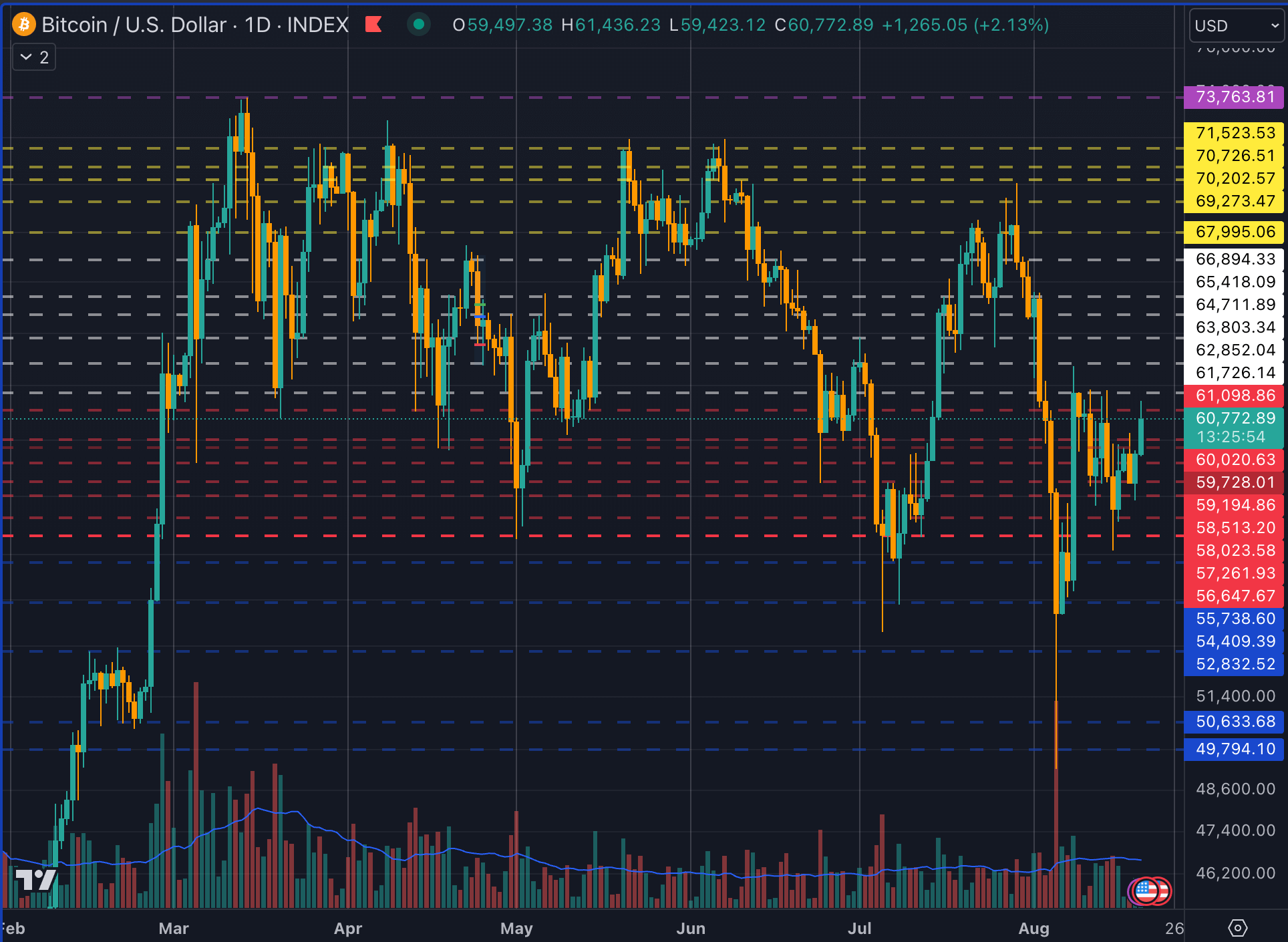

By evaluation of Bitcoin futures leverage, spot market order books, and psychological buying and selling ranges, I created a set of channels which have proved surprisingly resilient over the previous six months.

