Bitcoin not too long ago broke the $67,000 mark, hitting a excessive of $67,264 earlier than sliding again to $66,915. This surge exhibits a significant resistance degree at $67,000, however the drop in promoting strain hints at a bullish development.

Let’s dig in.

The Ichimoku Cloud exhibits Bitcoin buying and selling inside its boundaries, that means the market has consolidated. There’s the potential for both an upward or downward breakout.

The conversion line is above the baseline, suggesting bullish momentum. But, the cloud forward mixes alerts. It exhibits fast assist at its decrease boundary of $66,704 and resistance on the higher boundary of $67,005

The 50-period shifting common is at $66,704.69, whereas the 200-period MA is at $65,615. The value staying above these MAs additionally signifies a bullish market. The OBV indicator stands at 8.726K.

This decline means shopping for strain has stabilized somewhat, and it occurs when there may be profit-taking or a short pause in a bull run. To substantiate continued upward motion, an increase in OBV could be mandatory.

The MACD although tells a unique story, with its line at 35.76, whereas the sign line is at 42.19. The histogram is adverse, exhibiting a worth of -6.44. It is a bearish crossover, so the bears are nonetheless round and will get highly effective.

Bitcoin’s latest attempt to cross $67,000 confronted promoting strain, exhibiting robust resistance. The value above key shifting averages and throughout the Ichimoku Cloud factors to potential consolidation earlier than a decisive transfer.

Assist ranges are clear at $66,704 (50 MA and cloud decrease boundary) and stronger assist at $65,615 (200 MA). Speedy resistance stands at $67,005 (cloud higher boundary) and a significant resistance round $67,000.

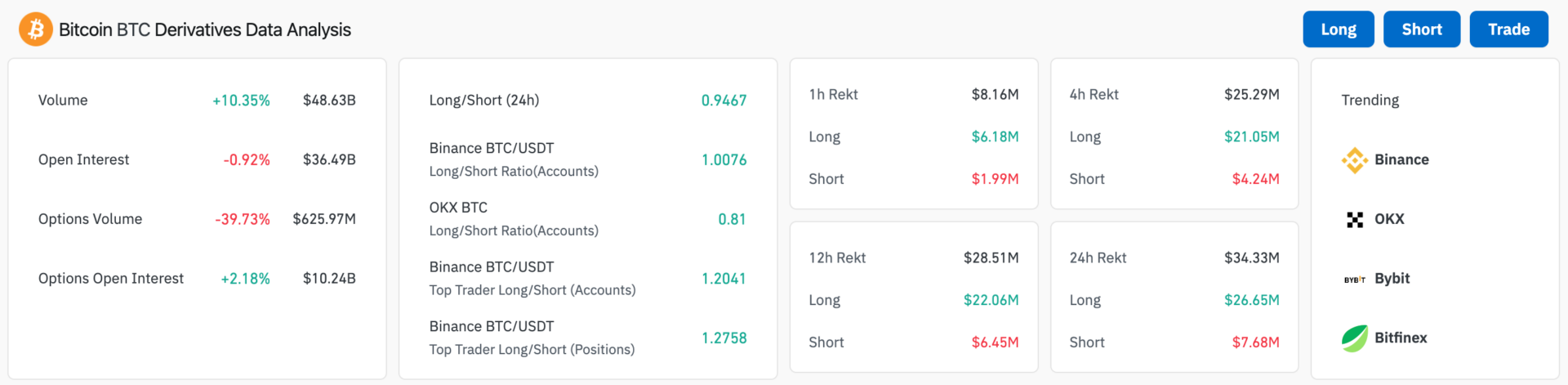

The buying and selling quantity for Bitcoin derivatives has spiked by 10.35%, reaching $48.6 billion. This enhance exhibits heightened buying and selling exercise and curiosity in Bitcoin derivatives.

Nevertheless, open curiosity has decreased barely by 0.92%, standing at $36.49 billion. Which means that new positions are being opened, however current positions are being closed at the next fee.

The lengthy/brief ratios present a snapshot of market sentiment. The general lengthy/brief ratio for the final 24 hours is 0.9467, exhibiting a slight tilt in direction of brief positions.

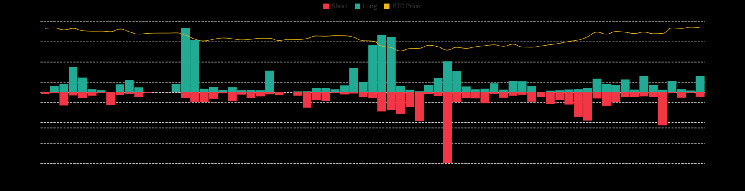

Liquidations have been large. Previously hour, complete liquidations have been $8.16 million, with $6.18 million in lengthy positions and $1.99 million in brief positions.

During the last 4 hours, complete liquidations are $25.29 million, with $21.05 million in lengthy positions and $4.24 million in brief positions.

Previously 12 hours, liquidations stand at $28.51 million, with $22.06 million in lengthy positions and $6.45 million in brief positions.

The whole liquidations prior to now 24 hours are $34.33 million, with $26.65 million in lengthy positions and $7.68 million in brief positions.