BTC broke via the $97,500 barrier earlier at this time amid sustained curiosity from institutional traders akin to Technique and Metaplanet, regardless of decrease buying and selling quantity.

Institutional Curiosity Stays Excessive as Bitcoin Climbs to $97.5K

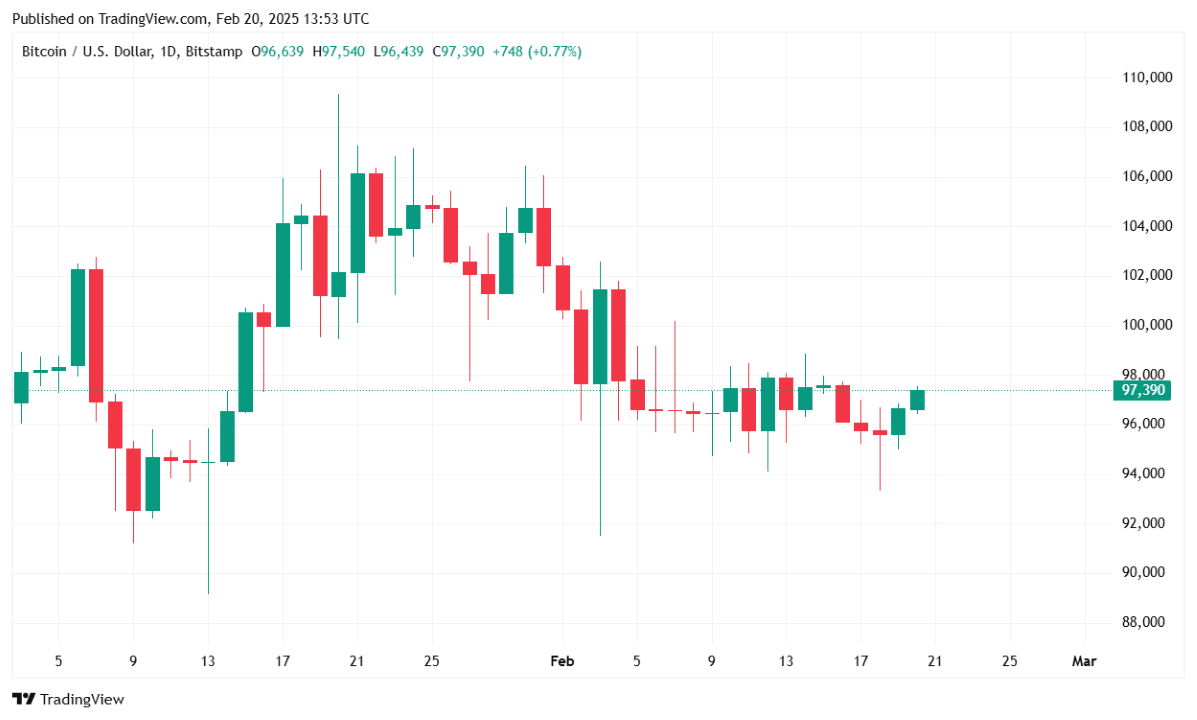

Bitcoin (BTC) continues its cautious upward climb, reaching $97,414.42 on the time of reporting. This marks a 1.17% enhance over the previous 24 hours and a 1.45% achieve over the previous week. The cryptocurrency has traded inside a 24-hour vary of $95,412.89 to $97,552.58, reflecting reasonable bullish momentum regardless of broader market stagnation.

(BTC value / Buying and selling View)

Buying and selling Quantity Drops, However Futures Exercise Climbs

Whereas BTC’s value noticed a gradual rise, its 24-hour buying and selling quantity fell 28.25% to $27.26 billion. This decline suggests lowered market participation or a short lived pause in buying and selling exercise. Nonetheless, regardless of decrease quantity, bitcoin’s complete market capitalization edged up 1.22% to $1.93 trillion, reinforcing its stability amid market uncertainty.

