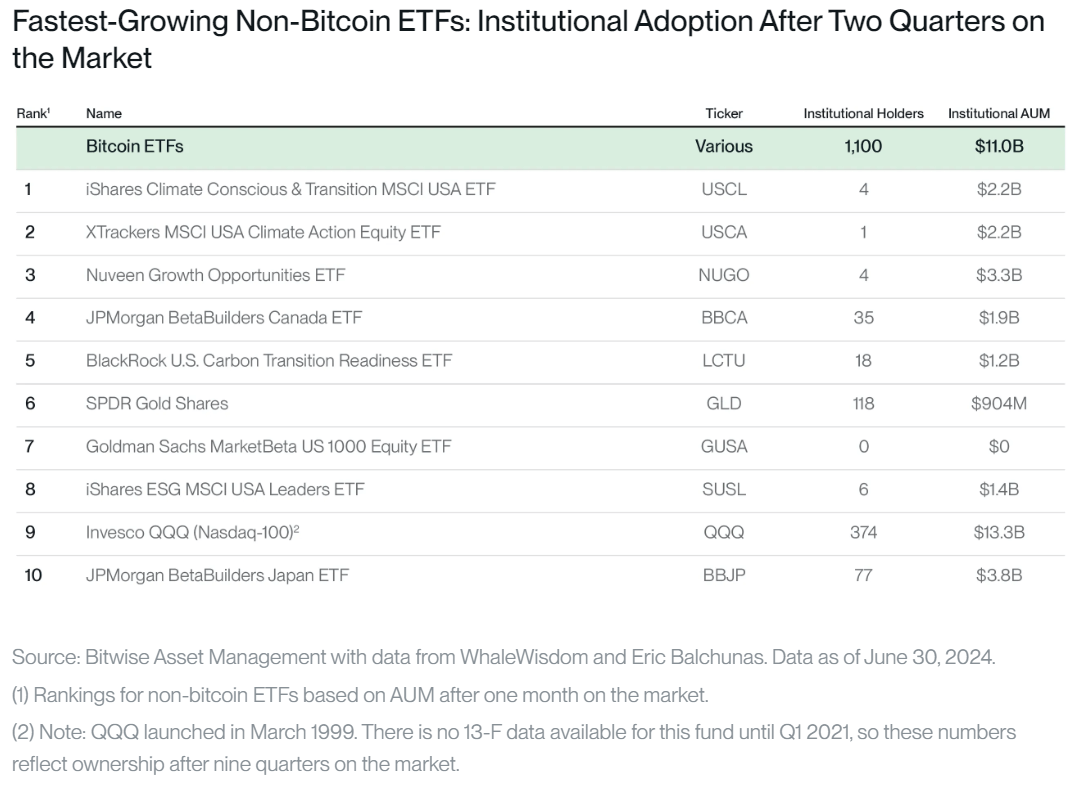

In accordance with him, the variety of institutional traders holding Bitcoin ETFs grew by 14% quarter-over-quarter, rising to 1,100 from 965. These traders now management 21.15% of the whole belongings beneath administration (AUM) in Bitcoin ETFs, up from 18.74%. By the top of Q2, institutional holdings in Bitcoin ETFs totaled $11 billion.

Regardless of 112 traders exiting their Bitcoin ETF positions throughout Q2, 247 new corporations entered the market, leading to a internet addition of 135 institutional traders.

Hougan famous that the extent of adoption of Bitcoin ETFs is similar to the early development of Invesco’s QQQ ETF, which launched in March 1999. Notably, the BTC ETFs have attracted 3x as many institutional consumers inside simply two quarters.

Hougan addressed considerations about evaluating Bitcoin ETFs as a gaggle to particular person ETFs, stating that particular person Bitcoin ETFs nonetheless dominate. For instance, Bitwise’s Bitcoin ETF — ranked fourth by AUM on the finish of June — had extra institutional holders (139) than SPDR’s GLD ETF (118) on the identical stage in its growth.

Contemplating these numbers, Hougan concluded:

“We shouldn’t let the historic adoption of Bitcoin ETFs by retail traders obscure the actual fact that also they are gaining institutional traction sooner than every other ETF in historical past.”

Portfolio growth

The Bitwise CIO predicted that institutional publicity to the flagship digital asset would improve over time.

In accordance with him, whereas the median institutional investor at the moment allocates solely 0.47% of their portfolio to Bitcoin, this determine may exceed 1% inside a yr. He defined that skilled traders are inclined to progressively improve their crypto publicity, typically beginning with 1% or much less however ultimately elevating it to 2.5% and even 5% over time.

Hougan added:

“Yr 1 is usually a problem, however momentum tends to construct into Years 2, 3, 4, and 5. I count on the identical factor to occur right here.”

Talked about on this article