- Crypto belongings have sustained greater than $313 million in liquidations on Tuesday.

- Ethereum liquidations ranked highest after crossing $100 million.

- Bitcoin’s open curiosity dropped by $2.4 billion following the worth correction.

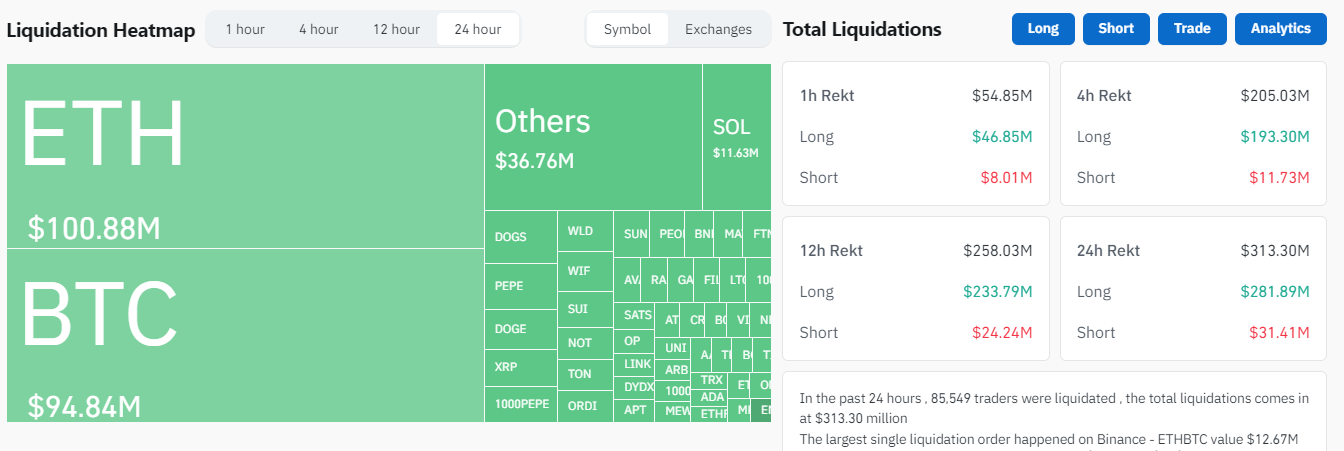

The crypto market skilled over $313 million in liquidations on Tuesday after Bitcoin plunged under $60K, per Coinglass information. Lengthy merchants have sustained 90% of the entire liquidations value $282 million, a magnitude above $31.36 million briefly liquidations.

Bitcoin and Ethereum lead crypto liquidations

Ethereum led the liquidations rank, with over $100 million, of which $93.52 million had been liquidated lengthy positions. Ethereum has plunged by almost 9% up to now 24 hours.

Crypto market liquidations

Bitcoin follows intently with over $94 million in liquidations, with lengthy and brief liquidations accounting for $85.97 million and $8.87 million, respectively. Notably, Bitcoin’s open curiosity (OI) has dropped by greater than $2.4 billion up to now few hours.

Open curiosity is the entire variety of unsettled open lengthy and brief positions out there. A drop in open curiosity signifies elevated liquidations or warning from merchants, usually attributable to declining costs.

The correction follows a spike in Bitcoin’s funding fee on August 25, which reached its highest degree on the DyDx alternate since BTC’s all-time excessive in March, in response to Santiment information.

Funding charges are periodic funds exchanged between consumers and sellers of crypto perpetual contracts primarily based on the distinction between the futures contracts and its index value.

Bitcoin DyDx Funding charges

A number of merchants more and more opened lengthy Bitcoin and Ethereum positions after the Federal Reserve (Fed) Chair Jerome Powell’s keynote indicated a possible rate of interest minimize in September. Nonetheless, the latest liquidation reveals the market moved in the wrong way.

“When funding charges get excessive in both path, they’re at all times liable to get liquidated and shoot markets in the wrong way,” famous Santiment analysts.

Solana was additionally closely hit, down greater than 7% on the day. Previously 24 hours, SOL has seen over $11 million in liquidations, with lengthy and brief liquidations accounting for $10.17 million and $1.01 million, respectively.