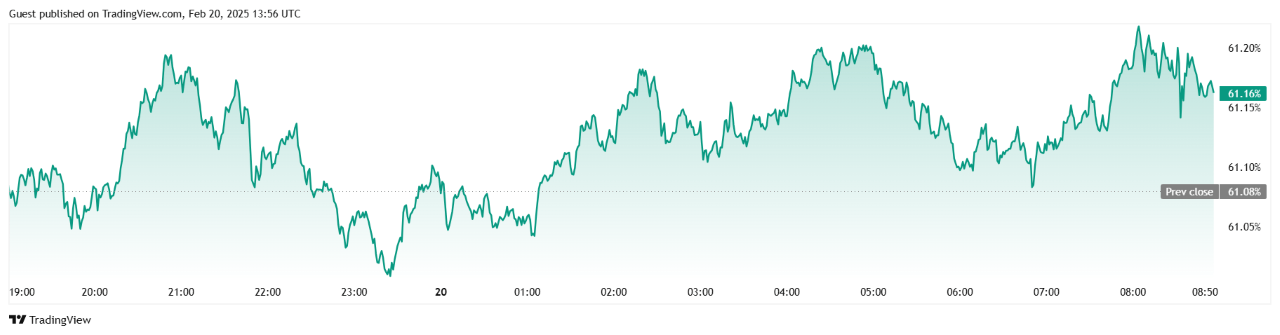

Bitcoin Dominance Bumps Up

In the meantime, BTC dominance ticked up barely by 0.15% to 61.17%, based on Buying and selling View, suggesting that traders stay extra assured in bitcoin than different cryptocurrencies.

(BTC dominance / Buying and selling View)

Futures Open Curiosity Jumps, Liquidations Favor Shorts

One notable shift in market conduct comes from the futures market. Bitcoin futures open curiosity noticed a big 2.84% enhance over the previous 24 hours, rising to $63.53 billion, based on Coinglass. This implies that merchants are inserting extra leveraged bets on BTC’s subsequent transfer, probably in anticipation of a breakout past the $97,500 stage.

Liquidation information exhibits a complete of $22.24 million worn out previously 24 hours. Notably, brief liquidations accounted for $14.94 million, whereas lengthy liquidations got here in at simply $7.30 million. This imbalance signifies that bearish merchants have been caught off guard by BTC’s newest value appreciation.

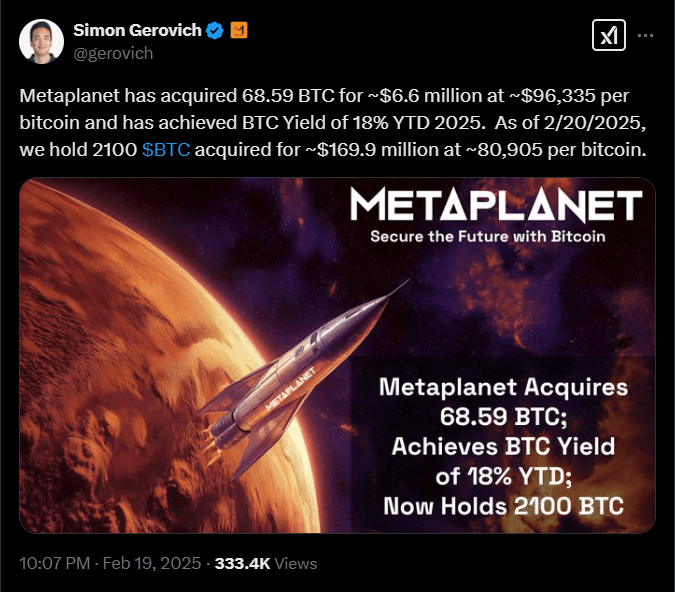

Institutional Shopping for Helps BTC’s Climb

Institutional exercise has performed a key function in bitcoin’s current value motion. Japanese resort developer-turned-bitcoin treasury agency Metaplanet introduced the acquisition of 68.59 BTC yesterday for about $6.6 million, at a median value of $96,335 per bitcoin. This buy brings Metaplanet’s complete BTC holdings to 2,100 BTC, acquired for about $170 million at a median value of about $80,905 per bitcoin, based on the agency.