I’ve not day traded crypto since 2021, focusing as an alternative on greenback value averaging into Bitcoin day by day. The elimination of the emotional facet of buying and selling allowed me to give attention to the information with out projecting my private emotions into trades and evaluation.

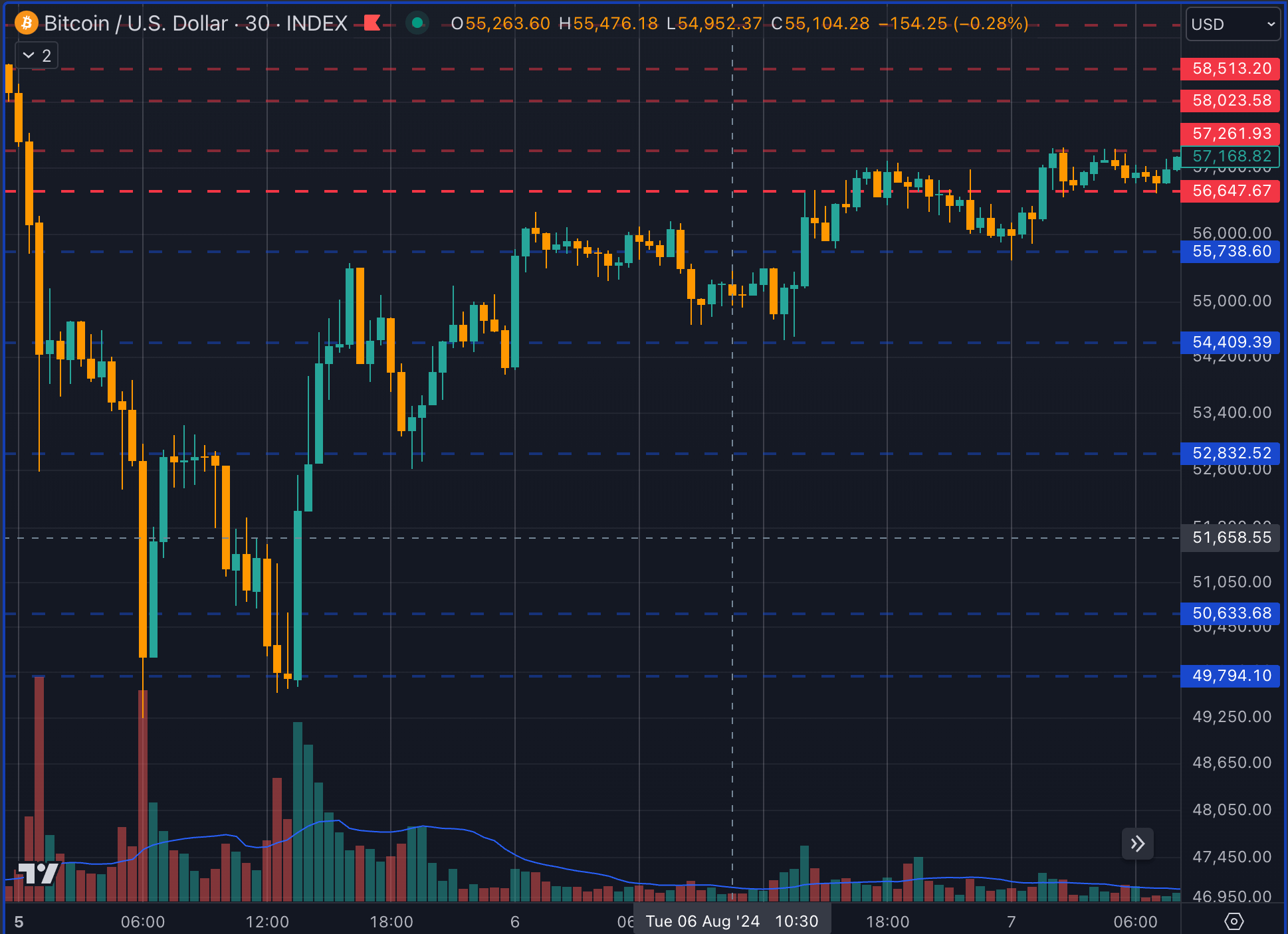

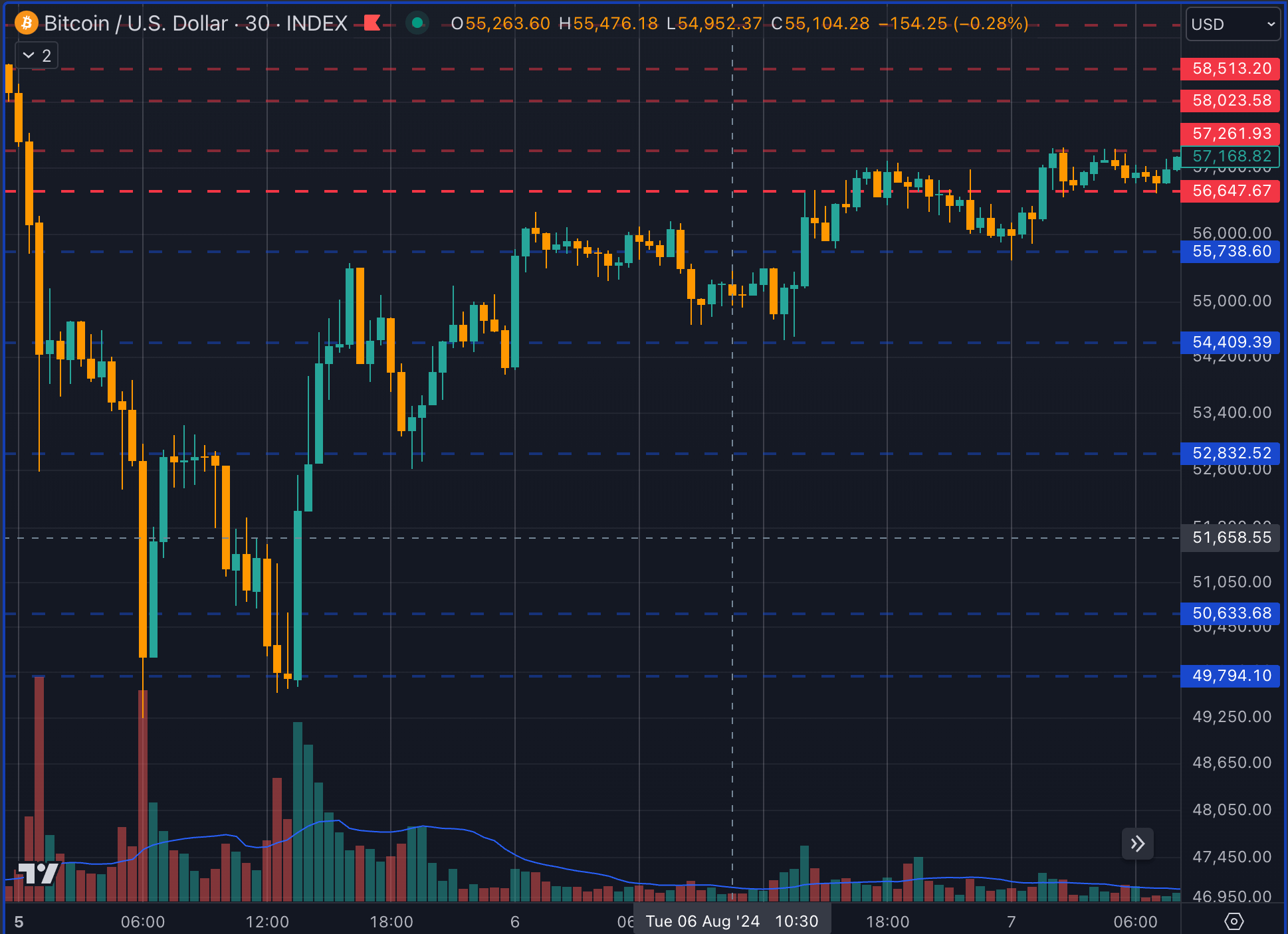

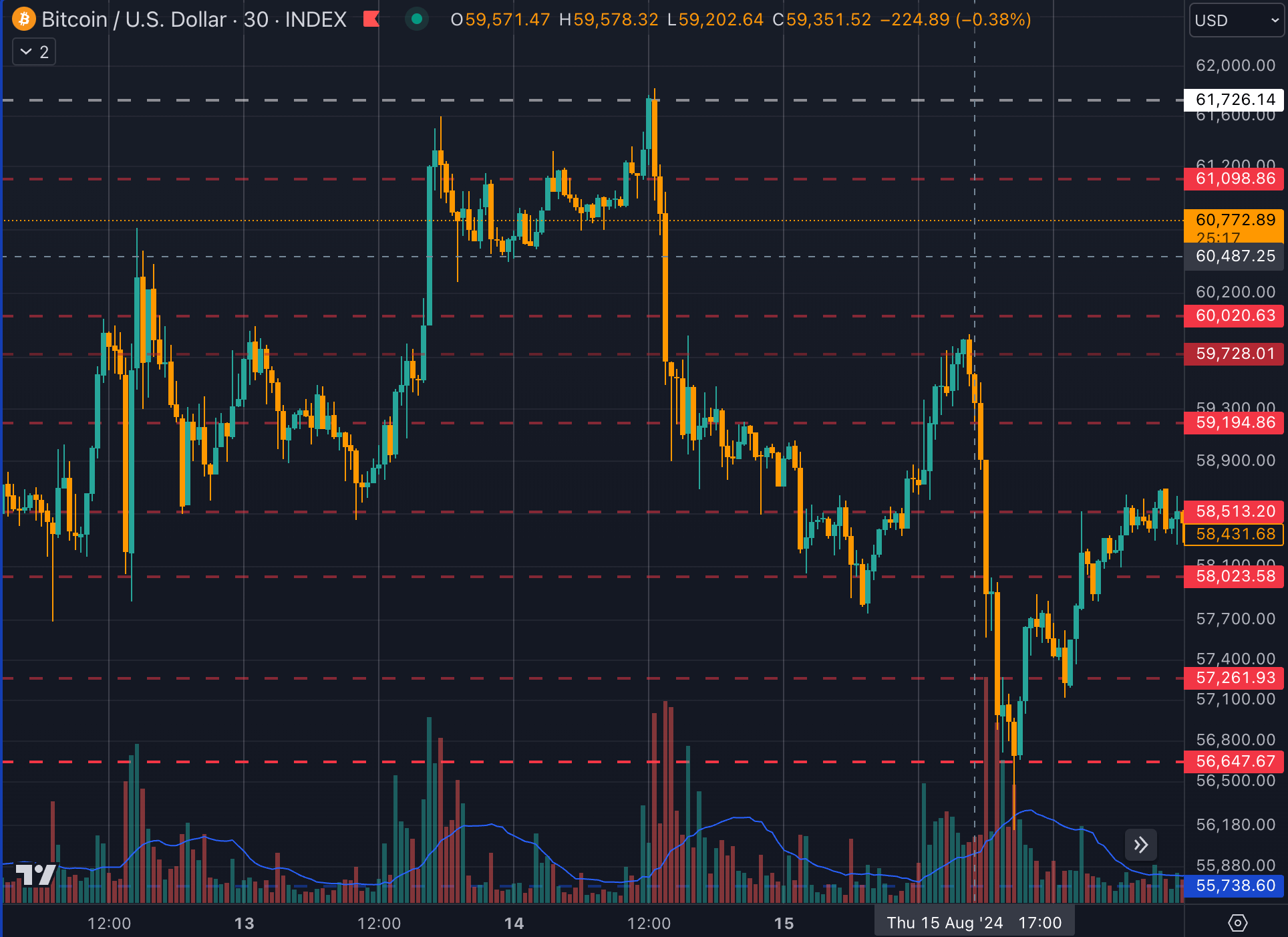

Trying solely on the 30-minute worth chart for Bitcoin, I drew horizontal strains in response to repeating shut costs to establish the place merchants could also be trying to place stop-losses. I then in contrast these ranges to Coinglass’s liquidation ranges to see which aligned with excessive leverage. Lastly, I reviewed the Binance spot market order e book to research the place massive purchase and promote orders had been positioned exterior the present mid-price.

Based mostly on this seemingly easy evaluation, I created 4 channels all through February and March to not predict the market however to establish the place we may anticipate assist and resistance. Over the previous six months, these channels have matched native backside and tops a number of occasions.

Additional, Bitcoin’s drop to $49,000 lined up completely with the final line of my backside channel. I postulated {that a} fall under this worth would open up new cheaper price discovery, opening up the potential for new decrease costs. Nevertheless, Bitcoin bounced off the underside channel earlier than hitting resistance on the high of the channel.

