Bitcoin exchange-traded funds (ETF) within the US skilled a big week of outflows, which is seen by Bitfinex analysts as an area backside for crypto. A complete of $544.1 million left the funds in what was highlighted within the “Bitfinex Alpha” report as “a mixture of foundation/funding arbitrage unwinding, on account of adverse funding charges, and traders’ reactions to short-term adverse information.”

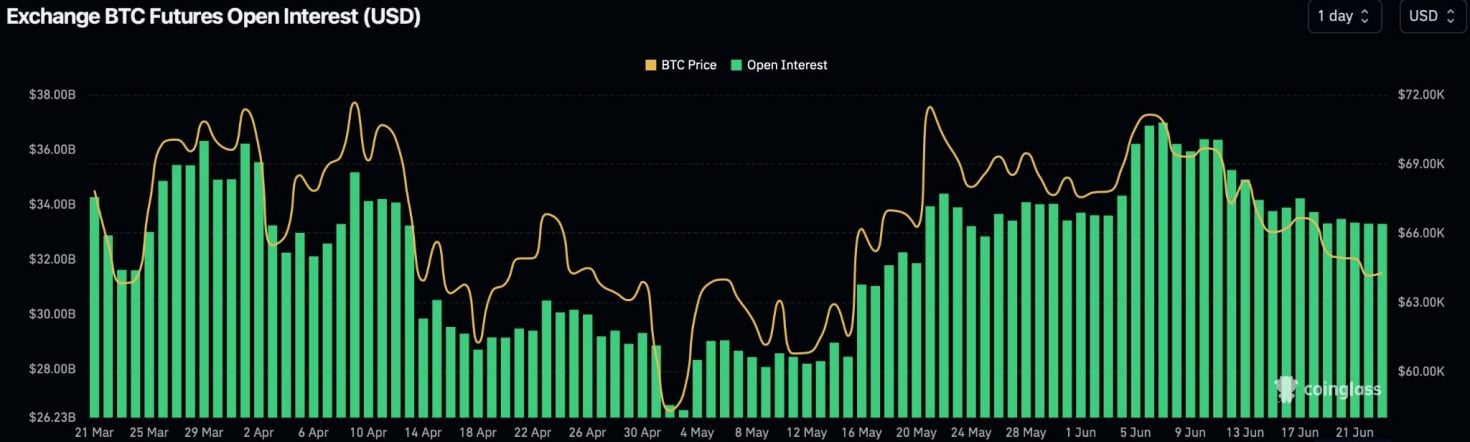

Moreover, aggregated Bitcoin (BTC) open curiosity additionally fell by over $450 million, with whole BTC futures open curiosity now at $33.3 billion, down from the June seventh excessive of almost $37 billion.

These actions align with adverse funding charges seen throughout exchanges, suggesting a considerable unwinding of funding arbitrage trades linked to ETF flows. Nonetheless, Bitfinex cautions that not all ETF outflows instantly translate to identify promoting. Historic knowledge signifies that ETF outflows usually precede the formation of native bottoms in BTC worth, a sample that appears to be repeating.

Regardless of a big BTC sale by the German authorities and a broader market downturn, MicroStrategy’s current buy of 11,931 BTC for $786 million offered some counterbalance.

Market volatility patterns proceed to supply potential indicators for market turns, with Thursdays and Fridays exhibiting probably the most vital worth actions. The current “triple witching” occasion in US inventory markets additionally contributed to the volatility, affecting crypto belongings on account of their correlation with the S&P 500.

Furthermore, the report highlights the stoop in crypto’s whole market cap final week, falling to a low of $2.17 trillion.

The US Greenback Index (DXY) reached a 50-day excessive of 105.8, indicating a shift away from currencies just like the euro, British pound, and Swiss franc. Notably, the DXY has a reverse correlation with BTC, and this motion is adverse for crypto typically.