(Metaplanet CEO Simon Gerovich proclaims bitcoin buy / Simon Gerovich on X)

Moreover, Michael Saylor’s Technique introduced a proposed $2 billion personal providing of convertible senior notes yesterday, with proceeds earmarked for additional bitcoin acquisitions. Technique stays the world’s largest company holder of BTC, and its continued funding alerts long-term confidence in bitcoin’s potential.

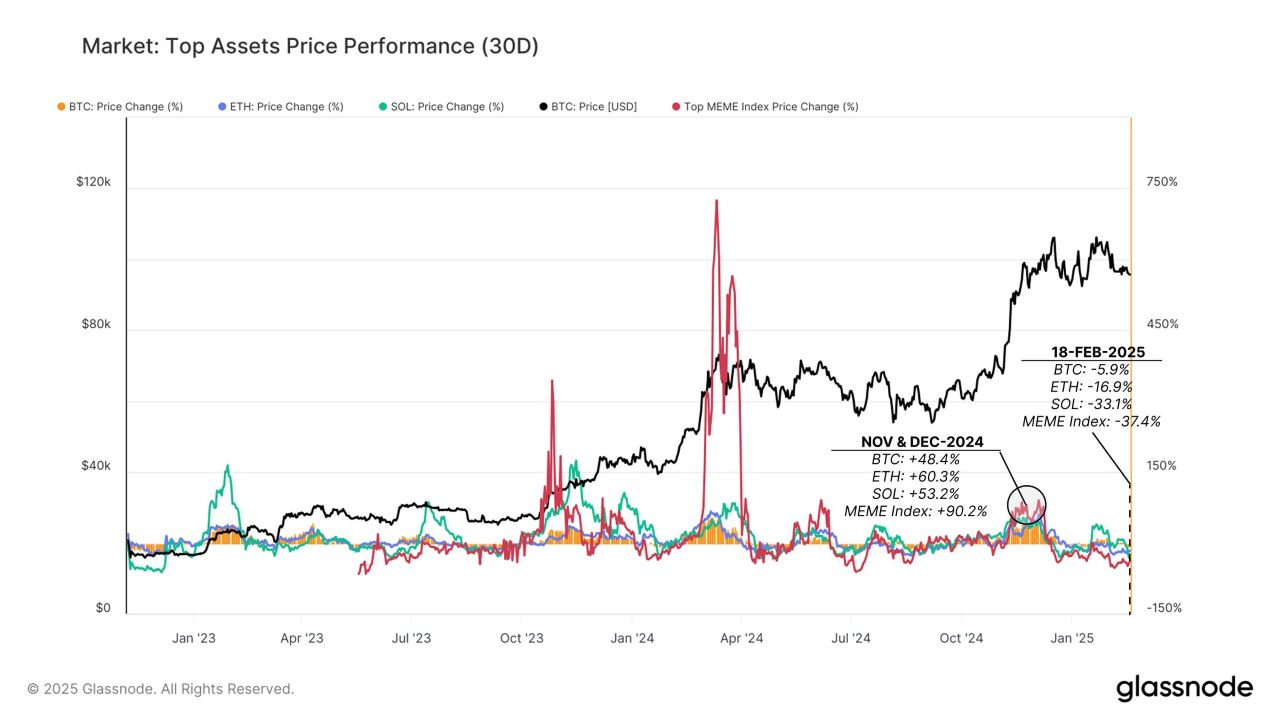

Market Momentum Stalls Regardless of BTC Energy

In accordance with information from Glassnode, whereas bitcoin has touched $97,500 at this time, general crypto market momentum has slowed. Since February, BTC has declined by 5.9%, whereas ether (ETH) and solana (SOL) have suffered deeper corrections of 16.9% and 33.1%, respectively. The sharpest decline has been within the memecoin sector, which peaked at 90.2% in late 2024 however has since dropped by 37.4%.

(BTC value efficiency vs. altcoins / Glassnode)

Bitcoin Market Outlook

Regardless of the broader market slowdown, bitcoin continues to show relative resilience, buoyed by institutional assist and elevated futures market exercise. Nonetheless, for BTC to interrupt out decisively, it might want to surpass the $97,500 resistance stage convincingly. On the draw back, assist stays at $95,000, which may present a vital ground if the value retraces.