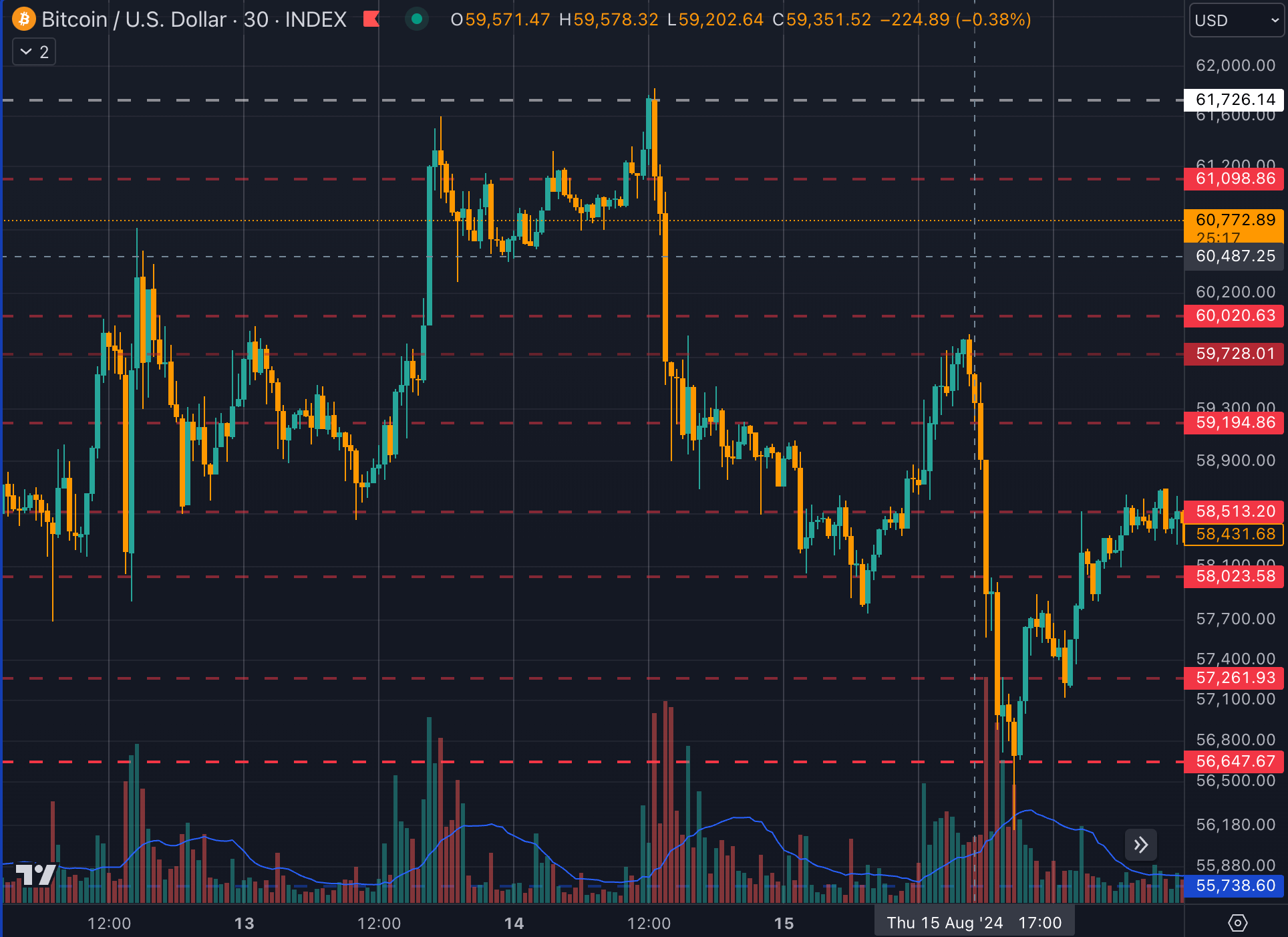

Between Aug. 12 and Aug. 16, Bitcoin bounced off the underside of the white channel earlier than falling to the underside of the pink channel, the place it once more discovered assist.

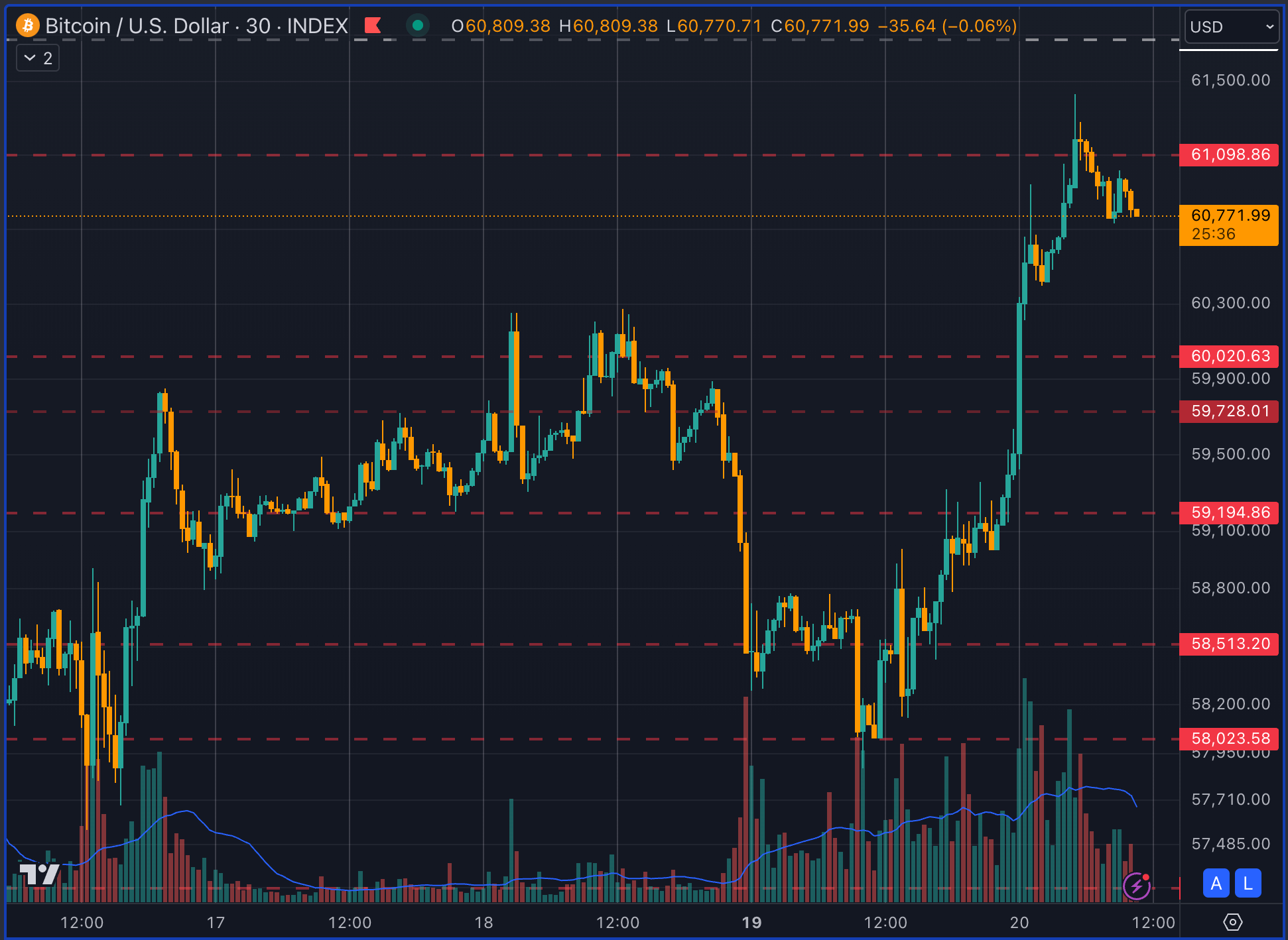

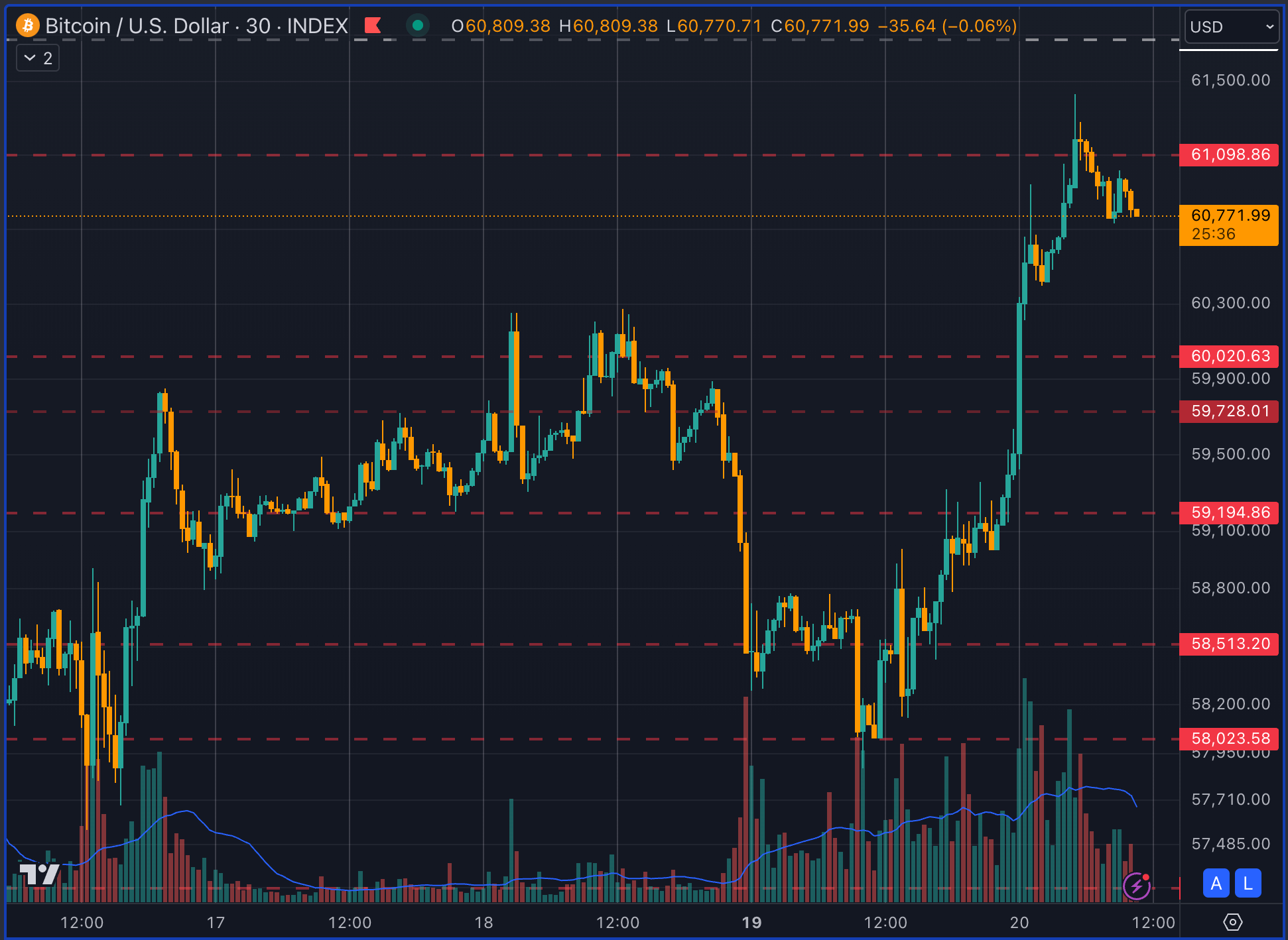

At present, Bitcoin has proven power, rebounding to the highest of the pink space, which is the second backside channel within the evaluation. Bitcoin depraved above the pink, threatening to enter the white earlier than failing a retest of the highest of the channel at $61k, probably returning to the subsequent stage at $60k.

Whereas I don’t imagine in buying and selling utilizing technical evaluation, many others do. Consequently, I see the worth in figuring out areas whereby different merchants will place orders to estimate the place to anticipate market reversals. In the end, charting is just a minor think about figuring out Bitcoin worth alongside regulation, geopolitical occasions, the financial local weather, social sentiment, and on-chain transactions.

I don’t declare to have the ability to predict Bitcoin costs day by day. Nevertheless, these channels have been extremely influential in figuring out how a lot strain Bitcoin must go sure worth ranges, both up or down.

As an illustration, at current, sizeable Bitcoin FUD brought on by establishments shifting massive quantities of Bitcoin on-chain will want appreciable social sentiment strain to tug Bitcoin under $56.6k. Likewise, bullish sentiment brought on by slicing charges or rising market liquidity would should be substantial to push by means of $66.8k to interrupt into the highest yellow channel.

I publish about this evaluation on the on-chain social media platform Lens Protocol, together with new SlateCast episodes, on the official cryptoteprise account. None of this evaluation ought to be thought-about private monetary recommendation; as talked about earlier, I don’t commerce off these ranges myself. I imagine in shopping for Bitcoin commonly and constantly at no matter worth it’s on that day.

Bitcoin Market Information

On the time of press 12:21 pm UTC on Aug. 20, 2024, Bitcoin is ranked #1 by market cap and the value is up 4.26% over the previous 24 hours. Bitcoin has a market capitalization of $1.2 trillion with a 24-hour buying and selling quantity of $27.95 billion. Study extra about Bitcoin ›

Crypto Market Abstract

On the time of press 12:21 pm UTC on Aug. 20, 2024, the overall crypto market is valued at at $2.14 trillion with a 24-hour quantity of $62.22 billion. Bitcoin dominance is presently at 56.02%. Study extra concerning the crypto market ›

Talked about on this article